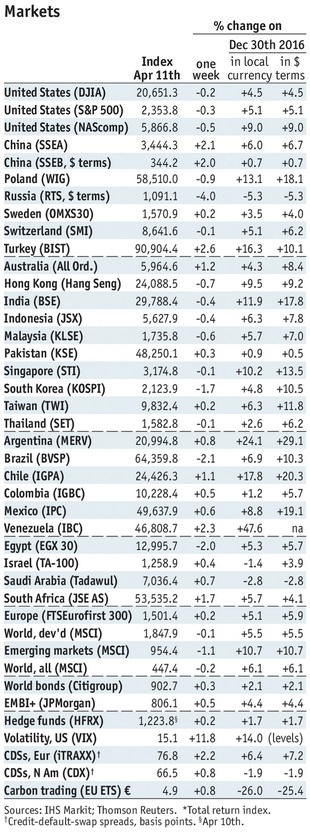

Stock Markets EM FX was mostly firmer last week, helped by Trump comments and softer US data. Whilst this seems positive for EM, the global backdrop remains uncertain. Some in EM (Russia, Turkey, and Korea) remain vulnerable to geopolitical concerns. In addition, idiosyncratic domestic political risks remain in play for other EM countries, such as Brazil, South Africa, and Turkey. We expect the investment climate for EM to remain challenging this week. Stock Markets Emerging Markets, April 11 Source: Economist.com - Click to enlarge Singapore Singapore reports March trade Monday, with NODX expected to rise 8.1% y/y vs. 21.5% in February. Despite firmer data, the MAS left policy unchanged last week and maintained its commitment to keep policy loose for an “extended” period. If data continue to firm, we expect a change in the forward guidance at the October meeting that sets the table for a 2018 tightening move. China China reports March retail sales and IP Monday. The former is expected to rise 9.7% y/y, while the latter is expected to rise 6.3% y/y. Q1 GDP will also be reported then, with growth expected to remain steady at 6.8% y/y. India India reports March WPI Monday, which is expected to rise 6.0% y/y vs. 6.55% in February. Last week, March CPI came in at 3.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Stock MarketsEM FX was mostly firmer last week, helped by Trump comments and softer US data. Whilst this seems positive for EM, the global backdrop remains uncertain. Some in EM (Russia, Turkey, and Korea) remain vulnerable to geopolitical concerns. In addition, idiosyncratic domestic political risks remain in play for other EM countries, such as Brazil, South Africa, and Turkey. We expect the investment climate for EM to remain challenging this week. |

Stock Markets Emerging Markets, April 11 Source: Economist.com - Click to enlarge |

SingaporeSingapore reports March trade Monday, with NODX expected to rise 8.1% y/y vs. 21.5% in February. Despite firmer data, the MAS left policy unchanged last week and maintained its commitment to keep policy loose for an “extended” period. If data continue to firm, we expect a change in the forward guidance at the October meeting that sets the table for a 2018 tightening move. ChinaChina reports March retail sales and IP Monday. The former is expected to rise 9.7% y/y, while the latter is expected to rise 6.3% y/y. Q1 GDP will also be reported then, with growth expected to remain steady at 6.8% y/y. IndiaIndia reports March WPI Monday, which is expected to rise 6.0% y/y vs. 6.55% in February. Last week, March CPI came in at 3.8% y/y, lower than expected but still faster than 3.65% in February. RBI is clearly in hawkish mode, and is likely to continue tightening gradually. Next policy meeting is June 7. If price pressures continue to rise, another 25 bp hike seems likely. BrazilBrazil central bank releases minutes from last week’s meeting Monday. At that meeting, it cut 100 bp and implied that this pace would be maintained for the next meeting or two. Brazil then reports mid-April IPCA inflation Thursday, which is expected to rise 4.48% y/y vs. 4.73% in mid-March. Next COPOM meeting is May 31, and another 100 bp cut to 10.25% is likely. ColombiaColombia reports February IP and retail sales Monday. The former is expected at -1.3% y/y, while the latter is expected at -1.6% y/y. The economy remains weak, and so the central bank is likely to continue cutting rates. Next policy meeting is April 28, and another 25 bp cut to 6.75% seems likely. MalaysiaMalaysia reports March CPI Tuesday, which is expected to rise 5.2% y/y vs. 4.5% in February. The central bank does not have an explicit inflation target, but rising inflation will make it hard to keep policy steady. Policymakers are concerned about sluggish growth and so for now, we see steady rates. Next policy meeting is May 12, no change is expected. South AfricaSouth Africa reports March CPI Tuesday, which is expected to rise 6.4% y/y vs. 6.3% in February. This would be above the 3-6% target range and yet for now, SARB is on hold. The weak economy should dictate lower rates, but high inflation is preventing this for now. Next policy meeting is May 25. What SARB does then will in depend on both internal and external factors. TaiwanTaiwan reports March export orders Thursday, which are expected to rise 10.7% y/y vs. 22.0% in February. Regional trade has been robust in recent months, and orders data suggest this will continue into H2. For now, the central bank is likely to remain on hold as price pressures are steady. PolandPoland reports March industrial and construction output, retail sales, and PPI Thursday. Data are expected to show continued strength in the economy. Central bank minutes will be released Friday. It has maintained a dovish stance, but its desire to keep rates steady until 2018 will be tested by rising inflation and a robust economy. We believe the first rate hike may be seen in H2 of this year. IndonesiaBank Indonesia meets Thursday and is expected to keep rates unchanged at 4.75%. Its tone has become more hawkish lately in response to rising inflation. CPI rose 3.6% y/y in March, which is within the 3-5% target range. |

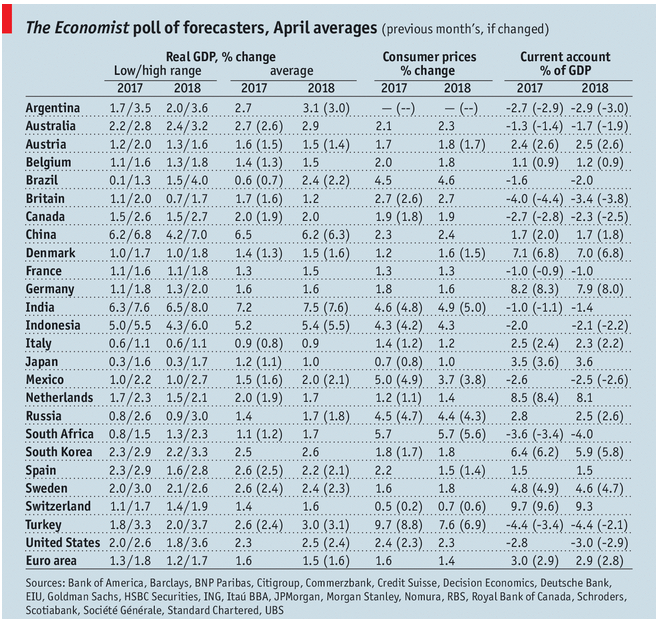

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent