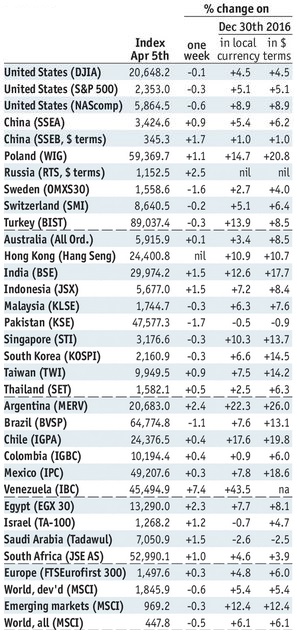

Stock Markets EM FX ended the week on a soft note, as the weaker than expected US jobs data was unable to derail the dollar’s rally. For the week, the worst performers were ZAR (-3%), TRY (-2.5%), and RUB (-2%). CZK bucked the trend, rising after the CNB exited the cap. This week, higher inflation readings in the US could draw market focus back to Fed tightening, which would be negative for EM. Risks of further flare ups in Syria could also lead to risk-off trading. Stock Markets Emerging Markets, April 05 Source: economist.com - Click to enlarge China China reports March money and new loan data this week, but no date has been set. March CPI and PPI will be reported Wednesday. The former is expected to rise 1.0% y/y and the latter by 7.5% y/y. March trade will be reported at the end of the week. In USD terms, exports are expected to rise 3.4% y/y, while imports are expected to rise 15.5% y/y. Venezuela Venezuela has .1 bln in PDVSA debt payments due this week. Press reports suggest senior officials met last week and agree to continue servicing its external debt (for now). Despite the rebound in oil prices, foreign reserves have fallen to .4 bln in March, the lowest since May 2002. We believe default risk will remain elevated this year.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newslettersent, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Stock MarketsEM FX ended the week on a soft note, as the weaker than expected US jobs data was unable to derail the dollar’s rally. For the week, the worst performers were ZAR (-3%), TRY (-2.5%), and RUB (-2%). CZK bucked the trend, rising after the CNB exited the cap. This week, higher inflation readings in the US could draw market focus back to Fed tightening, which would be negative for EM. Risks of further flare ups in Syria could also lead to risk-off trading.

|

Stock Markets Emerging Markets, April 05 Source: economist.com - Click to enlarge |

ChinaChina reports March money and new loan data this week, but no date has been set. March CPI and PPI will be reported Wednesday. The former is expected to rise 1.0% y/y and the latter by 7.5% y/y. March trade will be reported at the end of the week. In USD terms, exports are expected to rise 3.4% y/y, while imports are expected to rise 15.5% y/y.

VenezuelaVenezuela has $2.1 bln in PDVSA debt payments due this week. Press reports suggest senior officials met last week and agree to continue servicing its external debt (for now). Despite the rebound in oil prices, foreign reserves have fallen to $10.4 bln in March, the lowest since May 2002. We believe default risk will remain elevated this year.

Czech RepublicCzech reports March CPI Monday, which rose as expected to 2.6% y/y vs. 2.5% in February. This would be the highest rate since November 2012 and is creeping closer to the top of the 1-3% target range. Given low base effects from 2016, we see risks that inflation moves above the target range this year. Core CPI and PPI measures are also accelerating. On the other hand, significant CZK strength after the cap was lifted could help limit price pressures.

Turkey

Turkey reports February IP Monday, which is expected to rise 2.5% y/y vs. 2.6% in January, but instead contracted by 0.4% on the month to bring the year-over-year rate to 1.0%. The economy remains sluggish, and yet the weak lira will likely force the central bank to tighten policy again at its next policy meeting April 26. Markets remain nervous ahead of the referendum next weekend, with polls showing a narrow “yes” win that would expand the powers of the presidency. TaiwanTaiwan reported March trade figures earlier today. Exports are rose 13.2% y/y, a bit weaker than expected, while imports rose 19/9% y/y. That was also softer than expected. While the economy is picking up, price pressures have eased in the last two months. As such, the central bank can take a wait and see approach for now with regards to potential tightening.

HungaryHungary reports March CPI Tuesday, which is expected to rise 3.1% y/y vs. 2.9% in February. If so, this would be the highest rate since November 2012 and in the top half of the 2-4% target range. Central bank minutes will be released Wednesday. At that meeting, the bank added unconventional stimulus by lowering the cap on 3-month commercial bank deposits for Q2. We think that may be the last move.

South AfricaSouth Africa reports February manufacturing production Tuesday, which is expected to rise 0.2% y/y vs. 0.8% in January. It then reports February retail sales Wednesday, which are expected to contract -1.6% y/y vs. -2.3% in January. The economy remains weak, but the high inflation and a softening rand are preventing rate cuts. Next SARB policy meeting is May 25. While steady rates seem likely, much will depend on the external environment.

MexicoMexico reports February IP Tuesday, which is expected at -1.4% y/y % y/y vs. -0.1% in January. Banco de Mexico will release its minutes Wednesday. At that meeting, it hiked rates 25 bp, down from 50 bp at its last several meetings. For now, we think the bank would like to pause its tightening cycle and keep rates steady at 6.5% at the next policy meeting May 18. However, we think it may hike 25 bp at the June 22 meeting if the Fed hikes June 14.

SingaporeSingapore reports February retail sales Wednesday, which are expected to rise 0.5% y/y vs. 2.0% in January. It then reports advance Q1 GDP Thursday, which is expected to rise 2.6% y/y vs. 2.9% in Q4. The MAS typically meets on the same day as the advance GDP report. Price pressures are rising but the economy a bit sluggish, and so we think the MAS is likely to take a wait and see approach for now and leave policy unchanged.

India reports February IP and March CPI Wednesday. The former is expected to rise 3.9% y/y, while the latter is expected to rise 1.4% y/y. Price pressures are picking up, but markets were surprised at the timing of last week’s RBI hike in the reverse repo rate. We expect the RBI to continue tightening at a gradual pace this year. BrazilBrazil reports February retail sales Wednesday, which are expected to contract -6.5% y/y vs. -7.0% in January. COPOM then meets Thursday and is expected to cut rates 100 bp to 11.25%. IPCA inflation fell to 4.57% y/y in March, the lowest since August 2010. Мarket consensus is now for SELIC rate at 8.75% at year-end, which represents 350 bp of easing from current levels. Investors shouldn’t be happy with last Friday’s revision of the 2018 primary deficit target to –BRL129 bln from –BRL79 bln previously.

ChileChile central bank meets Thursday and is expected to keep rates steady at 3.0%. CPI rose 2.7% y/y in March, below the 3% target and in the bottom half of the 2-4% target range. So far this year, the bank has cut rates at every other meeting. It last cut in March, which suggests another cut at the May 18 meeting. KoreaBank of Korea meets Thursday and is expected to keep rates steady at 1.5%. CPI rose 2.2% y/y in March, the highest since June 2012 and above the 2% target. Despite rising inflation, BOK officials have expressed concern about a rapid slowdown in corporate loan growth. As such, it is likely to remain on hold in Q2 but may have to tilt more hawkish in H2 if price pressures remain high.

IsraelIsrael reports March CPI Friday, which is expected to rise 0.7% y/y vs. 0.4% in February. The central bank extended its forward guidance at last week’s meeting, saying the first rate hike will be seen in Q2 2018. This seems too dovish. Price pressures are picking up and low base effects should see inflation move close to the 2% target this year. Next meeting is May 29, no change is expected.

|

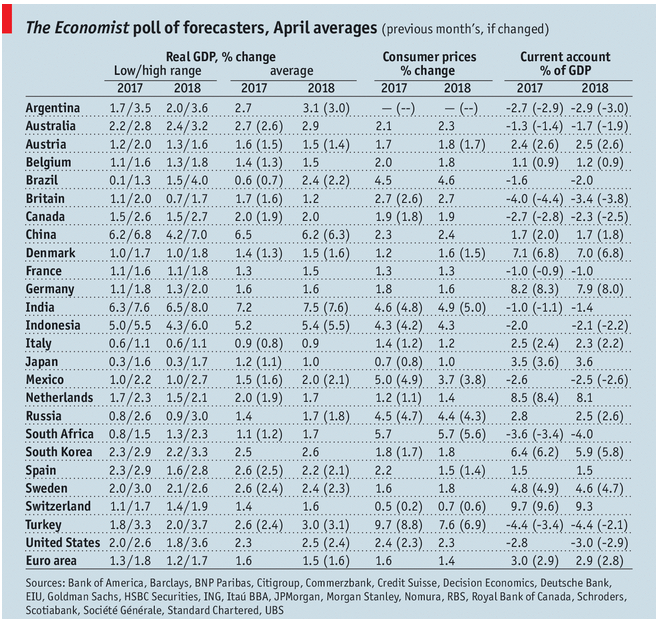

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent,win-thin