Stock Markets EM FX was mixed last week, as markets await fresh drivers. Jobs report this Friday could provide greater clarity with regards to Fed policy. BOE and RBA meet but aren’t expected to change policy. Data is likely to reinforce the notion that inflation remains low in EM, allowing those central banks to remain dovish. Czech National Bank is the main exception, as it may start the tightening cycle this week....

Read More »Emerging Markets: What has Changed

Summary Indonesia’s parliament approved a revised budget for 2017 that sees a wider deficit. Pakistan’s Supreme Court has ousted Prime Minister Sharif. Polish President Duda vetoed portions of the judicial reform bill submitted by the Law and Justice party. The European Commission (EC) is preparing possible sanctions against Poland. The US House of Representatives voted to impose new sanctions against Russia, Iran, and...

Read More »Emerging Markets: Week Ahead Preview

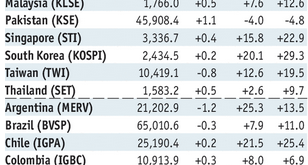

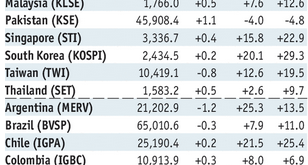

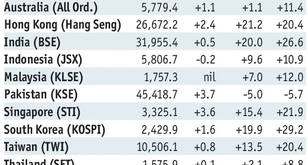

Stock Markets EM FX was mixed on Friday, but largely firmer over the entire week. Top performers were BRL, KRW, and ZAR, while the worst were ARS, MXN, and RUB. FOMC meeting this week poses some potential risks to the global liquidity story that’s supporting EM. Within EM, the low inflation/easy monetary policy narrative should continue with data and events this week. Stock Markets Emerging Markets, July 22 - Click...

Read More »Emerging Markets: What has Changed

Summary South Korea proposed resuming military and humanitarian exchanges with North Korea. The European Union may sanction Poland over its controversial judicial overhaul. Turkish Prime Minister Yildirim announced a cabinet shuffle after meeting with President Erdogan. Turkey’s worsening relations with Germany will come with economic costs. South African Reserve Bank surprised markets by starting the easing cycle with...

Read More »Global Asset Allocation Update: Not Yet

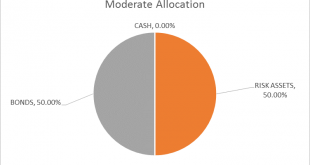

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months. The most significant change from last month is the continued...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX ended the week on a firm note, helped by softer than expected US data. Indeed, EM FX was up across the board for the entire week and was led by BRL, MXN, and ZAR. The ECB meeting this week will draw some interest, especially after the BOC last week became the second major central bank to hike rates. Stock Markets Emerging Markets, July 05 Source: economist.com - Click to enlarge Hungary...

Read More »Emerging Markets: What has Changed

Summary Pakistani Prime Minister Nawaz Sharif may face trial on corruption charges. Turkey will reportedly pay $2.5 bln for a Russian missile defense system. Nigeria said it was willing to cap its oil production to support OPEC efforts to cut global supply. Former Brazilian President Lula was sentenced to nine and half years in prison on corruption charges. S&P downgraded Chile one notch to A+ with a stable...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX was mixed last week but in general held up well in the aftermath of Super Thursday. The global backdrop seems relatively benign right now despite the FOMC meeting this week. We still think investors have to be picky. TRY, ZAR, and BRL at current levels seem too rich given the underlying risks in all three. On the flip side, we think China is looking stable right now and should help Emerging...

Read More »Emerging Markets: What has Changed

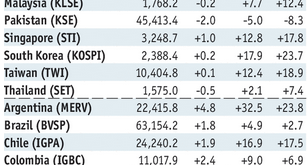

Summary: The Reserve Bank of India cut its inflation forecast for FY2017/18. South Korean President Moon suspended the installation of the remaining components of the THAAD missile shield. S&P cut Qatar one notch to AA-. Turkey looks likely to get caught up in yet another regional conflict. Brazil’s structural reform agenda has been delayed as President Temer remains on the ropes. Stock Markets In the EM equity...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX closed last week on a firm note as weak US jobs data supported the notion that the Fed will find it hard to tighten in H2. No major US data will be reported this week and the FOMC embargo for the June 14will be in effect. As such, there is little on the near-term horizon that might help the dollar, so it’s likely to remain on the defensive this week. As always, political risk in EM remains...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org