While Switzerland isn’t the most financially secretive nation in the Tax Justice Network’s recently published report, its combination of size and secrecy pushed it into first place, the worst rank in the Financial Secrecy Index 2018. Size is factored in because it measures the damage a nation’s financial secrecy has on the world, says The Tax Justice Network. © Kevkhiev Yury _ Dreamstime.com - Click to enlarge The...

Read More »Ticket cheats in Switzerland soon to be listed in a national register

Tickets cannot be bought on public transport in Switzerland. Passengers are required to have a ticket before boarding. Those caught on public transport without one will soon have their names put into a national register. This will ensure progressively higher fines are issued to repeat offenders. ©_SBB_CFF_FFS - Click to enlarge The new database will be rolled out from April 2019, reported RTS. By the end of 2019, the...

Read More »Roger Federer becomes oldest world number one

The 36-year-old Swiss tennis player beat Robin Haase in the Rotterdam Open to replace 31-year-old Rafael Nadal at the top of the ranking. .@rogerfederer rewrites history in Rotterdam: With his victory today, Federer has now surpassed Andre Agassi to become the oldest World No. 1 in ATP history! ?????1️⃣ ?: #USOpen pic.twitter.com/3ROFU0wfao — US Open Tennis (@usopen) February 16, 2018 Federer has now surpassed eight-time Grand Slam winner Andre Agassi, who was 33 when he lost the number one...

Read More »Vaud – vote on divisive dental tax and care plan

On 4 March 2018, voters in Vaud will vote on a plan to provide basic universal dental care funded by a tax on salaries. The initiative entitled: Reimbursement of dental care, Pour le remboursement des soins dentaires in French, claims that 10% of the population avoid the dentist because of the cost. They also claim links between poor dental health and cancer, diabetes and premature births. Their plan envisages the creation of a network of polyclinics that would provide basic dental care, but...

Read More »Switzerland tops latest financial secrecy index

While Switzerland isn’t the most financially secretive nation in the Tax Justice Network’s recently published report, its combination of size and secrecy pushed it into first place, the worst rank in the Financial Secrecy Index 2018. Size is factored in because it measures the damage a nation’s financial secrecy has on the world, says The Tax Justice Network. © Kevkhiev Yury _ Dreamstime.com The underlying financial secrecy score is made up 20 Key Financial Secrecy Indicators, which include...

Read More »Switzerland tops latest financial secrecy index

While Switzerland isn’t the most financially secretive nation in the Tax Justice Network’s recently published report, its combination of size and secrecy pushed it into first place, the worst rank in the Financial Secrecy Index 2018. Size is factored in because it measures the damage a nation’s financial secrecy has on the world, says The Tax Justice Network. © Kevkhiev Yury _ Dreamstime.com The underlying financial secrecy score is made up 20 Key Financial Secrecy Indicators, which include...

Read More »Ticket cheats in Switzerland soon to be listed in a national register

Tickets cannot be bought on public transport in Switzerland. Passengers are required to have a ticket before boarding. Those caught on public transport without one will soon have their names put into a national register. This will ensure progressively higher fines are issued to repeat offenders. ©_SBB_CFF_FFS The new database will be rolled out from April 2019, reported RTS. By the end of 2019, the 250 odd members of CH-Direct, a public transport union, should be connected. The system of...

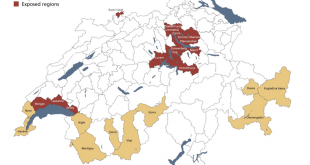

Read More »Swiss real estate risk falls two quarters in a row, says UBS

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction. The recent fall was driven by slow...

Read More »Swiss real estate risk falls two quarters in a row, says UBS

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. © Denis Linine _ Dreamstime.com Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction. The recent fall was driven by slow growth in mortgage lending (+2.6%),...

Read More »Swiss cross-border shopping not always worth it, says study

In 2015, Swiss residents made 24 million shopping trips abroad. The average Swiss-based cross-border shopper travelled 69 kilometres to shop in a neighbouring country, 55 kilometres further than they did when shopping in Switzerland, according to a study published by Credit Suisse. Credit Suisse calculated that, on average, a cross-border shopper would need to spend at least CHF 274 per vehicle to make the journey...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org