Three years after we first identified the former head of UBS's gold desk in Zurich as someone directly implicated in the rigging of precious metals prices, Bloomberg reports that Andre Flotron, a Swiss resident, was arrested while visiting the U.S., according to people familiar with the matter. Having been "on leave" since 2014, it appears Andre's hope that he was gone but "keen to return in due time" are now up in smoke. As Bloomberg reports, Flotron was...

Read More »Six Banks Join UBS’s “Utility Coin” Blockchain Project

Here’s a piece of news that the remaining human members of Wall Street’s FX sales and trading desks probably don’t want to hear. According to the Financial Times, six of the world’s largest banks have decided to join a blockchain project called “utility coin” that will allow banks to settle trades in securities denominated in different currencies without a money transfer. What’s worse, the banks expect to begin...

Read More »Sollten nicht Anleihen für Einkommen und Aktien für Kursgewinne sorgen?

Bild: birgitH (Pixelio) Laufendes Einkommen durch festverzinsliche Anlagen, Aktienkursgewinne für die Vermögensvermehrung. So handelten Anleger bis jetzt. Doch mittlerweile sind Dividendenrenditen von EU-Aktien höher als Renditen von Hochzinsanleihen, wie eine Grafik der Deutschen AM zeigt. Traditionellerweise haben Anleger festverzinsliche Wertpapiere gekauft, um laufendes Einkommen zu...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

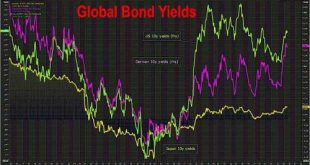

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »New Gold Pool at the BIS Basle, Switzerland: Part 1

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.” 13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England Introduction A central bank Gold Pool which many people will be familiar with operated in the...

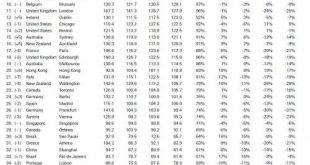

Read More »These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive – and in this year’s edition, best – cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of “cheap dates” in the world’s top cities. The index consists of...

Read More »These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive - and in this year's edition, best - cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of "cheap dates" in the world's top cities. The index consists of i) cab rides, ii) dinner/lunch for two at a pub or diner, iii) soft...

Read More »“Die Populisten scheinen 2017 an Schwung zu verlieren”

Stefan Kreuzkamp, Chef-Anlagestratege der Deutschen Asset Management. Stefan Kreuzkamp, Chef-Anlagestratege der Deutschen Asset Management, ist ab dem ersten Ergebnis der Präsidentschaftswahlen in Frankreich nicht überrascht, aber dennoch erleichtert. „Das Ergebnis des ersten Wahlgangs stärkt unsere Zuversicht, dass Frankreich ab dem Sommer erstmals von einem eher reformorientierten Präsidenten...

Read More »Jewish Trust Sues Deutsche Bank For $3 Billion

Just when it seemed that no more lawsuits are possible for Germany's largest lender, which over the past two years has settled or otherwise paid billions to set aside a barrage of allegations of wrongdoing leading to the bank's suspension of bonuses for most senior bankers, today we learn that Deutsche Bank was sued by a Jewish charitable trust in Florida, alleging that the bank wrongly withheld as much as $3 billion from the heirs to a wealthy German family. According to Bloomberg, the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org