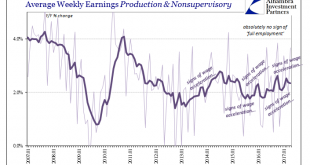

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014. At that time, the BLS in its various data series suggested an almost perfect labor market acceleration...

Read More »Signs of Something, Just Not Wage Acceleration

I have been writing for many years that they really don’t know what they are doing. I only wish it was that simple. There has been developing another layer or dimension to that condition, a second derivative of stupid, whereby when faced with this now well-established fact the same people, experts and authorities all, they have no frame of reference to figure out what next to do. In other words, they really don’t know...

Read More »The Anti-Perfect Jobs Condition

The irony of the unemployment rate for the Federal Reserve is that the lower it gets now the bigger the problem it is for officials. It has been up to this year their sole source of economic comfort. Throughout 2015, the Establishment Survey improperly contributed much the same sympathy, but even it no longer resides on the plus side of the official ledger. So many people may have exited the labor force in May that the...

Read More »Dollars And Sent(iment)s

Both US manufacturing PMI’s underwhelmed just as those from China did. The IHS Markit Index was lower than the flash reading and the lowest level since last September. For May 2017, it registered 52.7, down from 52.8 in April and a high of 55.0 in January. Just by description alone you can appreciate exactly what pattern that fits. The ISM Manufacturing PMI was slightly higher in May than April, 54.9 versus 54.8, but...

Read More »Pay No Attention To 50

China’s PMI’s were uniformly disappointing with respect to what Moody’s was on about last week. Chinese authorities expended great effort and resources to get the economy moving forward again after several years of “dollar”-driven deceleration. There was a massive “stimulus” spending program where State-owned FAI expenditures of about 2% of GDP were elicited to make up for Private FAI that at one point last year was...

Read More »Wo bleibt die Entschuldung?

Moderater Aufschwung: Eine Frau vergleicht den Dollar mit anderen Währungen im August 2015. Foto: Ricardo Moraes (Reuters) Als die Geldpolitik in Reaktion auf die Krise 2008/09 expansiv wurde, bestand die Hoffnung, dass der Schuldenstand sich stark reduzieren würde. Leider ist wenig passiert, wie die folgende Grafik zeigt. Die Schulden in den USA sind lediglich stabilisiert worden. Die US-Schulden befinden sich über dem Niveau der späten 1920er-Jahre, als die Grosse Depression begann,...

Read More »Wo bleibt die Entschuldung?

Moderater Aufschwung: Eine Frau vergleicht den Dollar mit anderen Währungen im August 2015. Foto: Ricardo Moraes (Reuters) Als die Geldpolitik in Reaktion auf die Krise 2008/09 expansiv wurde, bestand die Hoffnung, dass der Schuldenstand sich stark reduzieren würde. Leider ist wenig passiert, wie die folgende Grafik zeigt. Die Schulden in den USA sind lediglich stabilisiert worden. Die US-Schulden befinden sich über dem Niveau der späten 1920er-Jahre, als die Grosse Depression begann,...

Read More »Simple (economic) Math

.The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing...

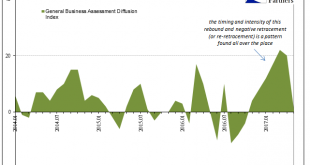

Read More »Suddenly Impatient Sentiment

Two more manufacturing surveys suggest sharp deceleration in momentum, or, more specifically, the momentum of sentiment (if there is such a thing). The Federal Reserve’s 5th District Survey of Manufacturing (Richmond branch) dropped to barely positive, calculated to be just 1.0 in May following 20.0 in April and 22.0 in March. It follows an all-too-familiar pattern, where sentiment spiked to start this year after being...

Read More »Less Than Nothing

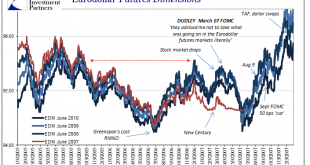

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs. It has been this way from the beginning, even before the beginning as if that was possible. The Great Financial Crisis has no official start date, but we...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org