After yesterday's algo-driven mad dash to close the S&P green both for the day and for the year following Fed minutes that came in shocking hawkish, the selling has continued overnight, led by the commodity complex as rate hike fears have pushed oil back down some 2% from yesterday's 7 month highs, which in turn has dragged global stocks lower to a six-week low, while pushing bond yields higher across developed nations as the market suddenly reprices the probability of a June/July rate...

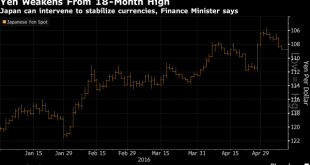

Read More »Global Stocks Jump; Oil Rises As Yen Plunges After Another Japanese FX Intervention Threat

In what has been an approximate repeat of the Monday overnight session, global stocks and US futures rose around the world as oil prices climbed toward $44 a barrel, with risk-sentiment pushed higher by another plunge in the Yen which has now soared 300 pips since the Friday post-payroll kneejerk reaction, and was trading above 109.20 this morning. At the same time base metals regained some of Monday’s steep losses following Chinese CPI data that came in line while PPI declined for 50...

Read More »Gold And Negative Interest Rates

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

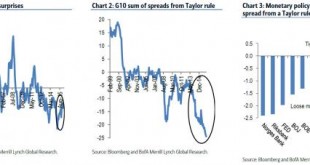

Read More »Bank Of America Reveals “The Next Big Trade”

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as the market reaction to central bank policies this year reflects transition to a new regime, in which investors start speculating which central bank will have to give up easing policies first. The market has started testing the central banks In...

Read More »Futures Jump On Chinese Trade Data; Oil Declines; Global Stocks Turn Green For 2016

With oil losing some of its euphoric oomph overnight, following the API report of a surge in US oil inventories, and a subsequent report that Iran's oil minister would skip the Doha OPEC meeting altogether, the global stock rally needed another catalyst to maintain the levitation. It got that courtesy of the return of USDJPY levitation, which has pushed the pair back above 109, the highest in over a week, as well as a boost in sentiment from the previously reported Chinese trade data where...

Read More »Japan Stocks Plunge; Europe, U.S. Futures, Oil Lower Ahead Of Payrolls

For Japan, the post "Shanghai Summit" world is turning ugly, fast, because as a result of the sliding dollar, a key demand of China which has been delighted by the recent dovish words and actions of Janet Yellen, both Japan's and Europe's stock markets have been sacrificed at the whims of their suddenly soaring currencies. Which is why when Japanese stocks tumbled the most in 7 weeks, sinking 3.5%, to a one month low of 16,164 (after the Yen continued strengthening and the Tankan confidence...

Read More »Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly in the Yuan's stronger fixing overnight) at the expense of Europe and Japan, both of which want the USD much stronger. ECB, BOJ don't want a weak dollar; China does not want a strong dollarFed sides with China for now — zerohedge (@zerohedge)...

Read More »BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is no ammo to lift stocks. An almost 200 point surge in Dow futures has been erased and Nikkei 225 has dropped 1000 points from its post BOJ highs... Dow futures have plunged... What a mess... And Nikkei has crashed over 1000 points... And...

Read More »Lessons from History: The Volcker Moment and the First Cap on CHF

In 1978 the SNB established for the first time a cap on the Swiss franc, to prevent the inflows of American funds into Switzerland that escaped the US stagflation but caused some “imported inflation” in Switzerland, too. The Swiss introduced a DEM/CHF floor at 0.80 CHF on October 1, 1978, having known that the US government and the Fed were ready to fight inflation and the weak dollar. About one month later the FOMC hiked rates to 9%. Paul Volcker With the money supply (M1) targeting...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org