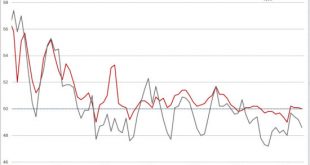

Recent data points to possibility of upside surprise in third-quarter GDP, but momentum may not last. September purchasing manager indices (PMIs) provided the latest evidence pointing to relatively strong Q3 GDP growth in China (the GDP report will be released later this month). However, we believe the structural downward trend in Chinese growth will resume as property investment loses momentum and the government continues to cut industrial overcapacity.China’s official manufacturing PMI...

Read More »Improved Chinese data may be foretaste of GDP surprise

Growth momentum regained traction in August after a poor July. Although GDP figures for the third quarter may surprise on the upside, the longer-term trend still shows Chinese growth slowing. Major economic indicators for August point to broad-based stabilisation of China's growth momentum after a weak start to the second half. The more upbeat macro picture is supported by improvements in the PMI reading and import data, and leads us to believe the likelihood of an upside surprise for...

Read More »Signs of recovery in Chinese trade data

Improved export and import data, together with fiscal measures, mean that the Chinese economy remains on track to achieve 6.5% growth this year According to data released last week, China’s exports in August fell 2.8% year over year, which was better than Bloomberg consensus forecasts of a 4% drop and the 4.4% fall seen in July. Exports improved across the board, with exports strongest to developed economies. China’s headline export growth in year-over-year terms has been negative since...

Read More »Chinese data suggest a soft start to H2

The latest data releases from China point to a sluggish start to the second half of 2016, but we are sticking to our 2016 growth forecast of 6.5%. Economic data released by China’s National Bureau of Statistics on 12 August remain largely consistent with our expectation of moderating growth momentum in China. Especially noteworthy has been the drop in fixed asset investment (FAI) growth. Going forward, we expect a further slowdown in property investment to be offset by fiscal support for...

Read More »China’s July PMI figures send mixed signals

The slight decline in the official manufacturing PMI does not tally with the Caixan equivalent. We believe the official PMI better reflects a Chinese economy heading towards growth of around 6.5% this year. China’s official manufacturing PMI declined slightly to 49.9 in July, while the Caixin (Markit) PMI rose significantly, to 50.6 from 48.6 in June. The official non-manufacturing PMI extended its rise from last month and increased by 0.2 to 53.9, well above the 50 mark that separates...

Read More »Chinese nonmanufacturing activity holds up, but manufacturing slightly down

Macroview Nonmanufacturing helped by construction, but growth may slow given stimulus pull-back China’s official and Caixan purchasing manufacturing indices (PMI) declined in June. The official figure stood at 50 (down from 50.1 in May), right at the mid-point between expansion and contraction, while the Caixin PMI fell to 48.6. At the same time, the official PMI figures show that activity at large companies, many of them state owned, was much stronger than at small and medium-sized...

Read More »GDP forecast for Europe maintained, revised slightly down for United States

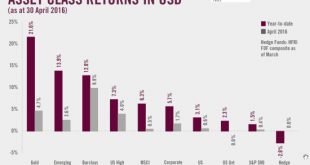

We retain our above-consensus forecast for the euro area this year, but weak first quarter leads to small cut in outlook for the US The conditions that we identified at the start of the year for a market rebound all subsequently fell into place: support from major central banks was forthcoming, the Chinese economy and the oil price stabilised, the US dollar bull trend paused, and systemic risk declined. Valuations have duly recovered. Now, banks need to start performing for markets to have...

Read More »China: Something has to give

Published: 12th April 2016 Download issue: A trip I took to Hong Kong and Singapore in March proved a useful way to gauge the mood of clients on China’s doorstep. Overall, my meetings with these clients—all entrepreneurs with significant investments in the Middle Kingdom— tended to confirm what other observers have been saying: the Chinese authorities have the resources to ensure the economy attains 6.5%-7% growth this year, and maybe even next year as well, but things may get complicated...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org