Recent data points to possibility of upside surprise in third-quarter GDP, but momentum may not last. September purchasing manager indices (PMIs) provided the latest evidence pointing to relatively strong Q3 GDP growth in China (the GDP report will be released later this month). However, we believe the structural downward trend in Chinese growth will resume as property investment loses momentum and the government continues to cut industrial overcapacity.China’s official manufacturing PMI for September was 50.4, the same as August, which was the highest reading since October 2014. Most sub-indices of the official PMI improved, consistent with the pickup in economic activity seen in recent months. Meanwhile, the Caixin manufacturing PMI rose slightly to 50.1, staying at/above the 50 threshold between expansion and contraction for the third consecutive month. The official non-manufacturing PMI has also held up well. Thanks to the significant revival in the property market, the construction sub-index of the non-manufacturing PMI surged to 61.9, the second-highest reading in the past 14 months.In summary, the latest Chinese PMIs confirm the more upbeat macro picture in China that we have been reporting over the past few weeks.

Topics:

Dong Chen considers the following as important: Chinese economic indicators, Chinese growth, Chinese manufacturing, Chinese PMIs, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Recent data points to possibility of upside surprise in third-quarter GDP, but momentum may not last.

September purchasing manager indices (PMIs) provided the latest evidence pointing to relatively strong Q3 GDP growth in China (the GDP report will be released later this month). However, we believe the structural downward trend in Chinese growth will resume as property investment loses momentum and the government continues to cut industrial overcapacity.

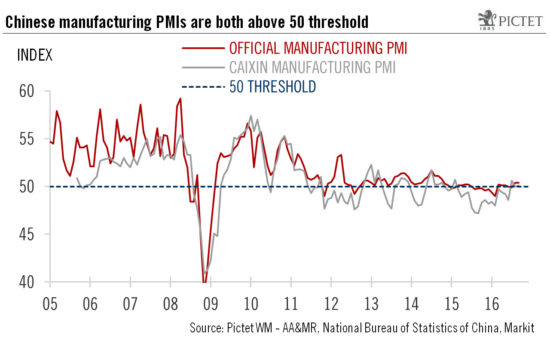

China’s official manufacturing PMI for September was 50.4, the same as August, which was the highest reading since October 2014. Most sub-indices of the official PMI improved, consistent with the pickup in economic activity seen in recent months. Meanwhile, the Caixin manufacturing PMI rose slightly to 50.1, staying at/above the 50 threshold between expansion and contraction for the third consecutive month. The official non-manufacturing PMI has also held up well. Thanks to the significant revival in the property market, the construction sub-index of the non-manufacturing PMI surged to 61.9, the second-highest reading in the past 14 months.

In summary, the latest Chinese PMIs confirm the more upbeat macro picture in China that we have been reporting over the past few weeks. Reconstruction following summer floods, strong government support for infrastructure investment, the property market boom and a gradual recovery in global demand may have all contributed to the stronger growth momentum. With further evidence pointing to rising momentum, we believe the Chinese economy may surprise on the upside in the next three to six months, with GDP growth likely coming in above 6.5% over H2 2016.

However, our medium-term view of prospects remains largely unchanged. We expect growth will slow again next year as fixed-asset investment resumes its downward trajectory. In our view, the recent surge in property prices across China is not supported by market fundamentals. The surge has raised serious concerns among Chinese policy makers and several major cities have re-introduced property-buying restrictions that were lifted only a year ago. As the property market loses steam and the government sticks to reform policies designed to cut industrial overcapacity, we expect China’s growth to decline towards 6.2% in 2017.