(Bild: S. Hofschlaeger, Pixelio) Candriam bietet die weltweit erste frei zugängliche Online-Trainingsplattform für nachhaltiges und verantwortliches Investieren. Damit will der Assetmanager zeigen, wie sich nachhaltige Investitionen in ein erfolgreiches Kundenportfolio einbetten lassen. Die neue Candriam Academy will das Bewusstsein von Finanzintermediären für SRI (Social Responsible Investing)...

Read More »“China muss den Innovationsmotor am Laufen halten”

Emil Wolter, Portfoliomanager Emerging Markets bei Comgest Emil Wolter, Portfoliomanager bei Comgest, ist der Ansicht, dass Innovationen die treibende Kraft für das "Neue China" sein müssen. Daraus können sich Gelegenheiten für Stockpicker ergeben. Emil Wolter, Portfoliomanager Emerging Markets bei Comgest erwartet, dass der 19. Parteitag der Kommunistischen Partei Chinas einen ökonomischen...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »Hard Assets In An Age Of Negative Interest Rates

Time is the soul of money, the long-view – its immortality. Hard assets are forever, even when destroyed by the cataclysms of history. It is the outlook that perpetuated the most competent and powerful aristocracies in continental Europe, well up through World War I and, in certain prominent cases, beyond; it is the mindset that has sustained the most fiscally serious democratic republic in the Western world, that of...

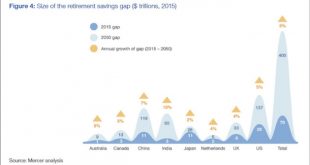

Read More »“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Lieber Ehrlichkeit als Rendite

Symbolbild, Raps. (Pixelio) Ein ökonomisches Experiment von Swiss Finance Institute-Professoren zeigt, dass viele Anleger ethische Überlegungen über finanzielle Rendite stellen. Dies trifft sowohl auf eigennützig orientierte als auch auf eher sozial eingestellte Anleger zu. Im Experiment, durchgeführt von den Swiss Finance Institute-Professoren Rajna Gibson Brandon (Universität Genf), Matthias...

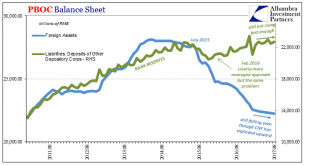

Read More »Not Political Risk For China, But Unwelcome Reality

China’s Communist Party concluded the Third Plenum of its 18th Congress in November 2013. It was the much-discussed reform mandate that many in the West took to mean another positive step toward neo-liberal reform. At its center was supposed to be a greater role for markets particularly in the central task of resource allocation. In some places, the Party’s General Secretary Xi Jinping was hailed as the great Chinese...

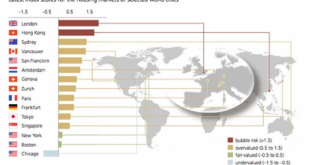

Read More »The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world’s most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. UBS Global Real Estate Bubble Index - Click to enlarge What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank’s Global Real Estate Bubble Index, it found that eight of the world’s...

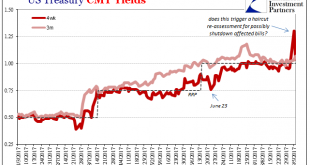

Read More »It Was Collateral, Not That We Needed Any More Proof

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. US Treasury, Jan - Sep 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Within two days of that move in bills, the GC market for UST 10s had gone...

Read More »The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world's most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank's Global Real Estate Bubble Index, it found that eight of the world's largest cities are now subject to a massive speculative housing bubble. And while perpetually low mortgage rates are clearly to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org