The popular image of the German industrial machine politics is one which has Germany’s massive factories efficiently churning out goods for trade with the South of Europe (Club Med). Because of the common currency, numerous disparities starting with productivity differences had left the South highly indebted to the North just as the Global Financial Crisis would strike. The aftermath of that crisis, particularly the second eruption in 2011, posed an economic challenge. Lack of recovery throughout Europe would mean Germany would have to seek its fortunes elsewhere around the world to find new customers in lieu of its old ones being somewhat questionable as to payment. According to the CIA’s World Factbook, in 2018

Topics:

Jeffrey P. Snider considers the following as important: 2.) Europe and Euro Crisis, 2) Swiss and European Macro, China, Composite PMI, currencies, economy, Europe, Eurozone Composite PMI, Eurozone Gross Domestic Product, Featured, Federal Reserve/Monetary Policy, Germany, global trade, IHS Markit, manufacturing, Markets, newsletter, PMI, services, ZEW

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The popular image of the German industrial machine politics is one which has Germany’s massive factories efficiently churning out goods for trade with the South of Europe (Club Med). Because of the common currency, numerous disparities starting with productivity differences had left the South highly indebted to the North just as the Global Financial Crisis would strike.

| The aftermath of that crisis, particularly the second eruption in 2011, posed an economic challenge. Lack of recovery throughout Europe would mean Germany would have to seek its fortunes elsewhere around the world to find new customers in lieu of its old ones being somewhat questionable as to payment.

According to the CIA’s World Factbook, in 2018 two-thirds of all German exports still landed for purchase somewhere inside the rest of Europe. The country’s second largest trading partner is France, after all. France, though, used be their largest. Germany’s biggest and third biggest export destinations are now the United States and China, respectively. Together, they account for more than 15% of all outbound German trade activity. Along with China, more than 18% of its exported goods ended up somewhere in Asia. Therefore, Germany’s industrial struggles in 2019 point the finger in the direction of its external focus which we know means the US, China, and Asia. |

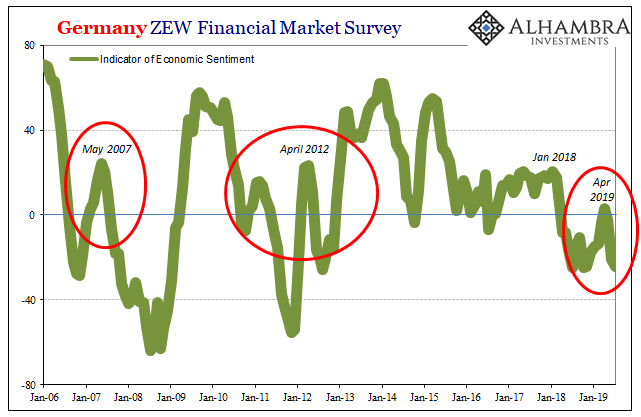

Germany ZEW Financial Market Survey, Jan 2006 - 2019 |

| Earlier this month, the ZEW reported renewed concerns about the state of the German economy. The institute’s sentiment index had rebounded in April to a positive number. This was the hoped-for evidence of the green shoots, the leading edge of what will be a second half rebound after the world’s “transitory” factors disappear.

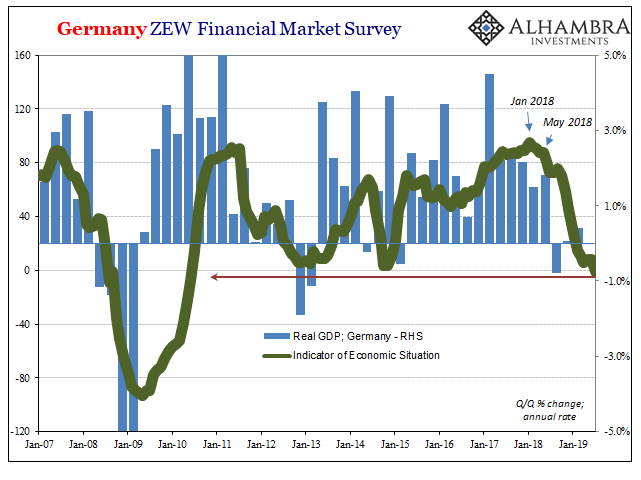

Over the next several months, however, the ZEW calculates sentiment has moved lower all over again. As of last week and the reading for July, the index has matched the lows of 2018. In terms of the current situation, the ZEW’s numbers suggest widespread weakness perhaps already turned into contraction. The situation index this month turned negative for the first time since June 2010. Not once had it fallen into minus territory during the (declared) recession in 2012. Together, both figures suggest Germany’s economy is in desperate shape (situation) and it doesn’t look like that will change (sentiment) anytime soon. |

Germany ZEW Situation and GDP, Jan 2007 - 2019 |

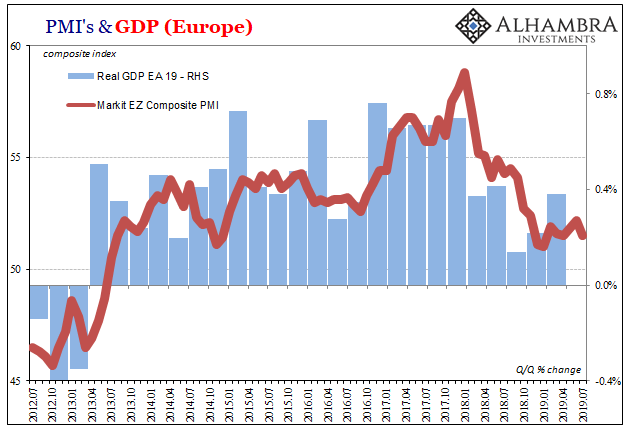

| As if to pile on the bad tidings, IHS Markit reports today that manufacturing continues to contract as negative factors pile up rather than disperse. The manufacturing index fell to 43.1 in July 2019, the lowest in 84 months (the last recession). That number is down from 45.0 in June, the green shoot prerequisite for the second half rebound never really getting out of the contracting side.

It is dragging the entire German economy down with it. The Composite PMI, including both manufacturing and services, fell back to 51.4 in the latest update. Without Germany’s trade engine, Europe as a whole while hanging in can manage nothing more than the bare minimum sputtering. Markit’s Composite PMI fell to 51.5 this month, down from 52.2 last month. The future does not look bright:

That’s for the whole of the European economy, not just Germany’s export-bound manufacturers. In the middle of 2019, Europe has practically ground to a halt. |

Eurozone GDP and Composite PMI, July 2012 - 2019(see more posts on Eurozone Composite PMI, Eurozone Gross Domestic Product, ) |

Isn’t that good news? For many, it seems like there is a clock on this thing. A recession or whatever downside has to show up soon or else there can’t be one. Weakness doesn’t just drag on for more than a year; plunge now or it ain’t happening.

That’s not how these things work, though. Everyone remembers the panic in 2008 and how it just came out of nowhere, devastating the world in the blink of an eye. It’s the common perception.

In truth, it took years to get to that point and then nearly a year more before it was all over. Curve inversions and bond market questions had developed in late 2006 – about two years before the final outbreak. Economic weakness had first shown up, in the US and elsewhere, in the early months of 2007.

Ben Bernanke told Congress subprime was contained in March 2007 because there were already serious questions and evident weakening.

What followed, even through the first half of what would only later be called the Great “Recession”, was similar confusion about where things stood. Economic officials and politicians saying everything would clear up, and markets increasingly in doubt. It looked bad, then it didn’t look that bad; the global economy seemed to be holding up and then it didn’t.

The NBER didn’t “officially” declare a recession until December 2008 after more than a year and a half talking about one (and innumerable official assurances it could never happen).

It therefore works the other way around; meaning, the longer the weakness lingers the more likely it is to turn toward a more serious downside. People and businesses will hang on for as long as they can, but if it looks like it will keep going and keep going the more likely they finally just throw in the towel. It is near impossible to predict when, at the same time increasingly straightforward to see the probabilities stacking up unfavorably.

As such, Germany’s woes aren’t really about Germany. They are being transmitted through that country coming from its largest marginal trading partners.

Tags: China,Composite PMI,currencies,economy,Europe,Eurozone Composite PMI,Eurozone Gross Domestic Product,Featured,Federal Reserve/Monetary Policy,Germany,global trade,IHS Markit,manufacturing,Markets,newsletter,PMI,services,ZEW