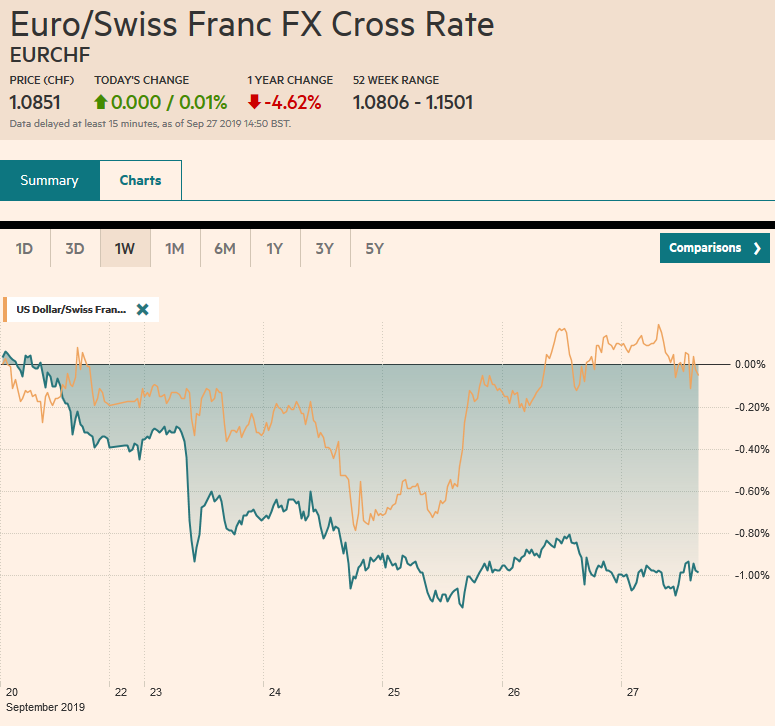

Swiss Franc The Euro has risen by 0.01% to 1.0851 EUR/CHF and USD/CHF, September 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities remain under pressures. The MSCI Asia Pacific Index lower today, though Chinese and Australian shares were firmer. It is the second consecutive week the benchmark has fallen. European equities are firmer, but not enough to offset the losses earlier this week and are set to snap a five-week advance. US shares are firmer, and the S&P 500 needs to gain about 0.5% today or record a back-to-back weekly decline. Core bond yields are a little firmer today paring this week’s decline. Dovish comments by a member of the Bank of England’s Monetary Policy Committee who is often seen

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, Currency Movement, Eurozone Consumer Confidence, Featured, MXN, newsletter, U.S. Core PCE Price Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.01% to 1.0851 |

EUR/CHF and USD/CHF, September 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

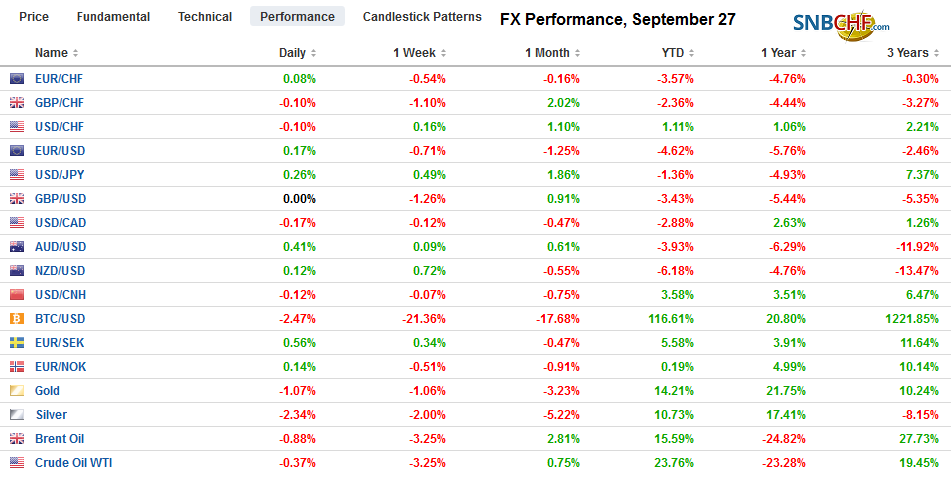

FX RatesOverview: Equities remain under pressures. The MSCI Asia Pacific Index lower today, though Chinese and Australian shares were firmer. It is the second consecutive week the benchmark has fallen. European equities are firmer, but not enough to offset the losses earlier this week and are set to snap a five-week advance. US shares are firmer, and the S&P 500 needs to gain about 0.5% today or record a back-to-back weekly decline. Core bond yields are a little firmer today paring this week’s decline. Dovish comments by a member of the Bank of England’s Monetary Policy Committee who is often seen as a hawk, helping to drive down UK yields. The dollar is firm but little changed against most of the major currencies. Sterling is extended its decline for a third session while the euro came close to $1.09 before steadying. Among emerging markets currencies, the large liquid and accessible currencies (e.g., South Africa, Turkey, Hungary) are weaker, while China, India, and Mexico (which delivered a rate cut yesterday) are firmer. |

FX Performance, September 27 |

Asia Pacific

Japan reports soft Tokyo September inflation, which ostensibly offers insight into the national performance. The headline rate slipped to 0.4% from 0.6% and was lower than expected. The core, which excludes fresh food, fell to 0.5% from 0.7%. With the sales tax hike coming into effect on October 1, pressure may build for the Bank of Japan to take fresh action when it meets at the end of October. A rate cut rather than QE is seen as the most likely course.

Foreigners were larger sellers of Japanese assets in the week ending September 20. They dumped what appears to be a record amount of Japanese bonds (JPY3.15 trillion). Some observers highlight the large maturities that took place. However, at the same time, foreigners sold (JPY1.18 trillion) Japanese equities, the most in six months. Some link it to the end of Japan’s fiscal half-year, but it is not clear why it would be such as a strong driver for foreign investors. Another hypothesis some are floating is it is more about the funding market and the cost of cross-currency swaps.

FTSE Russell declined to include Chinese bonds in its World Government Bond Index yesterday, bucking the trend of others, like the Bloomberg Barclay’s and JP Morgan’s emerging market bond indices. The decision was linked to feedback from investors seeking better bond liquidity and more flexibility in foreign exchange transactions and settlement. China will remain on FTSE Russell’s watch-list, and it seems like the question is when not if. There did not seem to be much of a market reaction.

The dollar has traded in about a quarter yen range above JPY107.65. It has not traded above JPY108 this week but remains within spitting distance. There is a roughly $410 mln option at JPY108.10 that expires today. The month’s high was near JPY108.50. The Australian dollar pinned near the week’s low (~$0.6740). The market anticipates a 25 bps rate cut by the Reserve Bank of Australia on October 1. It is meeting steady offers in the $0.6765 area.

EuropeBOE’s Saunders warned that even if there was a smooth Brexit, the lingering uncertainties could still require monetary accommodation. Saunders is often seen as a hawk on the MPC. The market favors a rate cut, but the BOE argued a rate hike may be needed. The MPC does not meet again until November 7. Following EC’s negotiator Barnier meeting with the EU Parliament, it is clear that the gap between the EU and the UK remains large. The latest proposals fall shy, it is said, of three key areas: consumer safety, protection of businesses, and the preservation of peace. Brexit is to be in six weeks, and UK Prime Minister Johnson still is pushing to leave one way or the other at the end of October. There is more speculation on how Johnson can circumvent Parliament again after its suspension was ruled illegal earlier this week. A couple of scenarios involve the Privy Council again or other courses to suspend Parliament’s demand that the government seeks a delay if no agreement is reached. Johnson did score a victory at an Appeals Court in Belfast that dismissed claims that a no-deal Brexit violated the terms of the Good Friday Agreement. |

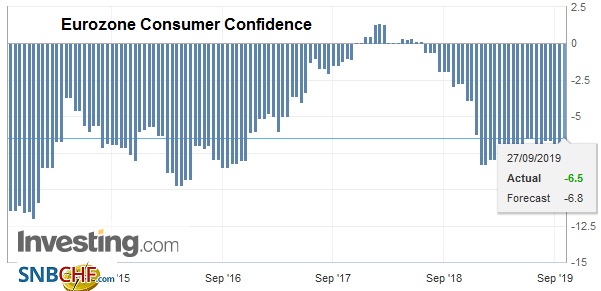

Eurozone Consumer Confidence, September 2019(see more posts on Eurozone Consumer Confidence, ) Source: investing.com - Click to enlarge |

Sterling has been sold in four of the five sessions this week and around $1.2285, is off about two cents from last week’s close. It is the weakest of the majors this week. With today’s losses, it has met the (50%) retracement objective of the rally seen from the $1.1960 low seen on September 3. The next retracement objective is near $1.22. The euro was sold to a fresh low since June 2017 earlier today and drew near $1.09 in Asia. It was a new marginal low after the sell-off in North America yesterday. Initial resistance is now seen near $1.0940. The news stream remains poor with another softer confidence report and comments from Lane, the ECB’s chief economist noting scope for lower rates.

America

The Mueller investigation failed to have much impact on the dollar or the performance of US assets more broadly. Out of the frying pan and into the fire, so it seems, as the new scandal is pushing the impeachment process further along. Still, investors seem to be looking past it. The Republican hold in the Senate suggests that even if impeached (trial in the House of Representatives), the president would be acquitted. Also, Warren, who appears to be drawing more support than Biden, seems unlikely to persuade the so-called Reagan Democrats or those voters that opted for Obama but then cast their lot with Trump. We do not write much about these developments as the market impact seems minor at best.

The Federal Reserve is still struggling to provide sufficient cash to the banks. After increasing the overnight repo operation to $100 bln from $75 bln, the overnight operation did meet the demand, but the quarter-end pressures are still acute. The Fed doubled the size of the 14-day repo to $60 bln, and that was not sufficient to meet the demand for $72.6 bln. The overnight repo operations will continue through early October.

Mexico delivered a 25 bp rate cut yesterday in a split decision. Two of the five Banixco members wanted a 50 bp cut. Many suspect that the two dissents were appointments by President AMLO. The dissents plus the logic of the cuts suggest the door is open to further easing. Mexico’s real interest rates (adjusted for inflation) remain among the highest. The central bank cited four factors that will determine its course, though it acknowledged that downside risks to growth remain. The factors include the impact of the peso on inflation, the Federal Reserve, the economic slack, and cost pressures. Banixco meets again in mid-November, and delivering back-to-back cuts, it is expected to pause. However, the last meeting of the year is on December 19, and market participants are split between a 25 and 50 bp rate cut then.

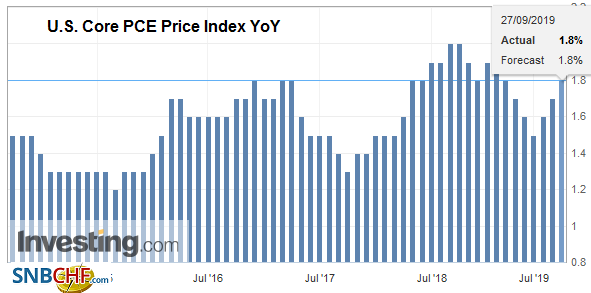

| The US reports August personal income and consumption data, and durable goods orders. The data will impact Q3 GDP expectations. Personal income is expected to have improved by 0.4% after a 0.1% gain in July. Household consumption is forecast to moderate after rising 0.4% in July. The core deflator measure may tick up to 1.8% from 1.6%. While Fed officials do talk about the core rate, the 2% target applies to the headline rate, which may be flat at 1.4%. Durable goods orders have risen for two months, but likely stalling in August after Boeing orders fell to six from 31. The underlying details, including shipments, likely held in better. The Fed’s Quarles and Harker speak today. |

U.S. Core PCE Price Index YoY, August 2019(see more posts on U.S. Core PCE Price Index, ) Source: investing.com - Click to enlarge |

The US dollar continues to trade in a narrow range against the Canadian dollar. The high for the week was set on Monday just above CAD1.33 to test the 200-day moving average. It has formed a little shelf near CAD1.3230. The dollar reached a three-week high yesterday against the Mexican peso near MXN19.6770 and made a marginal new high a little above MXN19.68 in Asia before seeing some profit-taking. It has tested initial support near MXN19.60. Stronger support is seen closer to MXN19.50, but that may be too far today.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,Currency Movement,Eurozone Consumer Confidence,Featured,MXN,newsletter,U.S. Core PCE Price Index