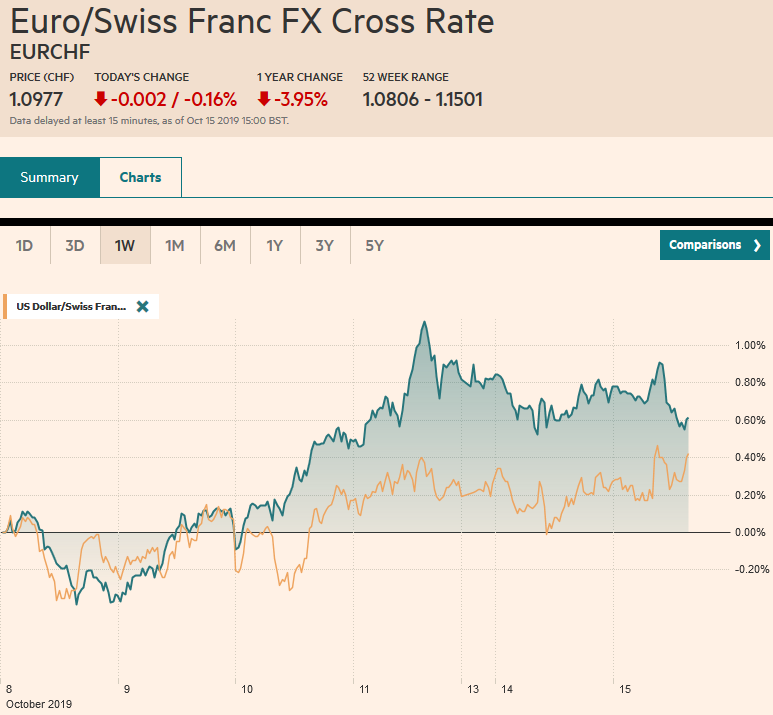

Swiss Franc The Euro has fallen by 0.16% to 1.0977 EUR/CHF and USD/CHF, October 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Ideas that a Brexit deal may be close is helping to firm sterling, while soft Chinese PPI offset the spike in food prices to show the weakness of the world’s second-largest economy. Minutes from the meeting of the Reserve Bank of Australia earlier this month kept a door open to a rate cut before the end of the year. Japan returned from holiday, and the Nikkei gapped higher, and its nearly 1.9% advance led the MSCI Asia Pacific Index higher. Europe’s Dow Jones Stoxx 600 is recouping yesterday’s 0.5% loss, while US shares are also trading firmer after yesterday’s slippage. Benchmark

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, China Consumer Price Index, Currency Movement, EUR/CHF, Eurozone ZEW Economic Sentiment, Featured, FX Daily, newsletter, Turkey, U.K. Unemployment Rate, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.16% to 1.0977 |

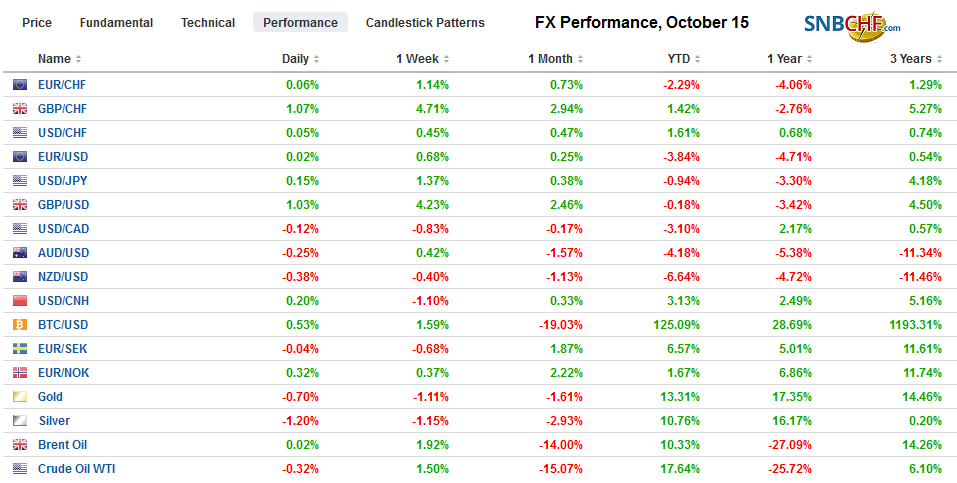

EUR/CHF and USD/CHF, October 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Ideas that a Brexit deal may be close is helping to firm sterling, while soft Chinese PPI offset the spike in food prices to show the weakness of the world’s second-largest economy. Minutes from the meeting of the Reserve Bank of Australia earlier this month kept a door open to a rate cut before the end of the year. Japan returned from holiday, and the Nikkei gapped higher, and its nearly 1.9% advance led the MSCI Asia Pacific Index higher. Europe’s Dow Jones Stoxx 600 is recouping yesterday’s 0.5% loss, while US shares are also trading firmer after yesterday’s slippage. Benchmark bond yields are little changed, though US Treasuries, which did not trade yesterday, are firmer today with the 10-year yield off four basis points to about 1.68%. Sterling is near $1.2650, even though the employment data was somewhat disappointing on the Brexit hopes. The yen and euro are little changed, while New Zealand, which reports its Q3 CPI tomorrow, is under pressure. The first trade deficit in a couple of years, due to falling energy prices, is weighing on the Norwegian krone. Among emerging markets, the Turkish lira stabilized after its recent shellacking, and the Chinese yuan snapped a five-day advance. Oil is edging lower after yesterday’s 2% drop, and gold is steady. |

FX Performance, October 15 |

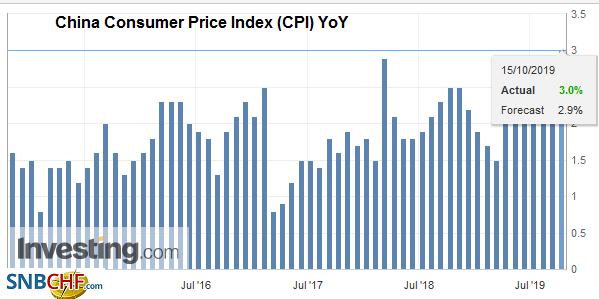

Asia PacificChina reported that September CPI accelerated to 3% from 2.8% in August. It is the most in four years. The 11.2% jump in food prices masks the underlying softness. Pork prices jumped 69% year-over-year, up from a 46.7% pace in August. More telling was the 1.2% decline in PPI compared with the 0.8% drop in August. It is the third consecutive month of deflation in producer prices. This, coupled with the larger than expected decline in imports, is understood to reveal the ongoing weakness of the Chinese economy and indicative of pressures on its trading partners. At the same time, Chinese lending is increasing. New yuan loans rose by around a third to CNY1.6 trillion in September after a CNY1.2 trillion expansion in August. Aggregate lending rose almost CNY2.3 trillion after rising CNY1.98 trillion previously. The difference between the aggregate lending and the new yuan loans is understood to non-bank activity (shadow banking). The last month of a quarter tends to see strong lending as if quota had to be met. |

China Consumer Price Index (CPI) YoY, September 2019(see more posts on China Consumer Price Index, ) Source: investing.com - Click to enlarge |

Minutes from this month’s meeting of the Reserve Bank of Australia kept the door more than ajar for another rate cut. With global rates and the ECB and Federal Reserve easing policy, blunts the risks associated with further easing by the RBA. That said, officials chose not to cut rates when they met on October 1 and seemed to recognize that additional rate cuts would likely be less effective. The tax cuts and spending increases, coupled with the past depreciation of the Australian dollar is already providing some stimulus. The market appears to have mostly discounted a rate cut at one of the two remaining meetings this year (November 5 and December 3).

Japan rejected claims that with falling inflation and low rates despite massive debt that is ought not been seen as an example of Modern Monetary Theory. That said, the government’s leaning toward a supplemental budget to ensure the October 1 sales tax increase does not send the economy into recession like past hikes, found a new justification in the form of Typhoon Hagibis wreaked havoc over the past weekend. Speculation is for a package of as much as JPY5 trillion, which would likely necessitate new bond sales.

The dollar has been confined to a little less than a 10-pip range on either side of JPY108.35 through the European morning. JPY108.00-JPY108.20 offers chart-support and about $1.5 bln options that expire today. It probably takes a sell-off in equities to send the dollar through JPY107.80, which would suggest a near-term dollar top is in place. The Australian dollar is also inside yesterday’s range as the market appears to be waiting for the North American session for leadership. Initial support is seen near $0.6750.

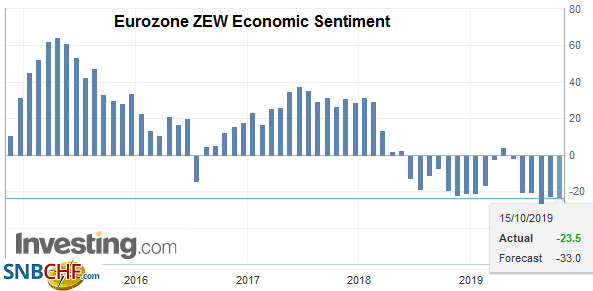

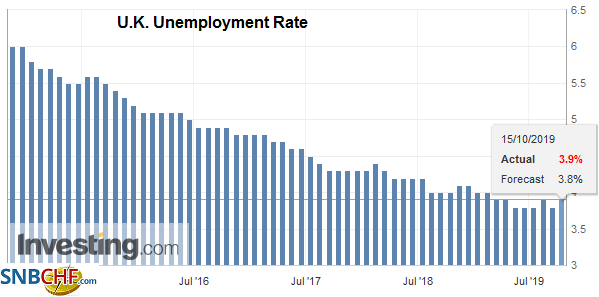

EuropeHopes of a Brexit deal remain elevated after EC negotiator Barnier confirmed that a deal this week is still possible, even though time is running out and talks remain difficult. Prime Minister Johnson has canceled a scheduled cabinet meeting to avoid leaks. The prospects of a deal have overshadowed a disappointing employment report. Jobs on a three-month-over-three-month period fell by 56k through August, matching a four-year low set two years ago. Average weekly earnings slowed to 3.8% from a 4% pace in July that was revised to 3.9%. The ILO unemployment rate ticked up to 3.9% from 3.8%. The claimant count rose in September by 21k, matching this year’s average. Investor sentiment in German has yet to stabilize. The October ZEW survey showed that the current assessment deteriorated to -25.3 from -19.9. It was worse than expected. The expectations component also posted a new low. The -22.8 reading was marginally worse than September’s -22.5, but not as bad as the -26.4 expected by the median forecast in the Bloomberg survey. The euro slipped to new lows for the session in response. |

Eurozone ZEW Economic Sentiment, October 2019(see more posts on Eurozone ZEW Economic Sentiment, ) Source: investing.com - Click to enlarge |

| The euro reached a three-week high before last weekend near $1.1065. It was sold below $1.1015 in response to the ZEW survey. There is an option for nearly 630 mln euros at $1.1020 that expires today. Tomorrow there is an option at $1.0950 for 1.4 bln euros that will be cut and may attract prices on a break of $1.10 today, which corresponds to a (61.8%) retracement of this month’s gains. Sterling is trading between the $1.26 on the downside where a GBP1 bln option is struck that will be cut today and the 200-day moving average that is found near $1.2715. It has not traded above the 200-day moving average in five months. It also corresponds to the (61.8%) retracement of sterling’s decline since the early May high just shy of $1.32. |

U.K. Unemployment Rate, August 2019(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

America

Although many observers have argued that because of the trade imbalance, the US dominates the tariff escalation ladder, we have argued that it is considerably more complicated than that. The bean counters make no qualitative distinctions as for example, rare earths and antibiotics that the US relies on China nearly exclusively are only worth their dollar value. Moreover, it abstracts from the political context. The Trump Administration has shown that it is more eager for a trade agreement than China. The premature announcement of a deal is like Bush-the-lesser, declaring mission accomplished. By doing so, when, in fact, no deal has been finalized, and as we have learned repeatedly in the last couple of years, nothing is agreed until everything is, gives President Xi the upper hand. It is unclear precisely what the practitioners of the Art of the Deal got in exchange for the suspension of the threatened tariff increase from 25% to 30%.

A week after the US announced it was moving a few dozen American troops embedded with Kurdish forces in northern Syria, which effectively removed the tripwire holding Turkish forces at bay, the Trump Administration announced new sanctions on Turkey and a few ministers for its offensive invasion of Syria. Tariffs of 50% on steel were re-imposed after being lowered in May. The administration suspended negotiations of a $100 bln trade deal, but nearly immediately, the claim was recognized as a gross embellishment. Last year, US trade figures indicate that bilateral trade was worth a little more than $20 bln. Reports that needed to be taken with the proverbial grain of salt suggest that Turkey state banks may have sold $1 bln yesterday defending the lira on top of the $3.5 bln rumored to have been sold last week. The concern is not only that that pace cannot be sustained, but also that thee are some $60 bln in hard currency debt coming due over the next 12 months.

Accidently, the NY Fed released its Empire State manufacturing sector yesterday, a day early. It edged up to 4 from 2. While this is better than the alternative, it offers a stark contrast to last year’s average, just below 20. The activity was bolstered by shipments, which rose to a five-month high, but more worrisome was the flat new orders and slower employment. That said, confidence was upbeat. The economic calendar is light today, featuring the monthly budget statement. The Fed’s Bostic, George, and Daly speak. Only George votes and she appears to favor steady policy unless the downside risks materialize. Tomorrow the US reports September retail sales, TIC data, and the Fed’s Beige Book. Canada reports existing home sales, where an increase of around 2% is expected. Its national election is October 21.

The US dollar is little changed against the Canadian dollar. A move above CAD1.3240 could spur gains toward CAD1.3280 today, with the 200-day moving average a few ticks above there. Initial support is seen near CAD1.3220. Weaker oil prices are a headwind for the Canadian dollar, but maybe blunted by the risk-on sentiment (reflected in high equity prices) and the growing premium Canada offers over the US dollar (now at 10 bp, it is the most in two years). The US dollar’s downside momentum against the Mexican peso is stalling near the 200-day moving average (a little below MXN19.26). Resistance today is seen in the MXN19.32-MXN19.35 area. It needs to resurface the MXN19.40-level to be anything significant.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,China Consumer Price Index,Currency Movement,EUR/CHF,Eurozone ZEW Economic Sentiment,Featured,FX Daily,newsletter,Turkey,U.K. Unemployment Rate,USD/CHF