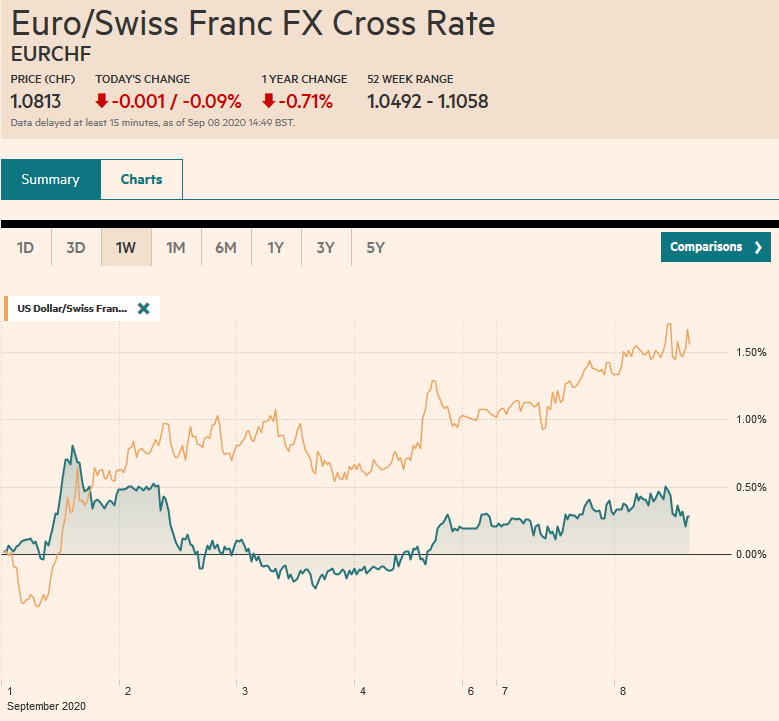

Swiss Franc The Euro has fallen by 0.09% to 1.0813 EUR/CHF and USD/CHF, September 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets remain on edge. US-China tensions are escalating. Strained Brexit talks are set to resume today. Profit-taking in the tech space has continued. The ECB meeting is around the corner. The MSCI Asia Pacific Index snapped a three-day slide today with most markets moving higher, led by a 1% gain in Australia. European bourses are mostly lower, and the Dow Jones Stoxx 600 is giving back more than half of yesterday’s 1.6% gain. US shares have fallen throughout the European morning. Benchmark 10-year yields are 2-3 bp lower, leaving the US yield near 68 bp. The dollar’s trend

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, Currency Movement, Featured, newsletter, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.09% to 1.0813 |

EUR/CHF and USD/CHF, September 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

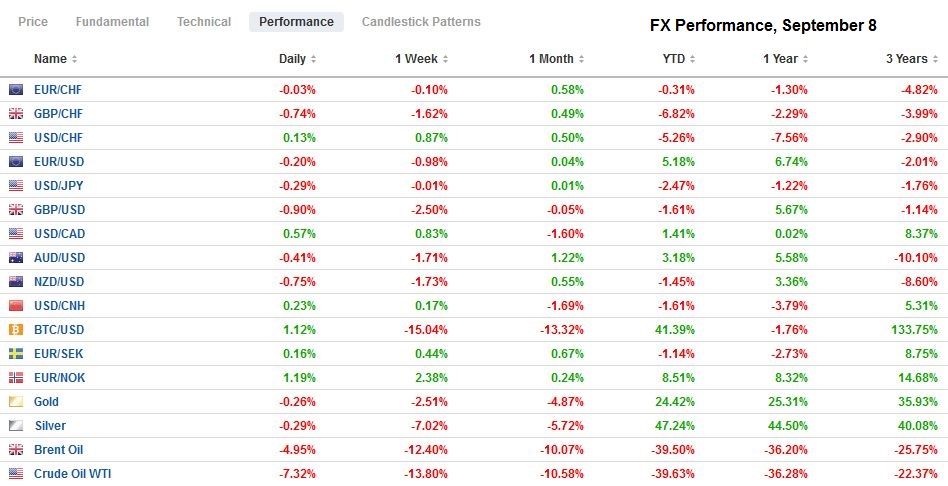

FX RatesOverview: The markets remain on edge. US-China tensions are escalating. Strained Brexit talks are set to resume today. Profit-taking in the tech space has continued. The ECB meeting is around the corner. The MSCI Asia Pacific Index snapped a three-day slide today with most markets moving higher, led by a 1% gain in Australia. European bourses are mostly lower, and the Dow Jones Stoxx 600 is giving back more than half of yesterday’s 1.6% gain. US shares have fallen throughout the European morning. Benchmark 10-year yields are 2-3 bp lower, leaving the US yield near 68 bp. The dollar’s trend continues, with both the Scandis lower for the sixth consecutive session and the euro and sterling off for the fifth day. Most emerging market currencies as also weaker. Gold was pushed below last week’s lows (~$1916), and oil prices are extending their drop. The October WTI contract that closed near $42.75 a week ago is now near $38.25, its lowest level here in Q3. |

FX Performance, September 8 |

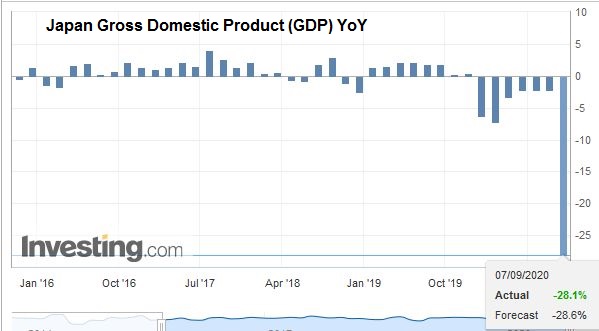

Asia PacificThe US presidential race has often seen rhetoric against China escalate. This time it was already elevated. President Trump has ratcheted pressure higher in the last 48-hours. China’s largest semiconductor fabricator has been threatened with sanctions. Decoupling has again been threatened. Trump has indicated that US companies that outsource jobs to China will be punished and denied access to government contracts. Cotton products made in the Xingjiang region could be subject to a ban in the latest threat. Separately, China has launched a new initiative to set a global standard for data security, which underscores, we suspect, the evolving fragmentation of the worldwide web. Privacy and data security protocols and rules are already diverging. It is not just China, but European regulations have been accused of as techno-nationalism by a former US trade representative in a recent op-ed in the Financial Times. Japan’s data disappointed. First, Q2 GDP was revised slightly lower to -7.9% from -7.8%. It is a 28.1% contraction at an annualized pace instead of 27.8%. The revision is due to much weaker than assumed capex (-4.7% instead of -1.5%), while offset in part by an unexpected build in inventories and a slightly smaller decline in private consumption. However, the latter is not the start of something notable. |

Japan Gross Domestic Product (GDP) YoY, Q2 2020(see more posts on Japan Gross Domestic Product, ) Source: investing.com - Click to enlarge |

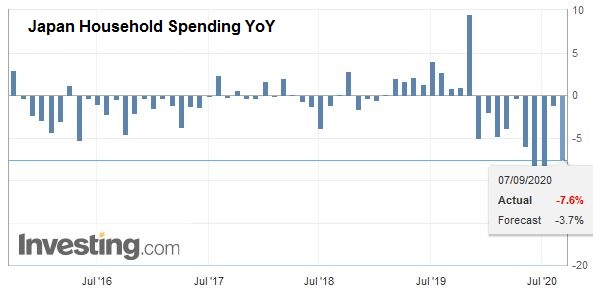

| Household spending fell by 7.6% from a year ago in July, twice the decline that economists expected and follows a 1.2% decline in June. |

Japan Household Spending YoY, July 2020(see more posts on Japan Household Spending, ) Source: investing.com - Click to enlarge |

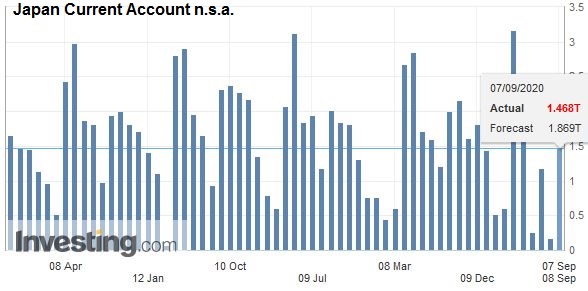

| Separately, Japan reported a smaller than expected current account surplus (JPY1.47 trillion rather than JPY1.9 trillion), of which the trade surplus was also smaller than anticipated (JPY137 bln rather than JPY182 bln). The new government is likely to provide a new supplemental budget, and the BOJ will likely inject more liquidity, perhaps via loans to Japanese companies. |

Japan Current Account n.s.a. July 2020(see more posts on Japan Current Account n.s.a., ) Source: investing.com - Click to enlarge |

The dollar is in a ridiculously narrow range of JPY106.20 to JPY106.35 through the European morning. Since last Thursday, the dollar has been in a JPY106.00 to JPY106.50 range. We suspect the upside is the most likely direction of the eventual break, but even then, the JPY107.00 area may offer formidable resistance. The Australian dollar peaked a little above $0.7300 in late Asian trading but met a wall of sellers that brought it to session lows near $0.7260 in early European turnover. It has now traded on both sides of yesterday’s range (outside day), and the close is important. A close below yesterday’s lows (~$0.7270) would have negative implications. The PBOC set the dollar’s reference rate at CNY6.8364, a little firmer than anticipated. Recall that the yuan has fallen in only one week so far in Q3.

Europe

Negotiations between the UK and Europe resume today, but the atmosphere seems poisoned by the latest threats. That said, even before the new UK threats to walk away from the negotiations, it was clear that a deal needed to be reached by the middle of next month’s EU summit to give both sides the time to ratify it. Given that there has been little progress so far, it seems like a Herculean task that neither side may be quite prepared for. Separately, the end of October is when the UK’s job furlough program is to end, and so far, pressure seemed most acute to extend it. However, the Bank of England’s Chief Economist Haldane weighed in, opposed on grounds that it would “prevent the necessary process of adjustment.”

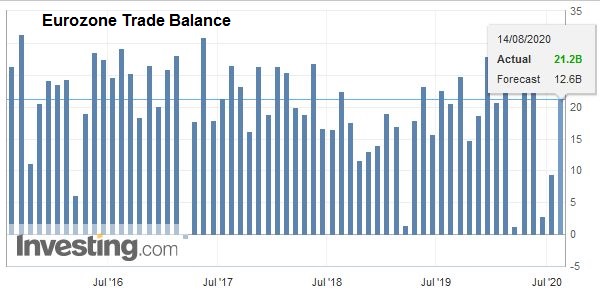

| France and German reported July trade figures. France’s deficit was larger than expected, near 6.99 bln euros, about 10% more than expected, though smaller than the revised 8.06 bln euro deficit in June. The current account deficit narrowed to 6.2 bln euros from 8.6 bln. Economists were wrong about the German figures but in the opposite direction. The German trade surplus stood at 19.,2 bln euro in July, not 15.9 bln as the median forecast in the Bloomberg survey anticipated. The trade surplus was 15.5 bln in June. |

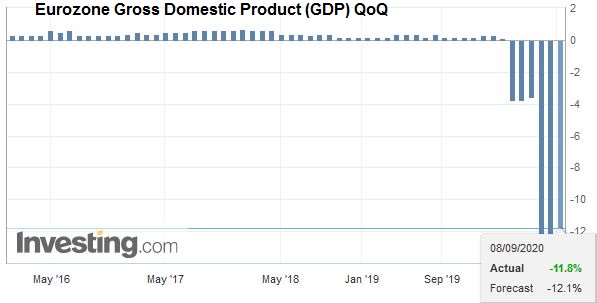

Eurozone Gross Domestic Product (GDP) QoQ, Q2 2020(see more posts on Eurozone Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| The improvement was not because of exports, which rose by 4.7% instead of 5% as expected. It was imports that did not meet up to forecasts for a 3.5% increase. They rose by 1.1%. The current account surplus narrowed slightly to 20 bln euros form 20.4 bln. Unlike Japan, where the current account is not driven by the trade balance, in both Germany and France, the trade balance does drive the broader current account. |

Eurozone Trade Balance, July 2020(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

The euro continues to trade heavily, and we expected further near-term declines into the $1.1750-$1.1760 area. There is an option for roughly 755 mln euros at $1.1695 that expires today, but it seems too far to be impactful today. We see this as a position-adjustment ahead of the ECB meeting on Thursday. Once that meeting is out of the way, attention will shift back to the FOMC meeting next week. Sterling, which was approaching $1.35 a week ago, is now set to test support at the lower end of last month’s range near $1.30, which is also roughly the (38.2%) retracement of the Q3 rally. A break could signal another cent or so loss.

America

Ahead of the PPI and CPI later in the week, and of course, the weekly jobless claims, the US economic calendar is light. The July consumer credit reports out late today usually have little if any market impact. Nevertheless, the linkages are notable. Consumer credit collapsed by more than $100 bln in the March through May period. Personal consumption fell by 6.7% in March and 12.9% in April. But, while consumer credit fell by nearly $14.4 bln in May, consumption rose a heady 8.6%. The trade deficit, often linked to debt-led consumption, jumped from $37 bln in February to $57.8 bln in May. The trade deficit narrowed in June, and consumption rose by 6.2%. Consumer credit rose by almost $9 bln in June. Now the July series. We already know that the (merchandise) deficit swelled by $10 bln to $63.55 bln, a new record, and that consumption grew by a still robust 1.9%. The median forecast in the Bloomberg survey is for consumer credit to have risen by nearly $13 bln in July. It would suggest that consumer credit is normalizing. It rose by an average of $15.2 bln a month last year.

The odds of another US fiscal stimulus package had already been reduced, but the unexpectedly large drop in the unemployment rate seems to lower the odds even more. To agree to a large plan would be to acknowledge that the US economy is still hobbled even though GDP is jumping this quarter. Reports suggest that the $1 trillion negotiating position by the White House will be halved in new proposals. Separately, there does seem to be sufficient rapport and common interest for the Republicans and Democrats to pass continuing resolution bills that will avoid a shutdown next month.

Canada and Mexico have light economic calendars today. The Canadian dollar is a little softer ahead of tomorrow’s Bank of Canada meeting. A week ago, the greenback was flirting with the CAD1.30 level. Today it is near CAD1.3150, the 20-day moving average, which it has not closed above since mid-July. It is holding just below last week’s high near CAD1.3165 in the European morning. However, it seems likely to be overcome, and the next target is CAD1.3200 on the way to CAD1.3240. The US dollar has found support against the Mexican peso near its 200-day moving average (~MXN21.54). Last week’s high was set near MXN21.95, and that offers the next upside target.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,Currency Movement,Featured,newsletter,Trade