Submitted by George Friedman and Jacob Shapiro via MauldinEconomics.com, What will the year ahead look like for Europe? 2017 will be another chapter in the European Union’s slow unraveling… a process that has been underway for over a decade. The EU is a union in name only. The transfer of sovereignty to Brussels was never total, and member states are independent countries… each with their own interests at stake....

Read More »Davos Elite Eat $40 Hot Dogs While “Struggling For Answers”, Cowering in “Silent Fear”

For those unfamiliar with what goes on at the annual January boondoggle at the World Economic Forum in Davos, here is the simple breakdown. Officially, heads of state, captains of industry, prominent academics, philanthropists and a retinue of journalists, celebrities and hangers-on will descend Tuesday on the picturesque alpine village of Davos, Switzerland, for the World Economic Forum. Unofficially, it’s the world’s...

Read More »Davos: In Defense Of Populism

Submitted by Mike Krieger via Liberty Blitzkrieg blog, DAVOS MAN: “A soulless man, technocratic, nationless and cultureless, severed from reality. The modern economics that undergirded Davos capitalism is equally soulless, a managerial capitalism that reduces economics to mathematics and separates it from human action and human creativity.” – From the post: “For the Sake of Capitalism,...

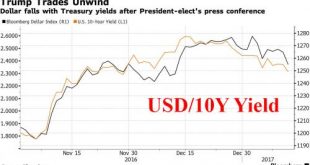

Read More »Dollar, Futures Slump; Gold Spikes Over $1,200 After Trump Disappoints Markets

Risk assets declined across the globe, with European, Asian shares and S&P 500 futures all falling, while the dollar slumped against most currencies after a news conference by President-elect Donald Trump disappointed investors with limited details of his economic-stimulus plans, and the Trumpflation/reflation trade was said to be unwinding. "The risk was always that a president like Trump would end up upsetting that consensus (of faster U.S. growth, stronger dollar) view by introducing...

Read More »When $4 trillion is Too Much and $3 trillion is not Enough

Summary: All of China’s capital outflows are not capital flight fleeing. Capital controls limiting outflows can be tightened. Paying down dollar loans, a major source of capital outflows, is not an infinite process. News that China’s reserves approached $3 trillion at the end of the last year has spurred expressions of concern. Its reserves have fallen by roughly $1 trillion since peaking mid-2014. The irony...

Read More »Gold Bars Worth $800,000 Owned By Prince

Prince, RIP, owned gold bars worth just over $800,000 according to the statement filed in a Minnesota court last Friday. At the time of his death, Prince had taken delivery of and had in his possession 67 gold bars, 10 ounce gold bars, valued at $836,166.70. That’s according to an asset inventory compiled by Bremer Trust released by the Carver County District Court, as first reported by the Minneapolis Star Tribune....

Read More »Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump’s violating the “One China” policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office. Even Bank...

Read More »FX Daily, January 10: Positioning more than Fundamentals Give Traders Pause

Swiss Franc EUR/CHF - Euro Swiss Franc, January 10(see more posts on EUR/CHF, ) - Click to enlarge Sterling is on the ropes following Brexit comments made by UK Prime Minister Theresa May over the weekend. It’s been a tough day’s trading for any clients holding the Pound with losses against all of the major currencies. GBP/CHF rates have dropped by a cent and a half with the pair now trading in the mid 1.23’s,...

Read More »Gold Price In GBP Up 4 percent On Brexit and UK Risks

Gold Price In GBP Rises 4% On Brexit and UK Economy Risks – Pound fell 2% against gold yesterday after Theresa May created Brexit concerns – May’s ‘Hard Brexit’ denial does not calm markets growing fears – Investors concerned about lack of government strategy and uncertainty – UK Prime Minister bizarrely blames media and “those who print things” for sterling depreciation – GBP gold builds on 31% gain in 2016 with 4%...

Read More »FX Weekly Preview: Macro Forces Underpin Dollar, Equities and Yields

Summary: Odds of a March Fed hike edged up last week, and Q4 GDP figures were revised higher. Many continue to expect the new US Administration to pursue pro-growth tax reform, deregulation and infrastructure spending. Although many other high income countries are growing, near trend divergence of monetary policy continues. United States The major US equity indices reached record highs before the weekend even...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org