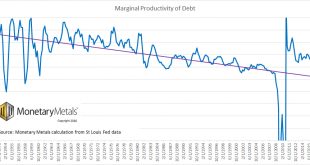

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity. This is so, even though assets have gone up. But unfortunately, as a consequence of assets going...

Read More »The Duality of Money, Report 10 Mar

This is a pair of photographs taken by Keith Weiner, for a high school project. It seemed a fitting picture for the dual nature of money, the dual nature of wood both as logs to be consumed and dimensional lumber to be used to construct buildings. Last week, in Is Capital Creation Beating Capital Consumption, we asked an important question which is not asked nearly often enough. Perhaps that’s because few even...

Read More »Macroeconomic Effects of Bank Solvency vs. Liquidity

In a CEPR discussion paper, Òscar Jordà, Björn Richter, Moritz Schularick, and Alan M. Taylor suggest that higher bank capital ratios help stabilize the financial system ex post but not ex ante, and that illiquidity breeds fragility. Abstract of their paper: Higher capital ratios are unlikely to prevent a financial crisis. This is empirically true both for the entire history of advanced economies between 1870 and 2013 and for the post-WW2 period, and holds both within and between...

Read More »Conference in Honor of Bob King at the Study Center Gerzensee

Jointly with the Journal of Monetary Economics and the Swiss National Bank, the Study Center Gerzensee organized a conference in honor of Bob King, long-term supporter of the Study Center. Program: PDF. Jaume Ventura’s discussion of a paper on trade and growth by Alvarez and Lucas: PDF. My discussion of a paper on debt and debt constraints by Bhandari, Evans, Golosov, and Sargent: PDF.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org