Yesterday, IHS Markit reported that the manufacturing turnaround its data has been suggesting stalled. After its flash manufacturing PMI had fallen below 50 several times during last summer (only to be revised to slightly above 50 every time the complete survey results were tabulated), beginning in September 2019 the index staged a rebound jumping first to 51.1 in that month. Subsequent months of data had continued the trend. By November, the PMI registered 52.6...

Read More »Everything Comes Down To Which Way The Dollar Is Leaning

Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.” That is a demonstrably false guess, one easily dispelled by the facts. A trade war produces winners from its losers. But we cannot find a single one. There have...

Read More »A Repo Deluge…of Necessary Data

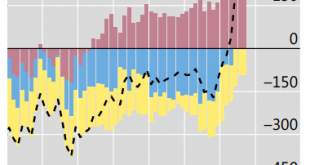

Just in time for more discussions about repo, the Federal Reserve delivers. Not in terms of the repo market, mind you, despite what you hear bandied about in the financial media the Fed doesn’t actually go there. Its repo operations are more RINO’s – repo in name only. No, what the US central bank actually contributes is more helpful data. Since our goal is to use that data to produce the best possible, most accurate interpretation of the facts, the depth and...

Read More »The BIS Misses An Opportunity To Get Consistent With The Facts

Much has been made about the repo market since mid-September. Much continues to be made about it. The question is why. It is now near the middle of December and repo looks dicey despite repo operations and a not-QE small-scale asset purchase intended to increase the level of bank reserves. Always the focus on “funds” which may be available. It was John Adams who took on the task of defending several British soldiers on trial for the Boston Massacre. A wholly...

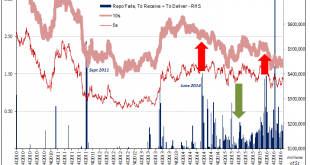

Read More »Fails Swarms Are Just One Part

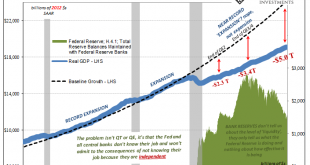

There it was sticking out like a sore thumb right in the middle of what should have been the glory year. Everything seemed to be going just right for once, success so close you could almost feel it. Well, “they” could. The year was 2014 and the unemployment rate in the US was tumbling, the result of the “best jobs market in decades.” Real GDP in that year’s two middle quarters was pretty near 5% in both. What wasn’t to like? As GDP-measured output was spiking, so,...

Read More »The Big One, The Smoking Gun

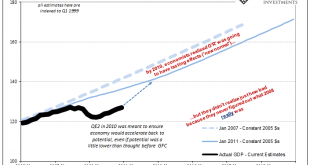

It wasn’t just the unemployment rate which was one of the key reasons why Economists and central bankers (redundant) felt confident enough to inspire 2017’s inflation hysteria. There was actually another piece to it, a bigger piece potentially complimentary and corroborative bit of conjecture. I write “conjecture” because despite how all this is presented in the media there’s very little precision to any of it. In many ways, if you pay close enough attention you...

Read More »More (Badly Needed) Curve Comparisons

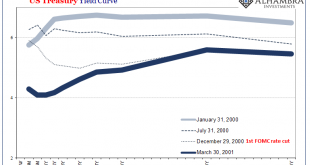

Even though it was a stunning turn of events, the move was widely celebrated. The Federal Reserve’s Open Market Committee, the FOMC, hadn’t been scheduled to meet until the end of that month. And yet, Alan Greenspan didn’t want to wait. The “maestro”, still at the height of his reputation, was being pressured to live up to it. The Fed had begun to cut rates. In Austin, Texas, where President-elect Bush and many prominent business leaders were gathered, the news...

Read More »FX Daily, November 8: Risk Appetites Satiated Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.06% to 1.0987 EUR/CHF and USD/CHF, November 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are consolidating the recent moves ahead of the weekend. Equities are paring this week’s gains, though the Nikkei, which was closed on Monday, extended its advance for the fourth consecutive session. Despite the profit-taking today, the MSCI Asia Pacific Index...

Read More »Three (Rate Cuts) And GDP, Where (How) Does It End?

The Federal Reserve has indicated that it will now pause – for a second time, supposedly. Remember the first: after raising its benchmark rates apparatus in December while still talking about an inflationary growth acceleration requiring even more hikes throughout 2019, in a matter of weeks that was transformed into a temporary suspension of them. Expecting the easy disappearance of “transitory” factors, that Fed pause was to be followed by the second half rebound...

Read More »Monthly Macro Monitor: Market Indicators Review

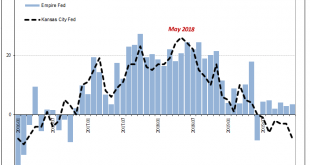

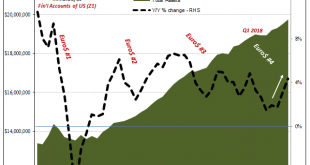

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations. The yield curve has also steepened as the 10 year Treasury yield rose faster than the 2 year. This...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org