Making its way to a Swiss home near you: an Amazon package The government has defended the deal struck that will see Swiss Post delivering packages for retail giant Amazon. There is no question of preferential treatment, it said. The response by the government came in response to a parliamentary question raised by politician Olivier Feller (Liberal-Radical), querying the deal that will see Swiss Post delivering Amazon...

Read More »Less Retail Jobs, More Amazon Robots: Get Used To It

When it comes to job creation in the United States, President Trump will be displeased to hear the latest findings from Quartz: 170,000 fewer retail jobs in 2017 – and 75,000 more Amazon robots. In November, we explained that while everyone likes to point the finger at Amazon, America’s retail apocalypse can’t be tied to just one catalyst (see: A Look At America’s Retail Apocalypse In Charts), however, fierce...

Read More »Global Asset Allocation Update

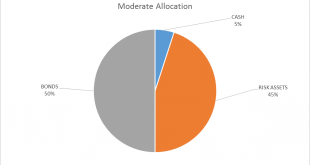

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise. Moderate Allocation - Click to enlarge No...

Read More »Hedge funds: US value strikes back?

Macroview Growth vs. value has been an important theme in long/short hedge fund portfolios--and a recent source of pain for some and profit for others owing to trend reversals this year. Amid slowing growth worldwide, growth stocks have outperformed value both in the US and Europe in the past decade and have been a profitable bet in long/short managers' books. There are some inherent differences in what value stocks represent in the two regions. Looking at the composition of the MSCI US...

Read More »US Tech: The Thrill Isn’t Gone

After six disappointing quarters in a row for Google and persistent doubts about when and if Amazon will generate steady profits, many investors have recently started to wonder how long double-digit revenue growth can continue, and whether growth on the bottom line will ever be as impressive as that on the top line, according to Uwe Neumann, a senior technology analyst in Credit Suisse’s Private Banking & Wealth Management Division. In other words, can Internet platform companies such as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org