I have previously explained how for Ludwig von Mises, democracy is necessary for the libertarian society because of its usefulness in achieving and maintaining social peace, insofar as social peace is a prerequisite for economic and civil liberty. This time I want to explain an idea that is implicit in Mises’s subjectivist philosophy and that leads him to defend democracy, understood as the consent of the governed, but which may go unnoticed because it is dispersed...

Read More »The “Meritocracy” Was Created by and for the Progressive Ruling Class

All of Al Gore's children went to Harvard. Are we really to believe that this is because the Gore kids had the most "merit"? The only real meritocracy is in the marketplace. Original Article: "The "Meritocracy" Was Created by and for the Progressive Ruling Class" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

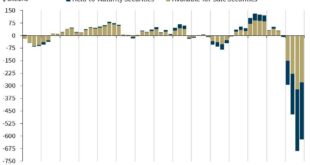

Read More »Silicon Valley Bank and the Failure of Fractional Reserve Banking

With the apparent failure of Silicon Valley Bank (SVB) potentially causing a crisis in the American and even the global financial system, we will be treated to all manner of explanations, very few of which will accurately state the cause of these troubles: fractional reserve banking. In modern banking there is little separation between warehouse and investment banking. The downside of investment banking is a potential loss of money since no investment can be a sure...

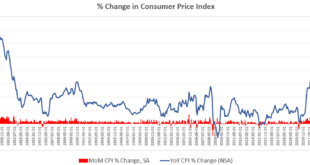

Read More »Looming Bank Failures Point to More Price Inflation as Real Wages Fall Again

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in eighteen months. According to the BLS, Consumer Price Index (CPI) inflation rose 6.0 percent year over year in February before seasonal adjustment. That’s down from January’s year-over-year increase of 6.4 percent, and February is the...

Read More »The Theory and Practice of Conspiracy

Adam Smith published The Wealth of Nations in 1776, at the beginning of the Industrial Revolution. The book was the result of twenty years of observation of human action and identification of the mechanisms and processes that lead to economic efficiency and to our well-being. The book was written at a time when guilds had not yet completely disappeared, even though it was already known that the guild system was a brake on innovation and freedom of trade, that guilds...

Read More »Jeff Grogg: Building The New Production Structure Of Entrepreneurial Capitalism

It’s time to re-imagine how entrepreneurs bring their innovative value propositions to market at the appropriate scale to meet the important needs of millions of people. The new way of thinking is for entrepreneurs to focus all their energy on designing, refining and strengthening the value proposition, and then plugging in to a network of resources assembled by others so that customers enjoy the full realization of the value experience the entrepreneurial has...

Read More »A Permanent Wartime Economy

Resources are scarce even when money is not. Original Article: "A Permanent Wartime Economy" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content] Tags: Featured,newsletter

Read More »Our Economic Illiteracy

“Economics,” wrote Henry Hazlitt, “is haunted by more fallacies than any other study known to man.” True. No epoch is immune to the scourge of economic illiteracy. Yet, we find ourselves in a moment of especially unprecedented economic ignorance. We’ve come a long way since the days of Hazlitt’s editorializing in the New York Times. In the 1930s, believe it or not, the Times held the line on economic orthodoxy in the face of emergent quackery. Fast forward and here...

Read More »A Bank Crisis Was Predictable. Was the Fed Lying or Blind?

Welcome to Whose Economy Is It, Anyway?, where the rules are made up and the dollars don’t matter. Or at least that seems to be the view of the Yellen regime. As Doug French noted last week, Silicon Valley Bank (SVB) was the canary in the coal mine. Over the weekend, Signature Bank became the third-largest bank failure in modern history, just weeks after both firms were given a stamp of approval by KPMG, one of the Big Four auditing firms. While some in the crypto...

Read More »Yes, the Latest Bank Bailout Is Really a Bailout, and You Are Paying for It.

Silicon Valley Bank (SVB) failed on Friday and was shut down by regulators. It was the second-largest failure in US history and the first since the global financial crisis. Almost immediately, the calls for bailouts started to come in. (Since Friday, First Republic Bank has failed, and many other banks are facing collapse.) In fact, on March 9, even before SVB failed, billionaire investor Bill Ackman took to Twitter to insist a federal “bailout should be considered”...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org