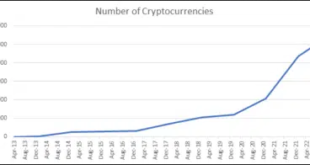

An intrusive intervention into the crypto market similar to what the EU has recently provided is not a sure promise of a Pareto efficient result. The cryptocurrency market has evolved at a rapid pace over the course of its short lifespan. With its community and users growing steadily. They offer the potential for new choices to be made in a field long dominated by government monopolies. They are a real financial alternative and might provide intense competition...

Read More »Deirdre McCloskey Becomes a Fellow of the Erasmus Forum

The Austrian Economics Center and the Hayek Institut congratulate Deirdre McCloskey on becoming a Fellow of the Erasmus Historical and Cultural Research Forum. Next week, on June 1, the London School of Economics is celebrating its Deirdre McCloskey inaugural lecture as a Fellow of the Erasmus Forum. This inaugural edition of the lecture will be held by McCloskey herself on The Near Impossibility of Policy. We at the Austrian Economics Center want to...

Read More »Public Healthcare Threatens Liberty in the U.S.

Despite higher healthcare costs, Americans receive better healthcare, provided by the individually tailored healthcare plans, courtesy of the private sector. There is no such thing as a free lunch. Whether you pay with your time or someone else’s money, Milton Freedman hit the nail on the head. Nothing in life is ever free; healthcare included. Many Americans argue that a universal healthcare system such as the ones implemented in Europe is the most...

Read More »War in Ukraine – Week 11

Business trips are very different these days. It was a wonderful and intense week, but nothing beats coming back home with bags full of supplies! Day 79 May 13 The very real price Ukrainians are paying for other people’s imperial delusions: survivors of the Kramatorsk train station bombing. More than 30 people were killed, and more than 100 injured among about 1000 people waiting to be evacuated from the city. ...

Read More »War in Ukraine – Week 10

Day 73 May 7 This is Liza. She is 15 years old. After her town got shelled and two people got injured she volunteered to drive them to get some medical help, because no one else would. First she got through mines on the road, then Russian soldiers shot at the car, injuring both of her legs. But she kept driving until the car stopped. Fortunately, they got picked up by our guys, and this brave little girl and her passengers are recovering right now....

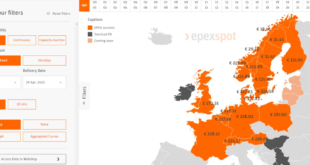

Read More »The EU energy price crisis – is the market design to blame?

The electricity prices reflect the supply and demand conditions in Europe and interfering with the price formation mechanism would have dangerous consequences. Since the end of 2021, we have witnessed unprecedented price levels in the European electricity markets, with an increase in electricity prices by 200% within less than a year. This tense market situation was further perpetuated by geopolitical events, namely the Russian invasion of Ukraine, impacting gas...

Read More »War in Ukraine – Week 8

Day 56 April 20 4-year old Alisa is begging to be evacuated from under siege Mariupol. So are thousands of others after about 50 days underground. But russia won’t allow it. They are holding these people hostage, watching them die slowly and painfully one by one. Source: Nataliya Melnyk on Facebook ********************************************************* Day 55 A big thank you from my little shelter van Goghs to everyone who helps us keep them distracted...

Read More »Ukraine and the Next Wave of Inflation, Part II, Can Russia Enact a Gold Standard?

Can Russia Enact a Gold Standard? In Part I we discussed how the fallout from the Russian invasion of Ukraine will lead to inflation, but not in the way most people think. In Part II we discuss the possibility of Russia repudiating the dollar and going on a gold standard. Can they do it? How would the world react? Why not enact a Bitcoin Standard instead? The Russian central bank reportedly has over 2,000 tonnes of gold. We have seen three arguments repeated many...

Read More »Mapping the Conflict in the Ukraine

Dear Readers, the following post has been published on the 3rd of March 2014. Due to the recent historical events we are reposting it, conscient of the prescience of the meanwhile passed author, Pater Tenebrarum. Michael, Editor Russian Troops in the Crimea John Kerry is appropriately aghast at the “incredible act of aggression” by Russia in the Ukraine: “You just don’t in the 21st century behave in 19th century fashion by invading another country on completely...

Read More »What’s In Your Loan?

Opposing Monetary Directions “Real estate is the future of the monetary system,” declares a real estate bug. Does this make any sense? We would ask him this. “OK how will houses be borrowed and lent?” “Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars. “What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!” “Yes, but housing is the collateral.” OK, so it’s not a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org