. The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is...

Read More »Stillbirths on the Rise

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is...

Read More »Did You Make Janet Yellen Rich?

The Stress of Losing Billions Up until the WallStreetBets crowd short squeezed Melvin Capital for a $7 billion loss, Robinhood had it made. But losing billions is stressful. And when your product blows up your customer the clucking that follows comes hot and heavy. A surprise revival of business at Game-Stop… [PT] One of the sweetest displays in the world, we’ve been told, is the bursts of digital confetti that shower down Robinhood’s investment app to celebrate the...

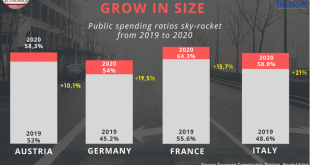

Read More »Governments Grow in Size

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is...

Read More »The economic cost of lockdowns

As many countries face their second or even third lockdowns (Germany, Austria, Israel), others (Switzerland, the United States) have done what they can to escape such repetitions. Much of the discussion about this drastic move involves its costs. As Covid-19 became pandemic in early 2020, most countries opted for a similar set of measures. They implemented social distancing, slowed down the traffic of people in public spaces and eventually put a stop to large...

Read More »New Opportunities 2021: Fiscal policy for the recovery

This GIS 2021 Outlook series focuses on the opportunities that stem from the upheaval of the past year. Coronavirus vaccine distribution has begun, most probably marking the beginning of the end of the global health crisis. A receding pandemic will leave behind intertwined economic and fiscal challenges for countries around the world. Those that address rising debts with expenditure-based reforms in 2021 and eschew higher taxes can expect to benefit from faster and...

Read More »Vaccine Passports Are a Terrible Idea

Vaccine rollout is advancing at snail pace in the European Union. At the same time, countries like the United States, the United Kingdom, and Israel are moving quickly to get large parts of the population vaccinated as promptly as possible. As Europe debates the success or failure of its vaccine policy, some countries want to be one step ahead and discuss the possibility of so-called vaccine passports. The concept is straightforward: those who have been...

Read More »Fear of Collapse for Small Businesses

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is precisely...

Read More »A Future Hunger Pandemic

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is precisely...

Read More »Grantham’s ‘Real McCoy’ Bubble in a World Gone Mad

The Lure of Easy Money Right now happens to be an attractive time to do something stupid. What’s more, everyone is doing it. Maybe you are too. Stock valuations and corporate earnings growth no longer appear to matter. Why not buy an S&P 500 index fund and let it ride? Or, better yet, why not buy shares of Nvidia? The stock of the semiconductor company is up more than 170 percent over the last 9-months. Perhaps it will double again from here. Of course,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org