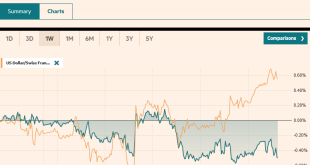

Swiss Franc The Euro has fallen by 0.07% to 1.0887 EUR/CHF and USD/CHF, August 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and...

Read More »FX Daily, August 22: Tick Up in EMU PMI Does Little, Waiting for Powell

Swiss Franc The Euro has risen by 0.17% to 1.0905 EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday’s 1.2% advance despite an unexpected gain in the EMU flash PMI....

Read More »FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

Swiss Franc The Euro has risen by 0.27% to 1.0882 FX Rates The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday’s losses and more. It was led higher by consumer discretionary, energy, and industrials. US shares are also trading firmer today,...

Read More »USD/CHF technical analysis: 21-DMA exerts downside pressure

USD/CHF pulls back to 23.6% Fibonacci retracement. 21-DMA limits near-term upside. Following its U-turn from the 21-day simple moving average (DMA), USD/CHF confronts 23.6% Fibonacci retracement of April-August declines as it takes the bids to 0.9793 ahead of the European session on Wednesday. While 14-bar relative strength index (RSI) shows normal condition, pair’s sustained run-up beyond 0.9800 enables it to challenge the short-term key DMA level of 0.9811. It...

Read More »FX Daily, August 20: Marking Time Ahead of PMI and Powell

Swiss Franc The Euro has risen by 0.13% to 1.0856 EUR/CHF and USD/CHF, August 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities and bonds are firmer in quiet turnover, and the dollar is narrowing mixed in narrow ranges. The big events of the week, the eurozone flash PMI and Powell’s speech at Jackson Hole still lie ahead. The MSCI Asia Pacific Index rose for the third consecutive session, led by...

Read More »USD/CHF technical analysis: 50 percent Fibo. limits upside to 0.9835/37 resistance-confluence

USD/CHF seesaws near two-week high amid overbought RSI conditions. A confluence of six-day-old rising trend-line, 4H 200MA adds to the resistance. The USD/CHF pair’s one-week-old recovery seems to fade as the quote seesaws near 0.9814 during the Asian session on Tuesday. Not only repeated failures to cross 50% Fibonacci retracement of current month declines but overbought conditions of 14-bar relative strength index (RSI) also increases the odds of its pullback....

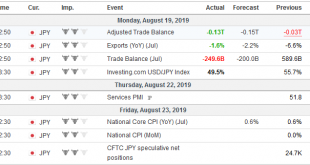

Read More »FX Daily, August 19: China’s Rate Reform Helps Markets Extend End of Last Week Recovery

Swiss Franc The Euro has risen by 0.27% to 1.0879 EUR/CHF and USD/CHF, August 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: China announced some changes in its interest rate framework that is expected to lead to lower rates. This helped lift equity markets, which were already recovering at the end of last week from the earlier drubbing. Chinese and Hong Kong shares led the regional rally with 2-3% gains....

Read More »FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends. To be sure, the end is conceivable but it seems beyond which the...

Read More »USD/CHF technical analysis: Heads to 0.9800/05 supply-zone amid bullish MACD

USD/CHF surges to seven-day high. Further upside to near-term key resistance-area expected based on the bullish technical indication. Carrying its early week’s gradual recovery forward, USD/CHF rises to a week’s top while taking the bids to 0.9790 ahead of Friday’s European open. While bullish signal via 12-bar moving average convergence and divergence (MACD) increases the pair’s further run-up, the 0.9800/05 area including mid-July lows and early-month high will...

Read More »FX Daily, August 16: Markets Take Collective Breath Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.01% to 1.0841 EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are ending the tumultuous week calmly, but it is far from clear that is will hold long. Next week’s flash PMIs have potential to disappoint, and there is risk of new escalation in the US-China trade conflict as the PRC threatens to take action to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org