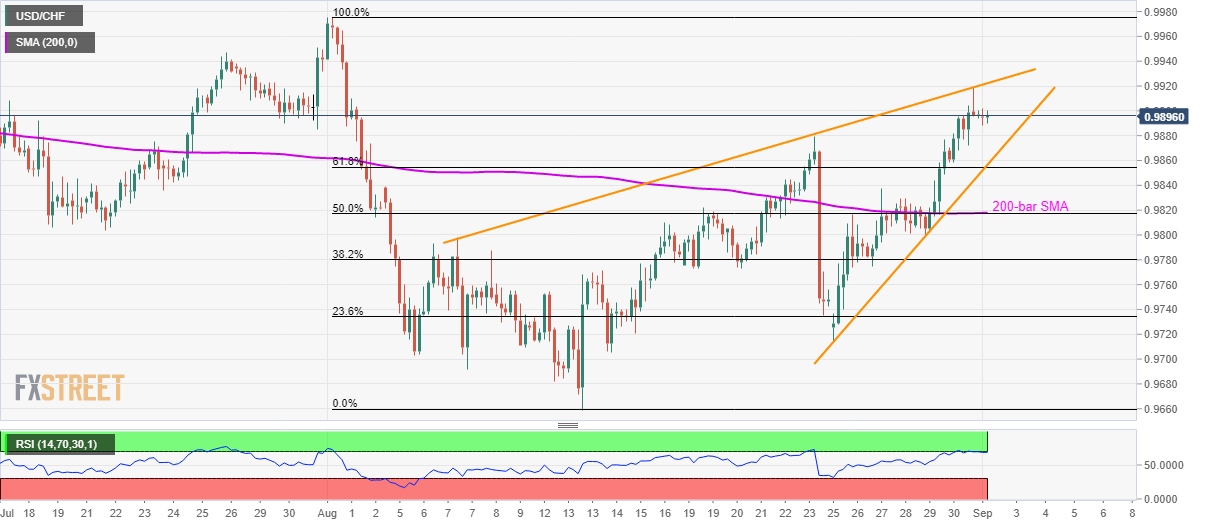

USD/CHF remains below near-term resistance-line forming part of immediate rising wedge bearish formation. 200-bar SMA, 50% Fibonacci retracement can question pair’s downside below 0.9857/54 confluence. USD/CHF fails to extend the latest upward trajectory as it trades near 0.9900 during Asian session on Monday. While drawing trend-lines with the help of highs and lows marked since August 23, a short-term rising wedge, bearish formation, appears on the four-hour chart. However, the resistance-line can be stretched since early-August levels for further precision. As a result, 0.9922 acts as a tough upside barrier amid overbought conditions of 14-bar relative strength index (RSI), a break of which can escalate the pair’s rise to July 26 high of 0.9948 ahead of

Topics:

Anil Panchal considers the following as important: 4.) FXStreet, 4) FX Trends, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

USD/CHF fails to extend the latest upward trajectory as it trades near 0.9900 during Asian session on Monday. While drawing trend-lines with the help of highs and lows marked since August 23, a short-term rising wedge, bearish formation, appears on the four-hour chart. However, the resistance-line can be stretched since early-August levels for further precision. As a result, 0.9922 acts as a tough upside barrier amid overbought conditions of 14-bar relative strength index (RSI), a break of which can escalate the pair’s rise to July 26 high of 0.9948 ahead of flashing August month top of 0.9968 on buyers’ radar. During the pair’s pullback, 61.8% Fibonacci retracement of August month downpour and the formation’s lower-line becomes the key support around 0.9857/54, a break of which can drag the quote to 200-bar simple moving average (SMA) and 50% Fibonacci retracement near 0.9818/17. In a case, prices keep trading southwards past-0.9817, August 25 low near 0.9717 could be bears’ favorite. |

USD/CHF Four Hours Chart, July - August 2019(see more posts on USD/CHF, ) |

Trend: pullback expected

Tags: Featured,newsletter