Swiss Franc The Euro has risen by 0.34% to 1.0959 EUR/CHF and USD/CHF, October 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Disappointing economic data again drove US equities lower, which in turn carried into Asia Pacific activity. Losses were recorded throughout the region, with the notable exception of Hong Kong. The Nikkei and Australia’s ASX were off by 2%. After its largest losing session of the year...

Read More »FX Daily, October 2: Greenback Shows Resiliency, Stocks Don’t

Swiss Franc The Euro has risen by 0.66% to 1.0928 EUR/CHF and USD/CHF, October 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Shockingly poor ISM data sent shivers through the market on Tuesday and hand the S&P 500 its biggest loss in five weeks and took the shine off the greenback. The S&P 500 reached a five-day high before reversing course and cast a pall over today’s activity. All the markets were...

Read More »FX Daily, October 1: Dollar Jumps to Start New Quarter

Swiss Franc The Euro has risen by 0.17% to 1.0893 EUR/CHF and USD/CHF, October 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is rising against nearly every currency today as global growth concerns deepen. Japan’s Tankan Survey showed large manufacturers confidence is a six-year low. The Reserve Bank of Australia cut 25 bp as widely expected and kept the door open for more. The final EMU PMI...

Read More »FX Daily, September 30: A Busy Week Begins Quietly

Swiss Franc The Euro has risen by 0.24% to 1.0862 EUR/CHF and USD/CHF, September 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the quarter ends, the capital markets are mixed. Equities in Asia Pacific were heavier, except in Hong Kong and Australia, while shares were mixed, leaving the Dow Jones Stoxx 600 little changed through the European morning. US shares are trading firmer. Benchmark 10-year bond...

Read More »FX Weekly Preview: Forces of Movement at the Start of Q4 19

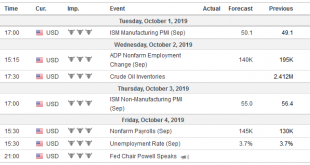

United States The world’s largest economy appears to have grown by about 2% in Q3 at an annualized pace, the same as in Q2, and in line with what many Fed officials understand to be trend growth. The strength of the US labor market underpins consumption, the powerful engine of the US economy. The latest readings of both the labor market and consumption will highlight the economic data in the week ahead. The strength of the recent housing data (starts and sales)...

Read More »FX Daily, September 27: Markets Limp into the Weekend with the Euro Languishing at New Lows and Sterling under Pressure

Swiss Franc The Euro has risen by 0.01% to 1.0851 EUR/CHF and USD/CHF, September 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities remain under pressures. The MSCI Asia Pacific Index lower today, though Chinese and Australian shares were firmer. It is the second consecutive week the benchmark has fallen. European equities are firmer, but not enough to offset the losses earlier this week and are set to...

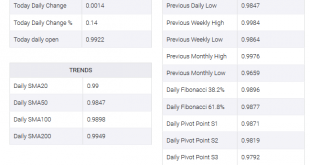

Read More »USD/CHF consolidates gains above 0.9900, limited by 0.9950

US Dollar rises versus Swiss Franc for the second-day in-a-row USD/CHF testing key 200-day simple moving average and 0.9950. The USD/CHF rose on Thursday, holding firm above 0.9900. The pair peaked on European hours at 0.9947 and then pulled back finding support at 0.9900. The bounced back to the upside unable to challenge daily highs and is trading at 0.9930. The move to the upside was not as strong as earlier today amid a deteriorating sentiment in markets that...

Read More »FX Daily, September 26: Greenback Remains Firm

Swiss Franc The Euro has risen by 0.15% to 1.0866 EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A compelling narrative for yesterday’s disparate price action is lacking. A flight to safety, which is a leading interpretation, does not explain the weakness in the yen, gold, or US Treasuries. Month- and quarter-end portfolio and hedge adjustments may be at work, but the risk is...

Read More »USD/CHF technical analysis: 1-week-old resistance-line, 23.6 percent Fibo. limits nearby upside

USD/CHF pulls back from a multi-day high, stays above 200-bar SMA. Trend-positive RSI increases the odds of upside. Despite bouncing off 200-bar simple moving average (SMA), USD/CHF fails to cross near-term key resistances as it trades around 0.9915 while heading into the European session open on Thursday. With this, the quote can witness pullback to 38.2% Fibonacci retracement of August-September upside, at 0.9880, ahead of highlighting the key 200-bar SMA level of...

Read More »FX Daily, September 25: Risk Appetite Stymied: Dollar Recovers while Stocks Slide

Swiss Franc The Euro has fallen by 0.13% to 1.0842 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities and fixed income reacted to the large moves yesterday in the US when the 10-year note yield fell eight basis points, and the S&P 500 fell by 0.85%. Investors have focused on three separate developments and two of which came from President Trump’s speech at the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org