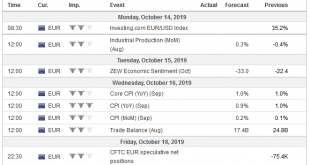

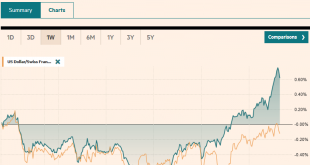

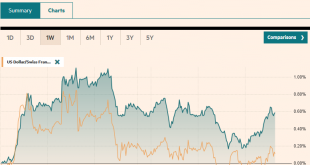

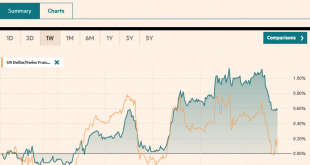

Swiss Franc The Euro has fallen by 0.16% to 1.0977 EUR/CHF and USD/CHF, October 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Ideas that a Brexit deal may be close is helping to firm sterling, while soft Chinese PPI offset the spike in food prices to show the weakness of the world’s second-largest economy. Minutes from the meeting of the Reserve Bank of Australia earlier this month kept a door open to a...

Read More »FX Daily, October 14: Optimism Took the Weekend Off

Swiss Franc The Euro has fallen by 0.16% to 1.0979 EUR/CHF and USD/CHF, October 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Japanese and Canadian markets are on holiday today. While the US bond market is closed, equities maintain their regular hours today. Asia Pacific equities rallied, led by 1% of more gains in China, Taiwan, South Korea, and Thailand. The buying did not continue in Europe, and after a...

Read More »FX Weekly Preview: Same Three Drivers in the Week Ahead but Changing Tones

Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little. It begins with the most substantive progress on Brexit in months, but also entails a possible new tariff truce between the US and China. Indeed, we irreverently...

Read More »FX Daily, October 11: Nothing Like Approaching the Edge to Focus the Minds

Swiss Franc The Euro has risen by 0.56% to 1.1031 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the edge of the abyss is approached in three distinct areas, there is hope that victory can be snatched from the jaws of defeat. US-China trade talks continue today, and there is hope of a small deal that could lead to the US not hiking tariffs next week. A shift in the UK toward a...

Read More »FX Daily, October 10: Setback for the Greenback

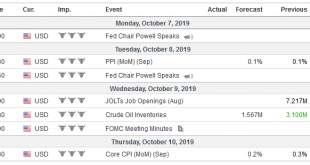

Swiss Franc The Euro has risen by 0.37% to 1.0962 EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Conflicting headlines about US-China trade whipsawed the markets in Asia, but when things settled down, perhaps, like the partial deal that has been hinted, net-net little has changed. Asian equities were mixed, with the Nikkei, China’s indices, and HK gaining, while most of the...

Read More »FX Daily, October 9: Hope is Trying to Supplant Pessimism Today

Swiss Franc The Euro has risen by 0.35% to 1.0912 EUR/CHF and USD/CHF, October 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 1.5% drop in the S&P 500 and the deterioration of US-China relations and the prospects of a no-deal Brexit failed did not carry over much into today’s activity. Asia Pacific equities were mostly a little lower, though China and India bucked the regional trend, while Korea was...

Read More »FX Daily, October 8: Not a Good Day for Negotiators

Swiss Franc The Euro has fallen by 0.27% to 1.0881 EUR/CHF and USD/CHF, October 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The re-opening of Chinese markets after a long holiday did not produce the volatility that many expected. Chinese stocks alongside most Asia markets traded higher today, and the yuan advanced. After opening higher and extending its recent rally, Europe’s Dow Jones Stoxx 600 turned...

Read More »FX Daily, October 7: Markets Unsettled to Start the Week

Swiss Franc The Euro has risen by 0.05% to 1.0926 EUR/CHF and USD/CHF, October 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are uneasy as the risks that have dominated investors’ concerns–trade and Brexit–remain front and center today. Expectations are low that this week’s talks between the US and China will lead to a breakthrough or will be sufficient to postpone further the next...

Read More »FX Weekly Preview: China Returns, ECB Record, Fed Minutes and the Week Ahead

Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment. Theory needs to accommodate the new facts. Theory is being...

Read More »FX Daily, October 4: The US Jobs Data to Close a Sobering Week

Swiss Franc The Euro has fallen by 0.37% to 1.0913 EUR/CHF and USD/CHF, October 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery of US shares yesterday signaled today’s fragile stability. Gains in Japan, Australia, and Taiwan blunted the losses elsewhere in the region, including a 1% slide in Hong Kong. The MSCI Asia Pacific Index fell for the third week. China’s markets have been closed since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org