There is a sense of new divergence. Most economists, including the staff at the Federal Reserve, no longer think the US is recession-bound. Unprecedented in modern times, inflation has fallen sharply, and unemployment has not risen, and the economy appears to be enjoying its third consecutive quarter, and the fourth in the past five, above what the Federal Reserve regards as the non-inflationary pace (1.8%). At the same time, and despite being among the fastest growing large economies, China's officials continue to make one announcement after another to support this or that sector, while the property market, which was a key engine of growth and savings, remains broken. The eurozone is struggling with two shocks, energy, and China. But unlike Beijing, there seems

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Featured, macro, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

There is a sense of new divergence. Most economists, including the staff at the Federal Reserve, no longer think the US is recession-bound. Unprecedented in modern times, inflation has fallen sharply, and unemployment has not risen, and the economy appears to be enjoying its third consecutive quarter, and the fourth in the past five, above what the Federal Reserve regards as the non-inflationary pace (1.8%).

At the same time, and despite being among the fastest growing large economies, China's officials continue to make one announcement after another to support this or that sector, while the property market, which was a key engine of growth and savings, remains broken. The eurozone is struggling with two shocks, energy, and China. But unlike Beijing, there seems to be little political will to offer new supportive measures, and there is risk that the monetary tightening cycle is not over. Japan, surprised with 6% annualized growth in Q2, but consumption contracted, and business spending stagnated. Net exports explain the growth of the world's third-largest economy. Subsides for gasoline, kerosene, and fuel for fishing vessels will be extended by three months until the end of year, and a supplemental budget is expected in September.

Ironically, amid the extensive discussions about de-dollarization, the greenback is still ruling the roost. Illustrating this is not just its performance in the foreign exchange market, but also its use on SWIFT, which rose to a record of 46% in July. The increase in the dollar's share seems to come at the expense of the euro, which is in second place and whose share slipped to a record low, slightly below 25%. The yuan's share was a little above 3%.

The BRICS met last month and despite talk about a gold-backed currency or trade settlement token, nothing really came of it. We argue the desire to internationalize the yuan and rupee make it unlikely that either China or India endorse a rival. Moreover, we suspect that the BRICS will repeat the broad development of the Asian Infrastructure Investment Bank, which is China's Xi's significant initiative next to the Belt-Road. Despite the US objections, the UK joined and now so are several NATO members. The AIIB supplements, not supplants, the other multilateral lenders. It takes subscriptions in dollars and makes dollar loans. Reports also suggest it is respecting the financial sanctions on Russia.

New members will join BRICS, but it is not clear what

"it" is. It is not a free-trade agreement. It is not a military

alliance. The BRICS have a bank, the New Development Bank, which has a

medium-term goal lifting the funds raised in local currencies to 30% from less

than 20% now. Moreover, the new Chinese official maps, issued days after the

BRICS summit concluded, seemingly making territorial claims on Russia, India,

Vietnam, Indonesia,

Malaysia, Brunei, and the Philippines. It illustrates the challenges that lie

ahead.

The dollar rose against the all the G10 currencies in August. The Federal Reserve’s broad trade-weighted dollar rose by about 2% in August and peaked as Fed Chair Powell delivered his speech at Jackson Hole on August 25. It pulled back in the last week of August, snapping a four-week advance, hinting at what may be in store for it in September. Student loan interest restarts ahead of resumption of payment in October, and this may cut into September spending after strong summer for American consumption. And the US budget drama returns as spending authorization is needed ahead of the start of the new fiscal year on October 1. Congress has made little progress. Also, there are numerous programs whose authorization lapses in September, including the expanded unemployment benefits. Rather than a default that was threatened by the debt ceiling brinkmanship, the failure to grant the spending authorization could lead to a partial government shutdown. In addition, on September 14, the United Auto Workers' contract expired, and the threat of a strike looms.

Bond yields jumped in the first half of August. It is sometimes difficult to untangle the web of causality and many narratives can be spun. We suggest the global move was led by the US, where the benchmark 10-year yield rose for the fourth consecutive month. Economic activity is stronger than expected and the anticipated supply jumped. That said, the Fitch downgrade on August 1 seemed more embarrassing than impactful for the Treasury market.

Some have suggested a role for the adjustment of Japan's Yield Curve Control at the end of July was responsible for the sell-off in global bonds in the first part of August. However, weekly Ministry of Finance portfolio flow report shows Japanese investors have been net buyers of foreign bonds. In fact, they have been net buyers of foreign bonds since the 10-year JGB yield cap was doubled to 0.50% from 0.25% last December. Japanese investor bought around $6.5 bln in foreign bonds in August. Others suggest that intervention in the foreign exchange market by some Asia Pacific countries would have weighed on Treasuries. It is possible, but the Treasuries and Agencies held in custody at the Federal Reserve for foreign central banks were essential flat last month (up~$5 bln from July 26 through August 30).

After a light August for G10 central banks, most meet in September. The central banks of Sweden and Norway has already signaled intentions to rise rates at least one more time. The Norges Bank has signaled a September move. Outside of Scandinavia, the Bank of England is recognized as the most likely to hike. Doubts about a move had crept in early last month, but the strength of labor earnings growth and little meaningful decline in the core CPI helped to persuade the market that not only will the Bank of England hike. The swaps market briefly flirted with the possibility of a half point move, but by the end of August, returned to status quo ante, with a 25 bp hike not quite fully discounted. The eurozone economy is stagnant for all practical purposes and price pressures are easing but apparently too slowly for many members. The swaps market downgraded the chances of an ECB hike to about 20% at the end of August from better than 50% in the middle of the month. At the September meeting, the ECB will update its macroeconomic forecasts. The risk is that this year's subdued growth forecast (0.9%) is shaved while weaker growth may spur a downward revision to next year's CPI projection (3.0%).

The Federal Reserve will update its Summary of Economic Projections at when the FOMC meeting concludes on September 21. The median forecast for growth is bound to be lifted as the June's 1.0% forecast has already been surpassed. The 4.1% median unemployment rate projected seems too high, though it unexpectedly rose to 3.8% in August (from 3.5% in July) as the participation rate increased to 62.8% (from 62.6%), the highest since before the pandemic. Inflation has fallen faster than Fed officials thought. The headline deflator, which the Fed targets, stood at 3.3% in July. The median Fed forecast is for its to be at 3.2% at the end of the year. This seems also be a candidate for a small downward revision.

Hampered by the wildfires and dockworkers industrial action, and some disappointing data, the Canadian economy is underperforming. The economy contracted by 0.2% (annualized) in Q2 and Q1 growth was revised to 2.6% from 3.1%. The swaps market never saw a hike at the September 6 meeting as particularly likely. It has fallen from a little more than 30% at the end of July to practically no chance after the disappointing GDP figures.

Two risks seem to be rising. The first is that the war in Ukraine widens and escalates. The counter-offensive fell short of objectives, and this was recognized by US officials. Shortly, thereafter permission was granted to Denmark and the Netherlands to transfer F-16 fighter jets to Ukraine. This represents an escalation in terms of weaponry, and Kyiv’s ability to strike deeper into Russia's homeland. It is estimated to take 4-6 months to train Ukrainian pilots to fly the F-16.

The second risk emanates from US regional banks, where the stress flared in March. Commercial real estate to which they are particularly exposed, continues to suffer, and it is little consolation to know that China's (residential) property market is also distressed. Earlier this year, rising rates and falling deposits was painful for many banks. Deposits have stabilized and are about $50 bln above where they were at the end of March. However, interest rates have continued to rise. The 10-year Treasury yield has risen by around 90 bp since the end of March. The KBW bank index, which tracks money center banks and large regional banks fell for three consecutive weeks before stabilizing in the last week of August.

Among the G10 components, the euro and sterling recovered from what appears to be a false downside break and trimmed their losses to 1.25%-1.40% against the dollar. The Australian and Canadian dollars were tagged for about 3.5% and 2.4% respectively, and, arguably, were punished for their central banks seemingly getting do with their monetary tightening cycle before the US and Europe.

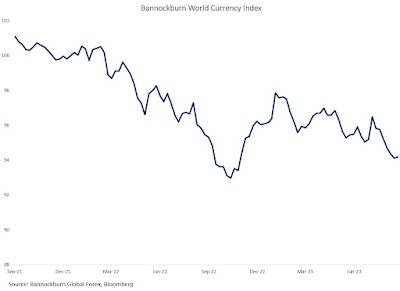

BWCI has been trending irregularly lower since peaking in early February, reflecting the end of the currencies recovery from extremes see September-October 2022. Given the extent of the apparent divergence favoring the US, a new low the BWCI (broadly higher US dollar) looks likely. Last year, a bottom took 5-6 weeks to form around 92.80-93.00. The low in late August was near 94.00. That said, we do look for it bottom, and the dollar to weaken, when evidence accumulates that calls into question the idea that somehow the business cycle has been repealed rather than just elongated.

U.S. Dollar: The relative strength of the US economy and the resulting increase in US rates helped the dollar extended the advance that began in the middle of July. However, the move seemed to stall at the end of the month. The two-yield approached the high for the year (above 5.10%) but tumbled more than 25 bp in the last three-days of August. The market has all but given up on the possibility of a September hike and, after the August jobs report, had about a 37% chance of a hike in the cycle at the next meeting that concludes on November 1. September's developments may be less supportive of the dollar. The Dollar Index has risen in September for the past four years, but we caution against reading much into the results of such a small sample. Over the past 20-years, the Dollar Index has risen in 11 Septembers and declined in 9, which is well within expectations of a random process. The weaker jobs growth (150k average in three months through August, the least since the pandemic) and slower auto sales sets the stage of softer economic impulses. After the August rally that carried the dollar to new highs for the year against the Japanese yen, Chinese yuan, Australian and New Zealand dollars, and Swedish krona, corrective forces were already evident as August drew to a close. A challenge to the somewhat less constructive outlook for the dollar maybe the August CPI due on September 13, a week before the FOMC meeting. The month-over-month increase may be among the largest since June 2022 (~0.6%) and the year-over-year rate is poised to increase for the second consecutive month (~3.6% vs. 3.2%). Many Americans were critical of Fitch's downgrade of the US rating on August 1, but a new fiscal drama is unfolding over next year's spending, and this could result in a partial government shutdown starting in early October.

Euro: The euro's retreat from the year's high set in mid-July near $1.1275 accelerated in August hitting a low near $1.0765 on August 25, shortly after Federal Reserve Chair Powell finished his Jackson Hole Speech. The driver was the economic divergence. It was expressed in the two-year interest rate differential between the US and Germany. In mid-July it had dipped to about 150 bp in the US favor. It peaked on August 24 near 207 bp. It came off sharply as the euro recovered on the back a disappointing US jobs opening report (JOLTS) and finished the month near 190 bp. It does seem like it is the US economy as the key here. The eurozone economy is barely growing and when the ECB meets the 0.9% growth it forecast this year could be revised lower. But there is little scope for stimulative fiscal or monetary policy. Still, the base effect suggests that in September and October, the eurozone's CPI will fall sharply, perhaps below 3.5%. Still, even after the higher-than-expected preliminary estimate of August CPI (5.3%) the market downgraded the chances of a quarter-point hike at the September 14 ECB meeting to around 22% chance from a near coin-toss. In addition, fiscal forbearance is ending. The Stability and Growth Pact has been suspended since 2020, first to help cope with pandemic and that cushion to blow from Russia's invasion of Ukraine. The budget rules are re-instated next year and that means they will be reflected in the 2024 budget submissions to the EU. There was an attempt to devise new fiscal rules that were more tailored to individual countries, but it has been bogged down in disagreements. A break of August lows could target the $1.0600-50.

(As of September 1, indicative closing prices, previous in parentheses)

Spot: $1.0780 ($1.1015) Median Bloomberg One-month f8orecast: $1.0840 ($1.1000) One-month forward: $1.0800 ($1.0925) One-month implied vol: 6.8% (6.7%)

Japanese Yen: The Bank of Japan doubled the upper-end of the 10-year JGB band to 1.0% in late July. The BOJ bought bonds in the first week of August in unscheduled operations, though the high yield was reached on August 23 near 0.68% in an apparent attempt to smooth the adjustment. The divergence of policy and economic performance saw the dollar climb slightly above JPY147.35 in late August, the high for the year, and above the levels that prompted officials to intervene in September 2022 when they sold about $19.5 bln as the dollar had approached JPY146.00. There is no reason to expect another change in Yield-Curve Control when the BOJ meets on September 22. However, there are other element of policy that could be adjusted, like the easing bias and negative overnight policy rate. Fiscal policy will come back into focus, as well. There are two key elements. First, the subsides for several types of energy, including gasoline, kerosene, and electricity, as well as agriculture products and fertilize expire at the end of September. Prime Minister Kishida has already indicated that the energy subsides will be extended and possibly expanded. Estimate suggest that the energy subsides have lowered headline CPI by as much as half of a percentage point. The second fiscal issue is new spending initiatives. Given the contraction in consumption and investment in Q2, and the weak support ratings for the prime minister, there are political and economic arguments for a supplemental budget. The government will likely offer new support for the fishing industry in light of several countries (including but not limited to China) adverse reaction to the decision to release Fukushima water back into the ocean. Part of the spending can be financed with unspent funds in the current budget (~JPY4 trillion or ~$28 bln). New borrowing will be expensive as bond yields are near nine-year highs. Moreover, demand at recent auctions has been soft and more supply could aggravate the pressure on the BOJ.

Spot: JPY146.20 (JPY141.15) Median Bloomberg One-month forecast: JPY144.10 (JPY139.55) One-month forward: JPY144.50 (JPY140.50) One-month implied vol: 9.0% (9.5%)

Spot: $1.2850 ($1.2590) Median Bloomberg One-month forecast: $1.2620 ($1.2775) One-month forward: $1.2590 ($1.2855) One-month implied vol: 7.6% (8.0%)

Canadian Dollar: The US dollar trended higher against the Canadian dollar in August as it recovered from the 10-month low recorded in mid-July slightly below CAD1.3100. A six-week rally took the greenback above CAD1.3600 and took out the April/May highs in the CAD1.3650-70 area after the disappointing 0.2% contraction in Q2 GDP was reported on September 1. The Canadian economy is diverging from the US. Its contractions contrasts to the US, which still appears to be growing above trend. At the same time, price pressures are proving stubborn. Through July, headline CPI rose at an annualized rate of nearly 5.5%. After slowing below 3.0% in June, on a year-over-year basis, Canada's CPI rose to 3.3% (in July (from 2.8% in June) and likely increased again in August. The swaps market has about nearly completely unwound even modest expectations of a hike at the September 6 Bank of Canada meeting. There are three market-sensitive economic reports in September. The August employment report is released two days after the Bank of Canada meeting concludes (September 8), the August CPI (September 19), and the July GDP (September 29).

Spot: CAD1.3590

Australian Dollar: Nothing went right for the Australian dollar for most of August. It fell by more than 5.5% against the US dollar, at its worst, to return to its lowest level since last November (~$0.6365). The Aussie's slump was more than the reflection of the strong greenback. The central bank defied economists' expectations for a hike to start the month. Australia unexpectedly lost jobs in July, and the nearly 15k decline was the most since September 2021. The August composite PMI was below the 50 boom/bust level for the second consecutive month. At 47.1, it is the lowest since January 2022. The disappointing performance of the Chinese economy has not help, though the rolling 60-day correlation between change in the Australian dollar and the CSI 300 has fallen from its highest since March 2022 (~0.45) in mid-July to a five-month low below 0.25 in August. At the same time, Australia's discount to the US for two-year borrowing fell to 120 bp in late August, the most since April. The Reserve Bank of Australia meets on September 5. The market sees practically no chance of a hike. It is Governor Lowe's last meeting and Michele Bullock, the deputy governor since April will replace him on September 18. The swaps market sees steady policy through next year. The Australian dollar formed a double top on the charts near $0.6900 and took out the neckline around $0.6600 in early August. It targets $0.6300 and the August low may have satisfied it. A push above $0.6570-$0.6600 may needed to boost confidence a low is in place.

Spot: $0.6455

Mexican Peso: After falling for the first seven months of the year, the dollar rose by 1.75% against the peso in August, and it all took place on the last day of the month. The peso slumped after officials indicated that that currency hedging facility, which has been in place for nearly seven years, was going to wind down with a 50% reduction ($7.5 bln facility) in September. Market positioning more than a change in underlying drivers sent the greenback higher, and it now looks poised to test the highs here set earlier in Q3 (~MXN17.39-MXN17.43). Still, with the market expecting the Federal Reserve to stand pat in September at 5.50%, Mexico’s 11.25% policy rate indicates the attractive carry (interest rate pick-up) will persist. Inflation continues to trend lower, and the external account is strong. Minutes from the August central bank meeting showed a majority still see the core rate at elevated levels and that service inflation is still not in a clear downtrend. The central bank also boosted this year's GDP forecast to 3.0% from 2.3% and next year's to 2.1% from 1.6% and acknowledged that exports to the US help explain the economy's resilience. The swaps market is pushing out expectations for the first cut into next year. That said, Chile and Brazil have already begun to cut rates, and are poised to cut again in September.

Spot: MXN17.0890 (MXN16.6870) Median Bloomberg One-Month forecast MXN17.1750 (MXN16.9250) One-month forward MXN17.18 (MXN16.78) One-month implied vol 11.4% (10.9%)

Chinese Yuan: Sentiment is fickle. It has swung from "China stands astride the world and set to eclipse the US" to" it cannot do anything right and is collapsing." Previously, it was the US and Europe "turning Japanese" and now a fashionable argument is that it is really China that is experiencing a balance-sheet recession, sparked by the collapse of the property market bubble. Yet, China does not appear to be de-leveraging, though one of the largest developers appears to be on the verge of failing. New lending is being strongly encouraged. Property sales were a key source of revenue for provincial governments, and as this dried up, their fiscal straits intensified. After numerous policy announcements, including a reduction in current mortgages and lower down payments, and a push for provincial governments to meet quotas for special bonds, with Beijing setting a September deadline to use their remaining allocations, it may begin convincing investors. Still, many are dismayed that Beijing is not taking out the proverbial "bazooka." One explanation is that Xi is trying to get rid of the China put, whereby an economic slowdown would be greeted with stimulus (largely on the supply-side), just as much as Fed Chair Powell is said to want to get rid of the "Fed put" (seen in response, the theory goes, to sharp declines in the equity market). Moreover, Xi tends to agree with those who argue that welfare disincentivizes hard work and contributes to laziness. The dollar made a new high for the year against the Chinese yuan in August (~CNY7.3175) while holding below last year's high (CNY7.3275). The PBOC has taken numerous measures to slow the yuan's decline, including cutting the required reserves on foreign currency deposits, consistently setting the dollar's reference rate well below survey averages, discouraging banks from selling the yuan, and tightening offshore yuan funding. To this list, some would add ordering dollar sales through state-owned banks, but it is hard to distinguish between their normal activity on behalf of clients and itself. Still, many are not persuaded that Beijing can or even desire to turn the yuan around. There is talk of CNY7.60-CNY7.70 this year but we suspect it is exaggerated, suggesting sentiment may be extreme.

Spot: CNY7.2665

Tags: Featured,macro,newsletter