Summary:

Since failing systems are incapable of structural reform, collapse is the only way forward. Systems fail for a wide range of reasons, but I’d like to focus on two that are easy to understand but hard to pin down. Federal Government, 2005 - 2018 - Click to enlarge 1. Systems are accretions of structures and modifications laid down over time.Each layer adds complexity which is viewed at the time as a solution. This benefits insiders, as their job security arises from the need to manage the added complexity. The new layer may also benefit an outside constituency that quickly becomes dependent on the new layer for income. (Think defense contractors, consultants, non-profits, etc.) In short order, insiders and

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

Since failing systems are incapable of structural reform, collapse is the only way forward. Systems fail for a wide range of reasons, but I’d like to focus on two that are easy to understand but hard to pin down. Federal Government, 2005 - 2018 - Click to enlarge 1. Systems are accretions of structures and modifications laid down over time.Each layer adds complexity which is viewed at the time as a solution. This benefits insiders, as their job security arises from the need to manage the added complexity. The new layer may also benefit an outside constituency that quickly becomes dependent on the new layer for income. (Think defense contractors, consultants, non-profits, etc.) In short order, insiders and

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

Since failing systems are incapable of structural reform, collapse is the only way forward.

Systems fail for a wide range of reasons, but I’d like to focus on two that are easy to understand but hard to pin down.

|

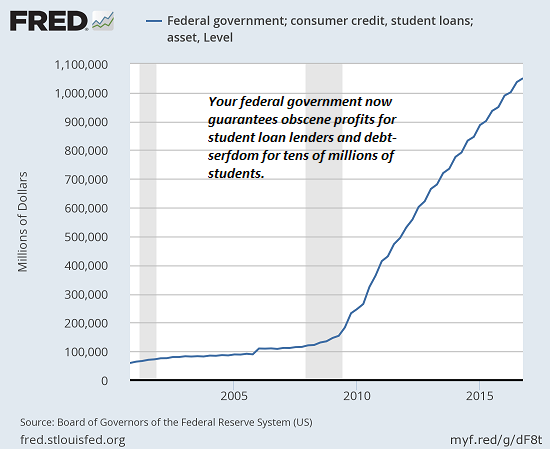

Federal Government, 2005 - 2018 |

|

1. Systems are accretions of structures and modifications laid down over time.Each layer adds complexity which is viewed at the time as a solution.

This benefits insiders, as their job security arises from the need to manage the added complexity. The new layer may also benefit an outside constituency that quickly becomes dependent on the new layer for income. (Think defense contractors, consultants, non-profits, etc.)

In short order, insiders and outsiders alike habituate to the higher complexity, and everyone takes it for granted that “this is how things work.” Few people can visualize alternatives, and any alternative that reduces the budget, payroll or power of the existing system is rejected as “unworkable.”

In this set of incentives, the “solution” is always: we need more money. If only we had another $1 million, $1 billion or $1 trillion, we could fix what’s broken.

But increasing the budget can’t fix what’s broken because it doesn’t address the underlying sources of systemic failure.

Those benefiting from the status quo will fight tooth and nail to retain their jobs and benefits, and so deep reform is essentially impossible, as the insiders and constituencies of each layer resist any reform that might diminish their security/income.

As a result, new layers rarely replaces previous layers; the system becomes more and more inefficient and costly as every new layer must find work-arounds and kludgy fixes to function with the legacy layers.

Eventually, the system becomes unaffordable and/or too ineffective to fulfill its mission.

|

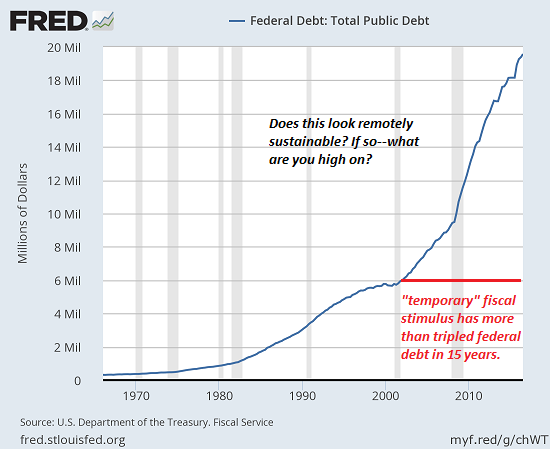

Federal Debt: Total Public Debt, 1970 - 2018 |

|

2. The organization is incapable of instituting deep reforms due to organizational sclerosis and leadership who only wants to hear “good news.”Organizational sclerosis isn’t just the result of insiders clinging to their job; the structure itself has lost the feedback loops and accountability needed to radically restructure a failing organization.

It’s easy for leadership to start demanding what it wants to hear rather than the inconvenient and troublesome truth. Due to the tendency to “shoot the messenger bearing bad news,” managers fudge their delivery dates and numbers. Lacking real data and metrics, management fails to recognize the gravity of the situation and makes catastrophically erroneous decisions based on false or massaged reports.

These dynamics can manifest in both private-sector corporations and public-sector agencies. Many public school districts have failed for these reasons despite ever-rising budgets, and the former leader of mobile telephony, Nokia, self-destructed in large part as a result of #2.

One of Steve Jobs’ first actions when he took control of failing-fast Apple in 1997 was to slash product lines and strip out the corporate layers that had accumulated to service this ineffective complexity.

All of this contrasts with self-organizing networks which lack the hierarchy necessary for sclerosis, self-serving insiders and fatally blinded management. Since “this is the way the system works,” we have a hard time imagining how public agencies and corporations might be obsoleted by self-organizing, opt-in, transparent rules-based networks.

Since failing systems are incapable of structural reform, collapse is the only way forward. Unfortunately collapse doesn’t guarantee success; if the rot is deep enough, the wherewithal to assemble a new and more sustainable system may be lacking.

|

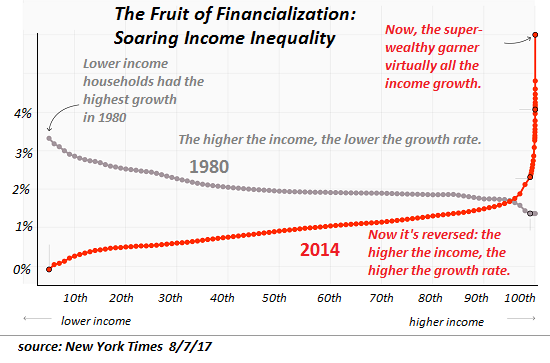

The Fruit of Financialization, 1980 - 2014 |

Tags: Featured,newsletter