The G3 central banks are in flux. The Federal Reserve is gradually raising rates and allowing the balance sheet to shrink by not fully reinvesting the maturing proceeds. The ECB will purchase half as many bonds in the first nine months of 2018 as it did in the last nine months of 2017. While some observers are talking about a rate hike late this year, it seems highly unlikely. The ECB has been clear that the first-rate hike will not take place until “well past” the end of the asset purchases. The Bank of Japan Governor Kuroda has been urging patience with its extraordinary monetary policy. Prime Minister Abe has, already this year, urged the BOJ to continue to support the economy through its policies. The BOJ

Topics:

Marc Chandler considers the following as important: Bank of Japan, EUR, Featured, FX Trends, JPY, newslettersent, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The G3 central banks are in flux. The Federal Reserve is gradually raising rates and allowing the balance sheet to shrink by not fully reinvesting the maturing proceeds. The ECB will purchase half as many bonds in the first nine months of 2018 as it did in the last nine months of 2017. While some observers are talking about a rate hike late this year, it seems highly unlikely. The ECB has been clear that the first-rate hike will not take place until “well past” the end of the asset purchases.

The Bank of Japan Governor Kuroda has been urging patience with its extraordinary monetary policy. Prime Minister Abe has, already this year, urged the BOJ to continue to support the economy through its policies. The BOJ continues to formally target purchases of JPY80 trillion of JGBs.

However, leaving aside the declaratory policy, operationally, the BOJ has changed tactics. In addition to its Quantitative and Qualitative Easing (QQE), in late 2016, the BOJ introduced a target for the 10-year bond yield (+/- 10 bp around zero). This has been dubbed “yield curve control (YCC) because the BOJ has set a negative 10 bp deposit rate, and has a 10-year target.

| Investors realized that the targeting the 10-year yield required buying few Japanese government bonds that the pure QQE. The BOJ, though, has not changed its formal target. On the other hand, the BOJ continues to buy other assets, including equity ETFs, J-REITS, and loans. In practice, this is what it means: In the 2016 calendar year, the BOJ’s balance sheet expanded by nearly JPY93.5 trillion. In 2017, it expanded by JPY44.9 trillion.

Moreover, without much fanfare, the BOJ reported that its balance sheet fell in December. The BOJ’s balance sheet fell by JPY444 bln (~$4 bln) to JPY521.4 trillion (~95% of GDP). Earlier today, the BOJ bought JPY10 bln fewer JGBs of 10-25-year maturities than it did last time (JPY190 bln vs JPY200 bln) and bought JPY10 bln fewer JGBS maturing in more than 25 years (JPY80 bln vs JPY90 bln previously). Japanese yields rose and the yen strengthened as investors and reporters suddenly see tapering. Before offering an initial evaluation, let’s look a bit more at the reduction of the BOJ’s balance sheet in December. The BOJ’s holdings of JGBs fell by JPY2.9 trillion (~$25 bln). Given that the balance sheet fell by only JPY444 bln, it means that the BOJ was still purchasing other assets. It appears that the BOJ may have simply not reinvested maturing proceeds. |

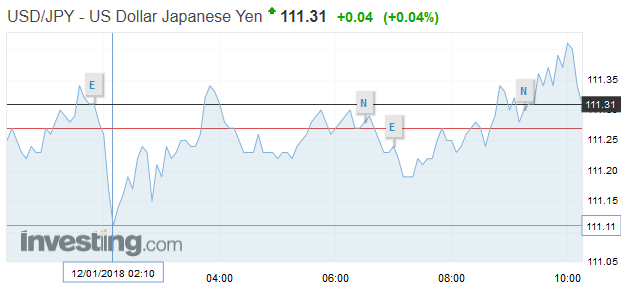

USD/JPY - US Dollar Japanese Yen, January 12 |

Rather than a new policy of covert tapering, the fewer JGB purchases (gross and net) is the consequence of the previous policy shift. That shift had signaled the move away from targeting the balance sheet itself to targeting interest rates. Therefore, we are reluctant to recognize that today marks some kind of shift in policy.

Some observers have argued that reduction of the Fed balance sheet by $420 bln this year is tantamount to nearly three Fed rates hikes. We pushed back. We argue that it was neither the buying (as many investors argued) or the holding (as many central banks argued), but in the signaling impact. The same logic applies to the BOJ. For years before the financial crisis, the BOJ conducted what it called “rinban” operations. These were permanent injections of liquidity through the BOJ purchases of JGBs. This was an embryonic form of QE before QE. It did not raise hackles because the of the official signaling.

The ECB’s Draghi argued that as economic conditions improved, the same amount of accommodation was not needed to have the same impact. It seems the BOJ could agree with this statement. Given the importance of forward guidance, especially since the Great Financial Crisis, investors should not simply dismiss the BOJ’s declaratory policy. Draghi noted that the ECB may be reducing its bond purchases, but its other policies, like negative 40 bp deposit rate, fully allocated fixed rate refi operations at zero interest rates, somewhat easier collateral rules, long-term repo operations. Similarly, as a consequence of YCC, the BOJ needs to buy (and therefore accumulate) fewer JGBs, but other elements of its innovative monetary policy remain intact.

We have noted that one of key drivers of the dollar-yen exchange rate has been the US 10-year yield. It might be the interest rate differential between the US and Japan, but with YCC, the Japan’s 10-year yield has been stable and this means that the differential is driven by the performance of US Treasuries. Last year the correlation, conducted on the percentage change of the US 10-year yield and the percentage change of the dollar against the yen remained at elevated level. The correlation on a 60-day rolling basis began 2016 near 0.6, and after a dip in mid-April, did not go below 0.7 and appears to have made a record high near 0.85 in late October. It has been trending lower since, and today the correlation is slipping below 0.62 to the lowest since December 2016. That said, a correlation on percentage change of more than 0.6 is still fairly robust for these kind of time series.

In the futures market, we have noted that as of January 2, the non-commercials (speculators) had a were record long euros on a net and gross basis. Speculators were net short yen. The 121.8k net short yen contracts was the third largest in the past two years. The gross short position reached a 10-year high last October near 185k contracts. As of January 2, the speculators gross short position stood at 161.4k contacts, which has only been surpassed a couple of times since the Great Financial Crisis.

The technical correction that appears to be unfolding in the foreign exchange market as seen the yen recover against the euro. From mid-September through mid-December, the euro was largely confined to a JPY132-JPY134 range. It was not perfect and there were violations that sometimes lasted a few days. However, the break higher took place and the euro ran up to JPY136.65 as of the end of last week. It was the highest level of the euro since October 2015. The euro came off yesterday and those losses have been extended today. The euro has retraced a little more than 50% of the run-up since mid-December (~JPY134.35) and dipped below the 20-day moving average (~JPY134.45) for the first time since mid-December. The 61.8% retracement is seen near JPY133.80.

The North American market tried to take the dollar through the lows see in Asia earlier today (~JPY112.50) and failed. Resistance is seen near JPY113.00. More broadly, the dollar remains in a JPY112.00-JPY113.65/75 range as it has for the past month. We suspect today’s price action is more corrective in nature than the start of a yen rally spurred by a change in BOJ policy.

Tags: #USD,$EUR,$JPY,$TLT,Bank of Japan,Featured,newslettersent