Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report. Major Findings • The UBS Swiss Real Estate Bubble Index stood in the risk zone at 1.35 points after a slight increase in the final quarter of 2016. • The further increase in the ratio of purchase prices to rents and income reflects increasing interest rate risks. • The stabilization of the index in the last few quarters is due to the sharp slowdown in household debt growth. UBS Swiss Real Estate Bubble Index The UBS Swiss Real Estate Bubble Index stayed in the risk zone in 4Q 2016 at 1.35 index points. The index increased only marginally over the slightly revised figure for the previous quarter. The sub-indicators price-to-earnings and price-to-rent increased slightly. On the other hand, the slower growth in mortgage debt had a dampening effect. Interest rate risks continue to rise In the meanwhile, the index has been moving in the range of 1.30 to 1.45 index points for one and a half years.

Topics:

UBS Switzerland AG considers the following as important: Featured, newslettersent, Swiss Macro, UBS bubble index

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report.

Major Findings

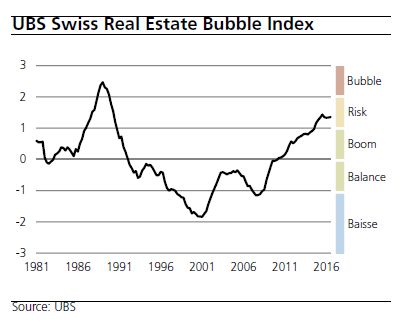

• The UBS Swiss Real Estate Bubble Index stood in the risk zone at 1.35 points after a slight increase in the final quarter of 2016.

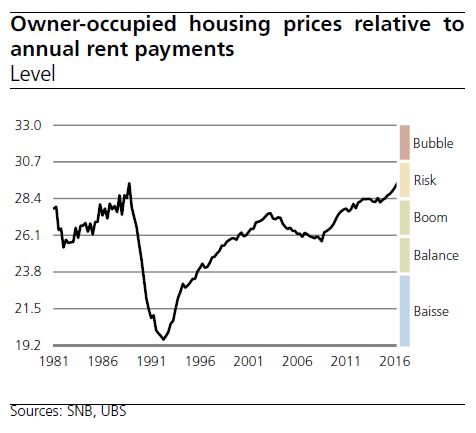

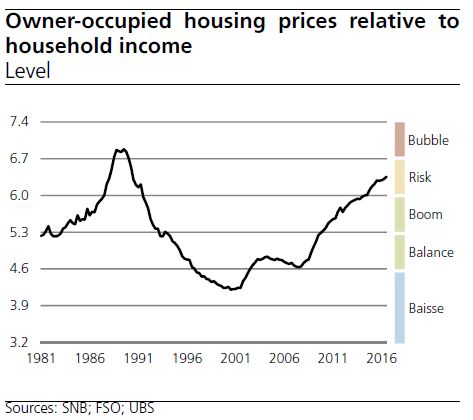

• The further increase in the ratio of purchase prices to rents and income reflects increasing interest rate risks.

• The stabilization of the index in the last few quarters is due to the sharp slowdown in household debt growth.

UBS Swiss Real Estate Bubble IndexThe UBS Swiss Real Estate Bubble Index stayed in the risk zone in 4Q 2016 at 1.35 index points. The index increased only marginally over the slightly revised figure for the previous quarter. The sub-indicators price-to-earnings and price-to-rent increased slightly. On the other hand, the slower growth in mortgage debt had a dampening effect. Interest rate risks continue to rise Debt only driven by new buildings |

Switzerland UBS Real Estate Bubble Index |

Sub-indices of the UBS Swiss Real Estate Bubble IndexOwner-occupied housing prices relative to annual rent payments • An above-average buy-to-rent ratio indicates a high dependency on sustained low interest rates or implies expectations of future price increases. • The long-term average is 26.1 annual rents. In March 1989, the indicator peaked at 29.3. • After the ninth consecutive increase, in 4Q 2016, it took 29.5 annual rents to purchase a comparable owner-occupied home. |

Switzerland Home Prices Relative to Annual Rent Payments |

Owner-occupied house prices relative to household incomeThe indicator shows whether the price behavior of the owner-occupied housing market is supported by changes in household income. A decoupling of prices from average household income can be interpreted as a sign of interest rate risks. As a long-term average, it takes 5.3 annual incomes to purchase an owner-occupied home in the medium price segment. In 4Q 2016, it took around 6.3 annual household incomes to purchase an owner-occupied home in the medium price segment. Compared to the previous quarter, the index rose slightly. |

Switzerland Home Prices Relative to Household Income |

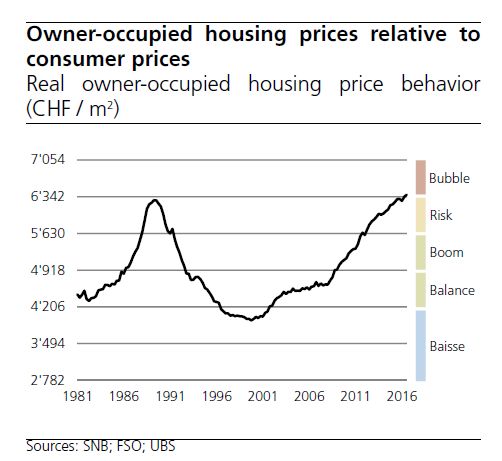

Owner-occupied home prices relative to consumer pricesIn the long term, owner-occupied housing prices are likely to be oriented towards the development of construction costs and general inflation. A sharp and lasting increase in inflation-adjusted owner-occupied housing prices is thus a warning signal for a possible correction. • After adjustment for inflation, owner-occupied housing prices are meanwhile around 1% above the high of 1989. • Owner-occupied housing prices increased 0.6% in real terms due to negative inflation. Year-on-year, a rise of 1.3% was recorded. |

Switzerland Home Prices Relative to Consumer Prices |

Tags: Featured,newslettersent,UBS bubble index