Precious Metals As Safe Havens – Reassessing Their Role New research confirms that not just gold but also the other precious metals – silver, platinum and palladium bullion – act as safe havens, especially from ‘Economic Policy Uncertainty.’ This is something that is particularly prevalent today due to the ‘Hard Brexit’ impact on the UK and the Eurozone, risk of trade wars and heightened financial and geopolitical risk under the Trump Presidency. In their just released paper, Reassessing the Role of Precious Metals As Safe Havens – What Colour Is Your Haven and Why?, Dr Brian Lucey and Sile Li, of Trinity College Dublin and Trinity Business School, examine the “safe haven properties versus equities and bonds of four precious metals (gold, silver, platinum and palladium) across eleven countries.” Brian Lucey and Sile Li - Click to enlarge The research suggests that each of the precious metals “play safe haven roles” and that “there are times when one metal is not while another may be a safe haven against an asset.” “Stock volatility, exchange rates, interest rate and credit spreads are also found to be significant” and the results are found to be “quite mixed for different markets and are fragile of model specification.

Topics:

Mark O'Byrne considers the following as important: Brian Lucey, Daily Market Update, Featured, GoldCore, newsletter, Sile Li

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Precious Metals As Safe Havens – Reassessing Their Role

New research confirms that not just gold but also the other precious metals – silver, platinum and palladium bullion – act as safe havens, especially from ‘Economic Policy Uncertainty.’ This is something that is particularly prevalent today due to the ‘Hard Brexit’ impact on the UK and the Eurozone, risk of trade wars and heightened financial and geopolitical risk under the Trump Presidency. In their just released paper, Reassessing the Role of Precious Metals As Safe Havens – What Colour Is Your Haven and Why?, Dr Brian Lucey and Sile Li, of Trinity College Dublin and Trinity Business School, examine the “safe haven properties versus equities and bonds of four precious metals (gold, silver, platinum and palladium) across eleven countries.” |

|

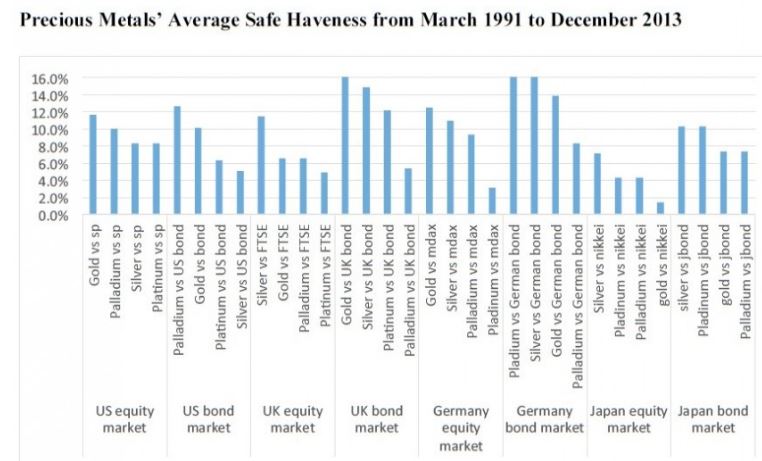

| The research suggests that each of the precious metals “play safe haven roles” and that “there are times when one metal is not while another may be a safe haven against an asset.”

“Stock volatility, exchange rates, interest rate and credit spreads are also found to be significant” and the results are found to be “quite mixed for different markets and are fragile of model specification.” This is to be expected somewhat, given the broad range of the study of four precious metals performance versus a range of assets in 11 different countries. Dr Brian Lucey and Sile Li attempt to “identify robust economic and political determinants of precious metals’ safe haven properties.” Of note is that they find that ‘Economic Policy Uncertainty’ is found to be a “positive and robust determinant of a precious metal being a safe haven” and that this “holds across countries”. The research attempts to characterize those periods under which political, economic and financial conditions, gold, silver, platinum and palladium are more likely to become safe haven assets and hedge the risks of market declines. |

Precious Metals Safe Havenss |

| “Political risk is found to be a positive and robust determinant across countries when precious metals are safe haven against stock and bond markets tail events.”

The research strongly suggests that the precious metals are safe havens and financial insurance against event and fat tail risks. It corroborates the large body of academic and independent research which has found that gold is a safe haven asset and suggests that the other precious metals – silver, platinum and palladium – have a role as important investment diversification and portfolio insurance. As per the Abstract:

|

|

Dr Brian Lucey told me yesterday how the research suggests that the precious metals are safe havens that help protect against extreme, unexpected events and tail risk. They hedge and protect against risk events such as Brexit or the election of Donald Trump and that it is not just gold that insulates investors from these risks – it was frequently just as likely to be silver.

So gold did not always act as a safe haven and when this was the case, silver frequently acted as a safe haven showing the complimentary nature of gold and silver and indeed of the other precious metals.

We have long advocated owning all four precious metals for diversification and financial insurance purposes with larger allocations to silver and especially gold due to its monetary characteristics and smaller allocations to platinum and palladium.

Conclusion

Although tail events that negatively impact investment portfolios have traditionally been rare, they result in large negative returns. They are becoming more frequent due to heightened ‘Economic Policy Uncertainty’ and therefore, investors now more than ever before need to hedge against these events. Hedging against tail risk with precious metals enhances returns over the long-term, but investors must be willing to except short-term costs.

The precious metals in bullion coin and bar format are forms of financial insurance. People realise the benefit and are happy to pay annual premiums for their car, health and other insurance. An insurance buyer is not upset when they buy insurance and then do not break their leg or crash their car that year. They are happy and had the security of owning insurance that they did not need to use.

Similarly, a bullion coin or bar buyer who takes delivery or stores in secure storage has to pay a slight premium for this added security. Owning gold, silver, platinum and palladium bullion in a portfolio is simply the price you pay for added security.

Tags: Brian Lucey,Daily Market Update,Featured,newsletter,Sile Li