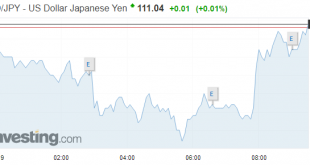

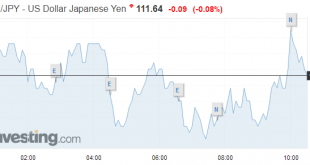

Our baseline scenario suggests limited upside potential for the dollar against the yen, given the current low stock market volatility environment.The Japanese yen has been weak recently, as volatility in the US stock market has receded. Indeed, the sharp increase in US stock market volatility at the end of last year favoured the yen through short-covering and repatriation flows, whereas the subsequent rebound in global risk appetite has penalised the defensive yen (see chart).This recent...

Read More »Fed Delivers, Market Yawns

The Federal Reserve did what it was widely to do. The fed funds target range was lifted 25 bp to 2.00-2.25%. Three-quarters of Fed officials anticipate a hike in December. The market had discounted around an 80% chance. The Fed sticks with the three rate hikes in 2019 and one in 2020. The year-end rate in 2021 is the same as in 2020. The Fed is signaling that it does not expect the fed funds target to move above...

Read More »US-Japan Trade Talks

The withdrawal of the US from the Trans-Pacific Partnership trade agreement lift it exposed on two fronts. First, the TPP was going to modernize the NAFTA. Without, the US remains locked in protracted negotiations. A breakthrough in talks with Mexico has been reportedly imminent for weeks. Talks with Canada have apparently not progressed very far in recently, and the US insistence on a sunset clause remains a...

Read More »Fed Looks to September

There was little doubt in the market’s collective mind that the Federal Reserve, which hiked rates in July, would stand pat today. It did not disappoint. The statement itself was almost identical. Growth was said to be “strong” instead of “solid,” for example, a nuance to be lost on most observers. It recognized that the unemployment rate stabilized after falling. Most notable is what is not included. The June minutes...

Read More »Weekly Technical Analysis: 04/06/2018 – USD/CHF, EUR/JPY, GBP/USD, AUD/USD, WTI

USD/CHF The USDCHF pair managed to break 0.9850 level and closed the daily candlestick below it, which supports the continuation of our bearish overview efficiently in the upcoming period, paving the way to head towards 0.9723 level as a next station, noting that the EMA50 supports the expected decline, which will remain valid for today conditioned by the price stability below 0.9870. Expected trading range for today...

Read More »Weekly Technical Analysis: 21/05/2018 – USD/JPY, EUR/USD, GBP/JPY, USD/CAD, USD/CHF

USD/CHF The USDCHF pair reaches the key support 0.9955 now, and as we mentioned in our last report, breaking this level will confirm completing the double top pattern that appears on the chart, to rally towards our negative targets that begin at 0.9900 and extend to 0.9850. Therefore, we will continue to suggest the bearish trend supported by the negative pressure formed by the EMA50, unless the price managed to rally...

Read More »Weekly Technical Analysis: 14/05/2018 – USD/JPY, EUR/USD, EUR/JPY, GBP/USD, USD/CHF

USD/CHF The USDCHF pair provided positive trading yesterday to test 1.0000 level and settles around it, and as long as the price is below this level, our bearish overview will remain valid, noting that our next target is located at 0.9900, while breaching 1.0000 followed by 1.0055 levels represent the key to regain the main bullish trend again. Expected trading range for today is between 0.9920 support and 1.0055...

Read More »Weekly Technical Analysis: 07/05/2018 – USD/JPY, EUR/USD, GBP/USD, Gold

USD/CHF The USDCHF pair’s recent trades are confined within mew minor bearish channel that we believe it forms bullish flag pattern, thus, the price needs to breach 1.0035 to activate the positive effect of this pattern followed by rallying towards our waited target at 1.0100. Therefore, we will continue to suggest the bullish trend supported by the EMA50, unless we witnessed clear break and hold below 1.0000. Expected...

Read More »Weekly Technical Analysis: 23/04/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, WTI oil futures

USD/CHF The USDCHF pair touched the bullish channel’s resistance that appears on the chart, and the price might be forced to show some temporary decline to test the support base formed above 0.9790 before resuming the rise again. In general, we will continue to suggest the bullish trend supported by the EMA50, depending on the organized trading inside the mentioned bullish channel, noting that our next target is...

Read More »Weekly Technical Analysis: 16/04/2018 – USD/JPY, EUR/GBP, GBP/USD, USD/CAD, USD/CHF

USD/CHF The USDCHF pair breached 0.9675 level and closed the daily candlestick above it, to open the way to achieve more rise in the upcoming sessions, paving the way to head towards 0.9790 as a next main station. Therefore, the bullish trend will be suggested, supported by the EMA50, noting that breaking 0.9675 and holding below it will push the price to test 0.9581 level before determining the next trend clearly....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org