(Disclosure: Some of the links below may be affiliate links) We all like getting raises at work! It always feels great to know your work is recognized, and you will get paid more. But is a raise that important for your financial independence? And how much of a raise can you afford to spend? In this article, I answer these questions through several examples. At the end of the article, you will know exactly how much of a save you should save! Impacts of a raise Before we start, when I talk about raises in this article, I talk about any increased income. This could be a raise at work, a new side hustle, or some extra allowance. They all impact you in the same way. The first impact is that you get more money every month. When you get a raise, your income increases. You are free to save that

Topics:

Baptiste Wicht considers the following as important: Earn, Save

This could be interesting, too:

Baptiste Wicht writes Migros Cumulus Visa Credit Card Review 2022

Baptiste Wicht writes I use budgetwarrior for my budget and net worth

Baptiste Wicht writes When is Mobility cheaper than owning a car?

Baptiste Wicht writes The costs of daycare in Switzerland

(Disclosure: Some of the links below may be affiliate links)

We all like getting raises at work! It always feels great to know your work is recognized, and you will get paid more.

But is a raise that important for your financial independence? And how much of a raise can you afford to spend?

In this article, I answer these questions through several examples. At the end of the article, you will know exactly how much of a save you should save!

Impacts of a raise

Before we start, when I talk about raises in this article, I talk about any increased income. This could be a raise at work, a new side hustle, or some extra allowance. They all impact you in the same way.

The first impact is that you get more money every month. When you get a raise, your income increases. You are free to save that money or to spend it.

The second impact is also significant, and most people will completely underestimate it. If you get a raise, you will also get to pay more taxes. If your marginal tax rate is 30%, 30% of your future raises will directly translate into more expenses as taxes.

The tax impact is significant. When they get a 1000 CHF raise, many people will think they can spend 1000 CHF extra per year. But, if their marginal tax rate is 20%, they can only spend 800 CHF extra. If they spend 1000 CHF extra, they will end up with a net increase in their expenses of 1200 CHF! This is one of the reasons that some people end up in worse situations when they get a raise.

But if you know the impacts of a raise, a raise is a great thing! People should improve their income over time as much as possible. In fact, past a certain point, it becomes more important to improve an income rather than lowering expenses.

How much can you spend?

The essential question people should ask themselves when getting a raise is: How much of a raise can you spend?

Let’s assume you want to reach financial independence or achieve another financial goal in the future.

We have seen before that the time to reach retirement is dictated only by your savings rate and investment returns. So, if two people invest in the stock market in the same way, the time to their retirement will be based on their savings rate only. The income and expenses level does not matter. The savings rate is what matters.

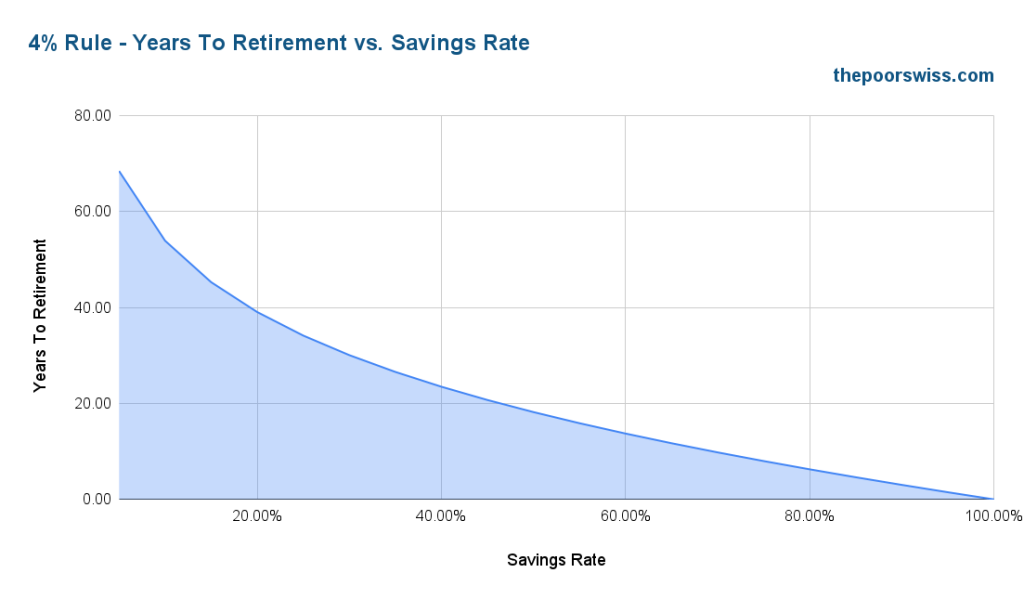

As a reminder, here is the time to retire using the 4% rule and 5% yearly returns:

As you can see, increasing your savings rate can significantly affect your time to retirement. But once you reach a high savings rate, you start to see diminishing returns. It saves you a lot of time to go from 10% to 20%, but not nearly as much when going from 50% to 60%.

So, knowing that, we can expect that how much of a raise we can spend depends on our savings rate.

Raise and savings rates

Intuitively, we can think that we can save as much as our current saving rates.

Let’s see how that works out with a few examples:

- David saves 20% of his income and has 36 years until she can retire

- Sonya saves 40% of her income and has 21 years until she can retire

- Judith saves 50% of her income and has about 17 years until she can retire

Let’s assume they all have a 100’000 CHF income and get a raise of 20% (20’000 CHF). If they all save at their current savings rate, their situation will not change!

Great, can we save our current savings rate for each raise we get? Unfortunately, there is a catch!

So far, we assumed that our three savers were at the beginning of their journey. Let’s see their situation after ten years if they had no raise.

- David still needs 26 years to retire and about 1.7M CHF more

- Sonya still needs 11 years to retire and about 971K CHF more

- Judith still needs 6 years to retire and about 581K CHF more

Now, let’s give them again a raise of 20% and see what would happen.

- David now needs 28 years to retire

- Sonya now needs 13 years to retire

- Judith now needs 7 years to retire

As you can see, they have all delayed their retirement. Even though they kept their savings rate, our three people now need longer to retire than before!

But we said that the savings rate is the only metric that matters, so what happened?

What happened is that they saved for ten years based on their previous savings. These savings would have been enough for their previous expenses, but not for the new ones!

So, how much of their raise should they save? If they want to retire at the same time as before:

- David needs to save 23% of his raise

- Sonya needs to save 50% of her raise

- Judith needs to save 63% of her raise

As you can see, they need to save significantly more than their savings rate not to delay their retirement. The higher your savings rate is, the more of each raise you need to keep! So, people with low savings rates can afford to spend more of their raises than people with high savings rates.

How much should you save?

Unfortunately, it is difficult to get the percentage you should save for each raise. But I can offer two rules of thumb.

The first rule of thumb is that you should save at least as much as your savings rate. If you save less of a raise, you will decrease your savings rate and increase the time to reach your financial goals.

The second rule of thumb is that you should try to save 50% of each raise. Most people have savings rates in the 5% to 10% range. For these people, saving half of their raise will increase their overall savings rate and result in a better situation.

For savers with a large savings rate (greater than 40%), saving a large part of a raise is probably not a huge deal. These persons are naturally saving money, so a raise should not present any issue for them.

It is fine to spend more!

So far, in this article, we have focused on the saving side. But one thing we can take away from these examples is that with a raise, we can still spend more and yet reach our goal at the same time!

These examples prove that some amount of lifestyle creep is perfectly fine! I think it is great to be able to spend a little more on what makes us happy when we make a raise.

I have also primarily focused on long-term spending with new expenses that will be there till the end. However, one-off spending is even better since you could spend your bonus or a raise the first month but not repeat it the next month. With that, you can have a lovely celebration and still improve your long-term financial goals.

Just be careful not to fall into the trap of lifestyle creep and overdo it. Spending your entire raise every month will lead to a lower savings rate. And this, in turn, will lead to a longer time to reach your financial goals.

Conclusion

You should probably save more of your raise than you thought! If you are spending your entire raise, you will put yourself in a worse situation than before due to the increased expenses. And you should save more than your current savings rate if you want to keep your target date for your financial goals.

These conclusions are important because they are not necessarily intuitive for everybody.

Importantly, these examples also show that we can spend extra when we get a raise without impacting our financial goals. Of course, you could save it all (careful with taxes!) to optimize the most. But at some point, you need to stop hustling and enjoy life! Do not forget to enjoy the journey!

Talking about raises, you can read my article about increasing your career income.

What about you? What is your strategy when getting a raise?