(Disclosure: Some of the links below may be affiliate links) I have talked a lot about budget and net worth on this blog. Now, it is time to talk about which budget application I am using to track my budget and net worth. I am using a simple tool for doing these two tasks. I also use the tool to generate the graphs in my monthly reports. While many people in the personal finance community use Personal Capital, Mint, or Quicken, I use a little-known tool called budgetwarrior. I wrote this application myself. This article presents this tool and how I use it to track my finances. budgetwarrior budgetwarrior started as a simple console application to manage my budget. I started this application in June 2013. Before, I used a simple spreadsheet for my budget. I was looking for a new personal

Topics:

Baptiste Wicht considers the following as important: Save

This could be interesting, too:

Baptiste Wicht writes How much of a raise can you spend?

Baptiste Wicht writes Migros Cumulus Visa Credit Card Review 2022

Baptiste Wicht writes When is Mobility cheaper than owning a car?

Baptiste Wicht writes The costs of daycare in Switzerland

(Disclosure: Some of the links below may be affiliate links)

I have talked a lot about budget and net worth on this blog. Now, it is time to talk about which budget application I am using to track my budget and net worth.

I am using a simple tool for doing these two tasks. I also use the tool to generate the graphs in my monthly reports.

While many people in the personal finance community use Personal Capital, Mint, or Quicken, I use a little-known tool called budgetwarrior. I wrote this application myself.

This article presents this tool and how I use it to track my finances.

budgetwarrior

budgetwarrior started as a simple console application to manage my budget. I started this application in June 2013. Before, I used a simple spreadsheet for my budget. I was looking for a new personal project to code, so I figured it would be interesting to do my own!

The idea of the tool is quite simple:

- You define categories for your budget

- You assign an amount to each category

- You keep track of all your expenses and earnings for each month

- The tool will give you information as to the current state of your budget

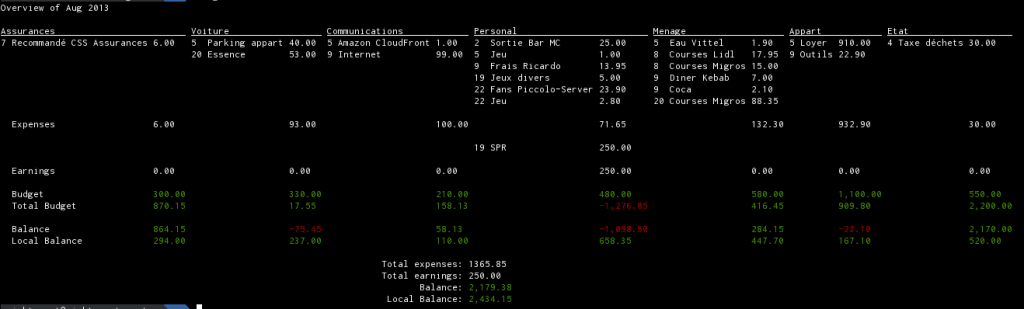

For instance, here is a command-line view of a monthly overview

As you can see in the above picture, the display of the monthly overview is quite simple. Doing it on the command line was more than enough for me initially.

However, since, I have added a web interface to budgetwarrior. I could not convince my wife to get onboard a command-line interface. We can now both use the same tool for budgeting. I use it much more than my wife, but she can also keep an eye on the budget from her phone.

The web interface

For most people, the web interface is much more convenient than the command-line interface. With budgetwarrior, you can do everything on the web interface.

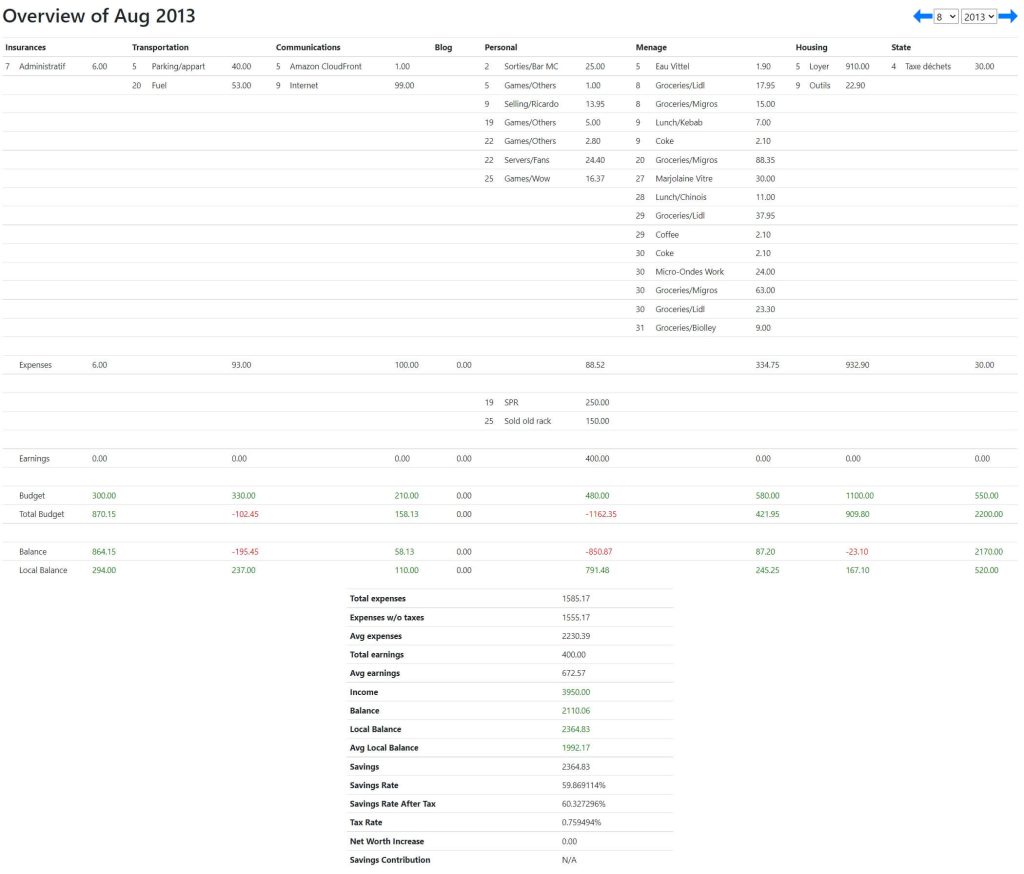

Here is the same monthly overview from the web interface:

I would say it is a pretty common way of displaying a budget.

I made the web interface, so it looks alright from the phone. But there is no mobile application and likely never will be since I do not enjoy developing mobile applications.

How I am managing my budget

Over time, I have changed a bit how I manage my budget.

I am not using a budget anymore. I am only tracking my expenses, not tracking a budget anymore. For instance, I do not say I have 200 CHF in the Food budget. Instead, I track every expense and see whether the result was good or bad at the end of the month.

I am not saying my way of tracking my expenses is better. It is what works best for me. Many people like to have a strict budget. But I do not find it necessary anymore.

Managing my net worth

When I started to track my net worth in October 2017, I decided to implement this new feature into budgetwarrior, so everything was centralized.

In the beginning, it was extremely simple, just a total net worth at the end of each month. But then, I have added many features, and now it tracks all my assets separately. It can even track the value of my shares automatically!

For these features, I have heavily focused on the web interface. Most of the features are available on the command line, but I have added many graphs to the web interface.

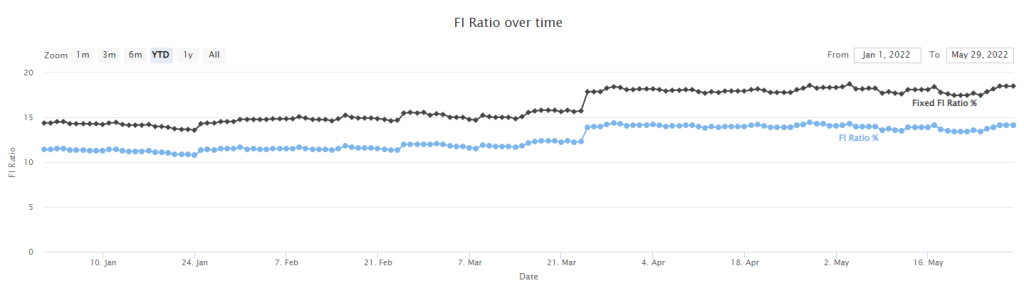

For instance, here is the evolution of my Financial Independence (FI) Ratio since I started tracking my net worth.

How I track my net worth

Tracking my net worth is a straightforward process for me. Every month, on the days following my salary, I update each asset on my application from the web interface.

The tool tracks the value of my shares, so I have to indicate whenever I buy or sell shares, but I do not have to set the value of my shares.

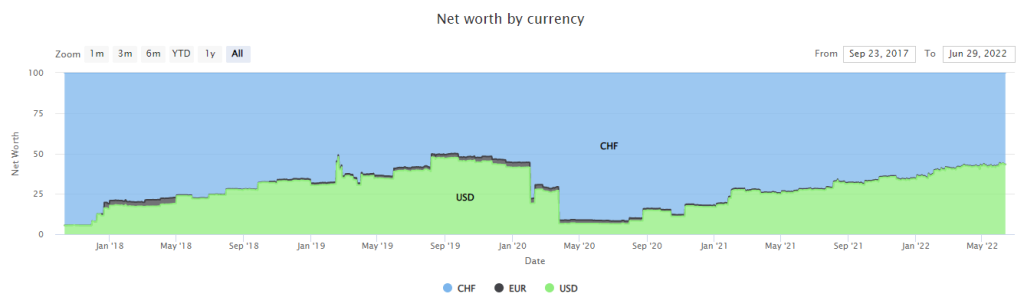

The tool also keeps track of currency exchange rates. That way, I can always see my net worth in CHF and the part of my net worth in each currency.

Other features

Over time, I have added many other features to the tool. Every time I thought something would be cool, I added it. Since I am the only user of the application (that I know of), I do what I want!

For instance, I have added features for retirement tracking. With that, you can compute your FI ratio and estimate when you will reach retirement. This feature also allows separating your net worth from your FI Net. For instance, your primary residence should not be part of your FI Net worth.

I have also added features to support side hustles to separate them into different overview graphs. I use this for my blog income.

I also have many smaller modules to track debts, wishes, and goals. But I rarely use them myself.

What budgetwarrior does not?

While I added many features, there are many things budgetwarrior does not.

But mostly, it does not connect to your accounts to update your data. The main reason is that I do not want any tool to connect to my broker or bank. I do not think it is safe.

On top of that, updating your net worth once a month or entering your expenses and earnings into a web page is not much work. Many people will disagree, but I think they either highly overestimate the time necessary to do that or do not want to.

Why did I not talk about it before?

Here is the main reason I did not talk about budgetwarrior before: it is not easy to start using it.

First, it only works on Linux, which most of my audience does not run. On top of that, if you want to run the web interface, you will have to run it on a server somewhere (either at home or on a VPS). So that limits, even more, the audience of the tool at this time.

Finally, it has very few users, so it was mostly only tested thoroughly by me and is made to suit my needs. I also never bothered writing help pages or documentation for the tool.

Are you interested?

Since many people are asking me how I managed my finances and whether I had some templates for them, I wonder if people would be interested in budgetwarrior.

As I mentioned before, it is currently not easy to install. If you want to install it yourself, you can read the Readme of the project for more information. If you want details or have questions about this, you can ask me on this blog or ask directly on the Github project. Currently, the web interface is in a separate private project.

However, I wonder whether people would be interested if I were to host that myself and offer access to it. It would not be free since I would have to pay for hosting, but I would like to know whether some people are interested or not.

I am not saying I will necessarily start this service. And this is not something I will start now with the limited time and energy I have.

Conclusion

You finally know exactly what tool I am using to manage my budget, my net worth, and how I go about it. As I mentioned on the blog before, I do not automate the tracking of my expenses. I enter every expense into the system manually. And it is not as much time as people think (or want to think).

I am sure some of you are disappointed that the tool is not readily usable. So, if you are interested in this tool, let me know in the comments below.

If you want to learn more about the tool, you can head to the Github Project.

What about you? What do you use to manage your budget and net worth?