(Disclosure: Some of the links below may be affiliate links) Your Safe Withdrawal Rate (SWR) is an essential component of your retirement planning if you plan to retire based on your investment portfolio. We have already talked at length about this method of retirement, the essence of the Financial Independence and Retire Early (FIRE) movement. But we have not talked in-depth about how to choose a Safe Withdrawal Rate for your situation. No SWR would fit every situation. And while there are some rules of thumbs, it is still something you have to decide for yourself. So, by the end of this step-by-step guide, you should know how to choose your Safe Withdrawal Rate. Safe Withdrawal Rate A Safe Withdrawal Rate is a withdrawal that is safe enough for you to have a successful retirement.

Topics:

Mr. The Poor Swiss considers the following as important: Financial Independence

This could be interesting, too:

Baptiste Wicht writes A few ways to simplify our life

Baptiste Wicht writes Retire Early: The Simple Guide – I wrote a book

Mr. The Poor Swiss writes 9 Reasons to Aim for Financial Independence

Mr. The Poor Swiss writes How to Open an Interactive Brokers Account in 2021?

(Disclosure: Some of the links below may be affiliate links)

Your Safe Withdrawal Rate (SWR) is an essential component of your retirement planning if you plan to retire based on your investment portfolio. We have already talked at length about this method of retirement, the essence of the Financial Independence and Retire Early (FIRE) movement.

But we have not talked in-depth about how to choose a Safe Withdrawal Rate for your situation. No SWR would fit every situation. And while there are some rules of thumbs, it is still something you have to decide for yourself.

So, by the end of this step-by-step guide, you should know how to choose your Safe Withdrawal Rate.

Safe Withdrawal Rate

A Safe Withdrawal Rate is a withdrawal that is safe enough for you to have a successful retirement. And a successful retirement means you will not run out of money before the end of the retirement period you have chosen.

The withdrawal rate defines the amount you will spend each year in the percentage of your portfolio. So, if you retire with 1’000’000 CHF and have a withdrawal rate of 4%, you will be able to spend 40’000 CHF per year. And each year, you will adjust this number for inflation. It is essential that the withdrawal rate is relative to your initial portfolio, not the current portfolio.

So, with a higher withdrawal rate, you can spend more money each year for the same initial portfolio. But spending more means you are increasing your risks of running out of money. So, a high withdrawal rate is riskier than a low withdrawal rate.

If you want more information and examples, I have done many simulations of withdrawal rates.

In this article, I will guide you through my six-step method of choosing your safe withdrawal rate, but this is not the only one. However, I believe it should work well for the majority of people.

1. Decide when you want to retire

I believe showing your safe withdrawal rate starts with deciding when you want to retire. Of course, this does not mean you are going to retire at precisely that time. In the end, you may retire earlier or later than that goal. But having a goal in mind will let you plan from now to your goal.

For instance, I would like to be financially independent at 50 years old. So, have to plan my journey from now to the point I am 50 years old. Currently, I am mostly on track to reach that goal. But things can change in the future.

2. Estimate how long you are going to live

Now that you have your starting point, you need an endpoint. You need an upper estimate on how long your retirement is going to last. There are several ways to approach this problem.

The simple way is to assume you will make it to 120 years old. I take 120 because the oldest verified person was 122 years old when she died. If you plan to retire at 40, you will need your portfolio to live for 80 years. These 80 years will be your financing period.

However, the issue with this technique is that you are extremely unlikely to reach this old age. For example, if you plan for 80 years of retirement and only live through half of it, you will have spent too many years working to fund your retirement plan. So, being too conservative will make it harder to reach your goal.

So, a better technique is to rely on statistics. Each developed country publishes life expectancy statistics. For instance, as of 2019, the life expectancy at birth for a man is 81.9 years old. So, should I expect to live until I am 82 years? Not really. There are three important concerns.

First, life expectancy at birth is not the most relevant statistic. What is more relevant is the life expectancy at your age. For, instance the life expectancy at age 30 in Switzerland is 52.6 years, bringing a total of 82.6 years. And at age 50, it is 33.3, for a total of 83.3 years. So, it is more important to take the estimate based on your age.

Second, if you plan precisely for your life expectancy, what will happen if you live longer? Your plan may fail. So, while you should not plan for anything shorter than your life expectancy, you should add a margin of safety to live longer than that.

Third, life expectancy depends on your current health. For example, a heavy drinker or smoker has a significantly lower life expectancy. On the other hand, a non-smoker with frequent exercise has a significantly higher life expectancy. So, this is something you should take into account as well.

For instance, my life expectancy at my current age is about 83 years old. So, I will plan my financing period to 90 years old. Seven years sounds like enough margin of safety for me. Therefore, I should plan for a financing period of 40 years, at least.

Of course, if your plan concerns several people (you and your partner for instance), you should take that into account. For instance, my wife is younger than me, and women live younger than men, so I should add 5 years to my estimation.

3. Choose your asset allocation

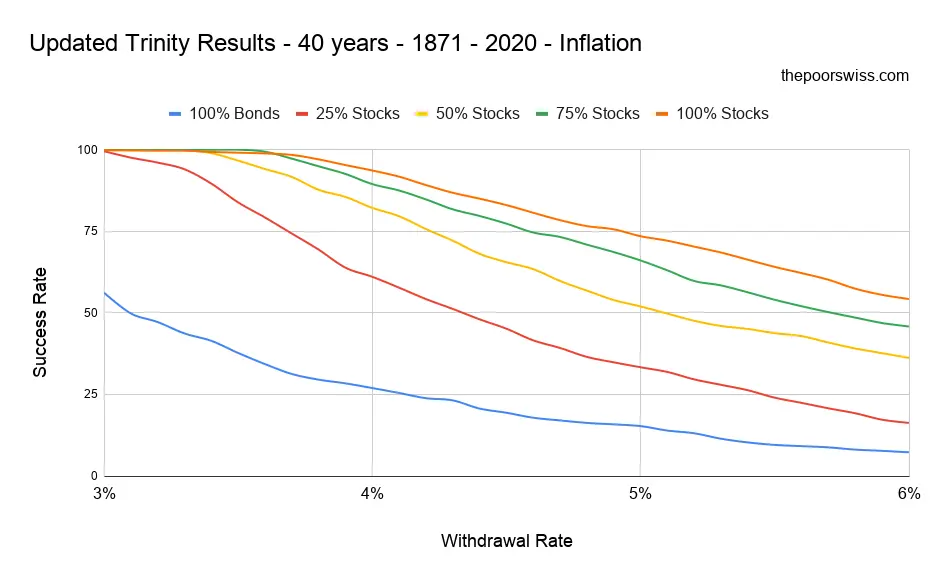

To estimate the success rate of a safe withdrawal rate, we need to know the asset allocation of the portfolio. Indeed, a safe withdrawal rate will have different results if you have a 100% stocks portfolio or 40% in bonds and 60% in stocks.

Now, here comes the tricky part. The asset allocation will play a role in the safety of your retirement plan. So, it will impact the success rate and worst duration of your retirement scenario. Indeed, asset allocation and safe withdrawal rates are highly related.

If you already decided on your asset allocation, go over to the next step. Otherwise, keep reading.

We are talking about your asset allocation at retirement, not the asset allocation of your current accumulation portfolio. For instance, I plan to keep 100% in stocks before retirement, and then I may switch 20% in bonds during my retirement. So, I should consider 20% in bonds as my asset allocation to choose my Safe Withdrawal Rate.

What bonds will do is reduce your chances of failing early. Put another way. They will increase the worst duration of your portfolio. The worst duration is the earliest time a portfolio can fail during retirement. So, you want it to be as high as possible.

On the other hand, adding a high allocation to bonds to a portfolio will reduce your chances of a successful retirement. Indeed, the low returns of bonds have historically been too low to sustain retirement. You can see this in action on this graph from my Trinity Study updated results.

Here are a few examples with different safe withdrawal rates and asset allocations (with my FIRE calculator):

- 4% withdrawal over 40 years

- 100% stocks: 93.67% success rate, can fail after 174 months

- 80% stocks: 90.20% success rate, can fail after 270 months

- 60% stocks: 86.03% success rate, can fail after 302 months

- 3.5% withdrawal rate over 60 years

- 100% stocks: 98.58% success rate, can fail after 222 months

- 80% stocks: 98.58% success rate, can fail after 402 months

- 60% stocks: 95.17% success rate, can fail after 437 months

If you want to be aggressive, having 100% in stocks is the allocation with the highest chance of success. However, it is also the one that can fail the earliest. Adding 20% bonds is generally a good bet since it would not hurt too much the success rate, and it would significantly improve the worst duration.

If you want more information, I have a guide on asset allocation.

4. Choose a Safe Withdrawal Rate

You now have all the information you need to choose your safe withdrawal rate:

- Your financing period

- Your asset allocation

With this information, you can use my FIRE calculator to get information about success rates and worst durations for several withdrawal rates. For instance, I have plugged my own situation into (40 years and 80% stocks) to get the following information:

| Withdrawal Rate | Success Rate | Worst duration |

|---|---|---|

| 3% | 100% | 480 months |

| 3.25% | 100% | 480 months |

| 3.5% | 99.85% | 402 months |

| 3.75% | 97.15% | 318 months |

| 4% | 90.20% | 270 months |

| 4.25% | 84.57% | 246 months |

| 4.50% | 78.86% | 231 months |

With this information, I would use a 3.75% withdrawal rate. Some people would prefer to have the 3.5% if they are more conservative. And some people would even go with the 4% if they aggressive enough. For me, one chance out of ten to run out of money is already too much, but not for everybody.

Since I am still hesitating with my asset allocation, I have also done the work with 100% in stocks and 40 years:

| Withdrawal Rate | Success Rate | Worst duration |

|---|---|---|

| 3% | 99.85% | 306 months |

| 3.25% | 99.69% | 246 months |

| 3.5% | 99.23% | 222 months |

| 3.75% | 97.99% | 198 months |

| 4% | 93.67% | 174 months |

| 4.25% | 88.19% | 162 months |

| 4.50% | 82.87% | 150 months |

If I went with 100% stocks, I would also go with 3.75%. But I would be careful about the worst duration during my retirement. So I would keep some flexibility to be able to reduce it to 3.5% if necessary.

5. Think of margin of safety

This step is optional, but it may make sense for some people to have a margin of safety in their choice. There are several reasons to introduce some more safety.

First, you may live much longer than expected. This is not a bad thing, of course. But if you have planned for 40 years and live 60 years, your plan may fail.

Second, we need to remember that all of this data is based on historical results. These simulations have worked for 150 years. And I am confident they will work in the future. But maybe they will perform slightly worse?

Third, your expenses may change. If you have not planned for your expenses and they end up increasing after your retirement, your effective withdrawal rate may be higher than you thought.

So, adding a little margin of safety to your retirement plan may not be a bad thing. There are several ways to add a margin of safety:

- Lower your withdrawal rate at the end

- Plan for more years for your retirement

- Increase your target success rate and worst durations

Of course, you should not go over the top with your margin of safety. In the end, most early retirees will end up with significantly more money than they started with. So, if you lower your withdrawal rate from 3.5% to 2.5%, you will have to accumulate significantly more money, and you will probably end up with a ton of money at the end of your retirement.

6. Revise your plan yearly

If you are going to retire soon, you are good to go. But if you retire in years or decades, you will want to update your retirement plan and your safe withdrawal rate every year or so.

I would encourage you to redo the first five steps quickly every year to make sure your plan is still working for your current situation. And this is also an excellent time to see where you are from your retirement.

Conclusion

With these six steps, you should have a good idea of how to choose a Safe Withdrawal Rate for your situation. It is an essential decision since it will shape your journey to financial independence.

As long as you are not retired, you have plenty of time to think about this. However, once you retire, you cannot change your withdrawal rate without changing your expenses which may not be possible. Therefore, it is worth taking the time to think about your withdrawal rate.

I have already changed my own Safe Withdrawal Rate several times. While writing this guide and doing the six steps myself, I have increased my withdrawal rate from 3.6% to 3.75%. I believe I will be safe enough with 3.75%. But I probably will not retire before 15 years. So, I expect my Safe Withdrawal Rate to change in the future again.

The best way to play with these numbers is to use my Safe Withdrawal Rate Calculator.

What about you? What is your own Safe Withdrawal Rate?