(Disclosure: Some of the links below may be affiliate links) Many people want to know whether they should rebalance their portfolios. This is an excellent question, and it becomes essential once in retirement. Rebalancing is the fact of selling the shares that have overperformed and then buy the stocks that underperformed. The idea is to keep your portfolio allocation to the same level. People disagree on whether you should rebalance in retirement or not. People do not even agree on that during the accumulation phase. So we will cover this subject as well. And since I now have a lot of data about the stock market, I figured it would be great to use. So, I am also going to simulate whether it has historically been better to rebalance or not. The data on this article is based on more than

Topics:

Mr. The Poor Swiss considers the following as important: Financial Independence, Investing

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

(Disclosure: Some of the links below may be affiliate links)

Many people want to know whether they should rebalance their portfolios. This is an excellent question, and it becomes essential once in retirement.

Rebalancing is the fact of selling the shares that have overperformed and then buy the stocks that underperformed. The idea is to keep your portfolio allocation to the same level.

People disagree on whether you should rebalance in retirement or not. People do not even agree on that during the accumulation phase. So we will cover this subject as well.

And since I now have a lot of data about the stock market, I figured it would be great to use. So, I am also going to simulate whether it has historically been better to rebalance or not.

The data on this article is based on more than 3.2 million simulations of withdrawal rates! So, without further ado, let’s delve into rebalancing!

Rebalance a portfolio

When you choose your investment portfolio, you decide on a particular allocation to each of the instruments in your portfolio. For instance, you could have 40% of bonds and 60% of stocks. It is a popular portfolio for the United States.

But, during a bull market, the stocks will probably outperform the bonds. So, after one year, your effective allocation may become 65% of stocks instead of 60%.

To rebalance your portfolio is to put your stock allocation back to 60%. For this, you will sell shares of stocks to buy shares of bonds. Once it is done, you are back with a 60%/40% portfolio.

The same can happen during a bear market where you can sell bonds to buy more stocks. And if you have different asset classes, for instance, small companies and large companies, you may also have to rebalance between both.

When to rebalance

There two main ways of seeing rebalancing:

- Perioding rebalancing: You rebalance each given period.

- Threshold rebalancing: You rebalance when your portfolio is too imbalanced.

Most people rebalance their portfolios either monthly or yearly. Monthly rebalancing does not make much sense because the stock market is very volatile. Quarterly and yearly are the two rebalancing schedule that makes the most sense. We have to keep in mind that rebalancing is not free. You will need to pay for both operations.

But in practice, you could rebalance at any time. There are some funds where they are rebalancing their assets daily.

On the other hand, you could also decide to rebalance once it is too much imbalanced for you. So you need to decide when you start to rebalance. For instance, you could choose not to rebalance a portfolio at 61%/39%. It is good to set a threshold, after which you will start rebalancing.

And of course, you can also opt for a hybrid of these two techniques. For example, some people will rebalance every quarter, but only if it is more than 2% out of balance.

Advantages of rebalancing

The apparent advantage of rebalancing is that your asset allocation stays the same over time. If you base your asset allocation on your risk tolerance, then the risks of your portfolio remain aligned to your risk tolerance. This stable allocation is essential for some people.

If you have several kinds of stocks in your portfolio, rebalancing can also help the diversity in your portfolio. For instance, you could allocate 40% of your portfolio to Swiss stocks and 60% to U.S. stocks. If the U.S. Stocks do very well, you may well end up with 80% U.S. stocks instead of 60%. You just lost diversification in your portfolio.

Some people also argue that rebalancing can improve the performance of your portfolio. You are automatically selling high to buy low. On paper, this makes a lot of sense. We will see later what this means in practice.

Disadvantages of rebalancing

One of the problems of rebalancing is that it is more costly than doing nothing. You will pay a fee to sell your shares. And you will pay a fee to repurchase the other shares. If you use a good broker, it is not a lot, of course. But if you often rebalance, for instance, once a month, this could significantly increase the yearly costs of your portfolio.

Another simple disadvantage is that it is more complicated. Doing nothing is simpler.

By rebalancing your portfolio, you are selling the shares that are doing well and buying shares that are not doing well. Unfortunately, it means that you may be missing out on the good shares doing even better.

Rebalance during the accumulation phase?

Before we consider rebalancing during retirement, let’s talk about rebalancing during the accumulation phase. This is the phase where you often invest in the stock market, and you do not withdraw money from it.

There are two ways to ensure a balanced portfolio during the accumulation phase:

- Actual rebalancing by selling and buying shares to go back to a better balance.

- Using your investments to balance your portfolio.

I do not think it is necessary to rebalance a portfolio during the accumulation phase. It should be enough to buy the shares that are too low in allocation. I am buying shares every month. And every time, I am choosing the shares that need the most buying.

It is cheaper to do it without actually rebalancing. But at some point, if there is too much of an imbalance, an actual rebalancing may be necessary. That is if you want to have your portfolio well balanced.

It makes sense to keep a balanced portfolio during the accumulation phase. But, I do not think it is as crucial as during retirement. And I think that using your regular investments will be enough for rebalancing.

Rebalance in retirement?

Now let’s get to the main point: Should you rebalance in retirement?

First, during retirement, you probably cannot balance by using investments. Even if you have some passive income, you will probably save much less than during the accumulation phase. Therefore, either you rebalance by buying and selling, or you do not rebalance.

You also have the choice of whether you want periodically rebalancing or threshold rebalancing. These are the same choices as during the accumulation phase.

The pros and cons are the same as we saw before. Now, let’s see what would have happened with and without rebalancing in the past.

Periodic rebalancing

Let’s start our first simulation to see how periodic rebalancing is doing.

We are going to use the same data I used for the Updated Trinity Results. Our simulation will include the period from 1871 to 2018. I am going to plot the success rate with different withdrawal rates.

I am going to compare three different setups:

- No rebalancing

- Monthly rebalancing with 0.005% fees per rebalancing

- Yearly rebalancing with 0.01% fee per rebalancing

So, let’s see whether we should rebalance for different portfolios.

We are not going to do the test for a 100% stock portfolio. Indeed, there is no rebalancing necessary. It is another advantage of a full stock portfolio.

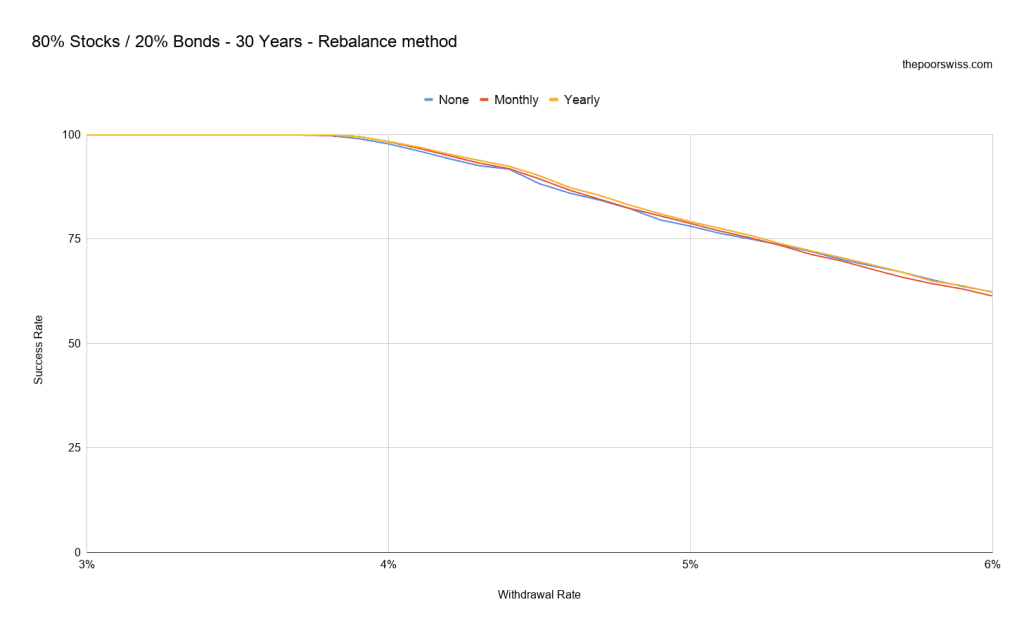

80% Stocks / 20% Bonds

Here are the historical results for a portfolio with 80% Stocks and 20% Bonds for 30 years:

As you can see, there is very little difference between the different rebalancing options. We can still observe two things.

First, yearly rebalancing is always better than monthly rebalancing! For low withdrawal rates, annual rebalancing is the best option. Then, no rebalance becomes better for higher withdrawal rates.

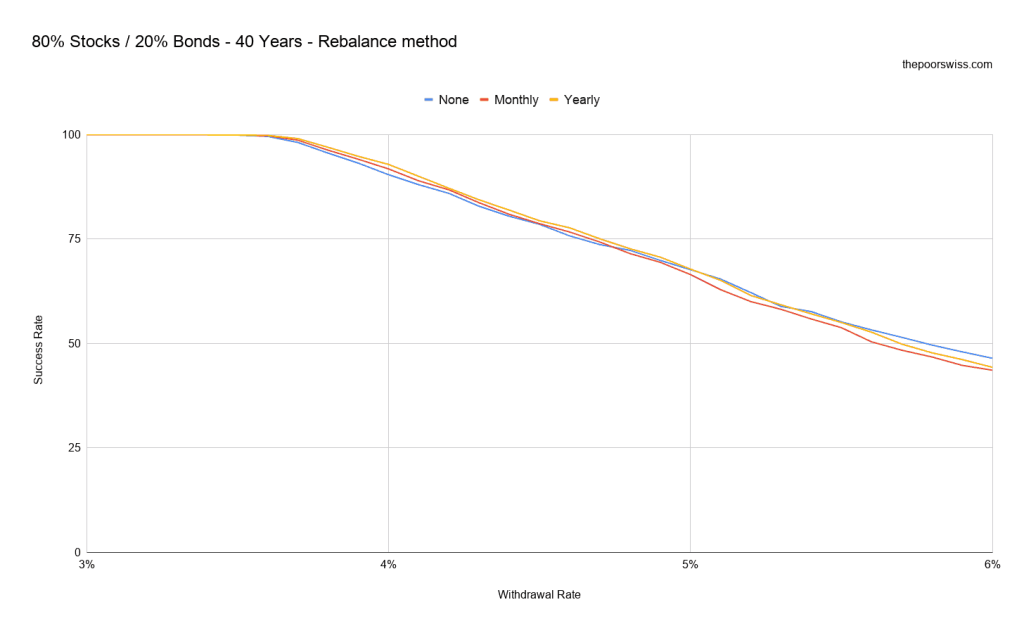

Let’s see what happens with a 40 years horizon:

With a longer time, no rebalancing starts to outperform yearly rebalancing. However, we are in a zone where the success rate is low.

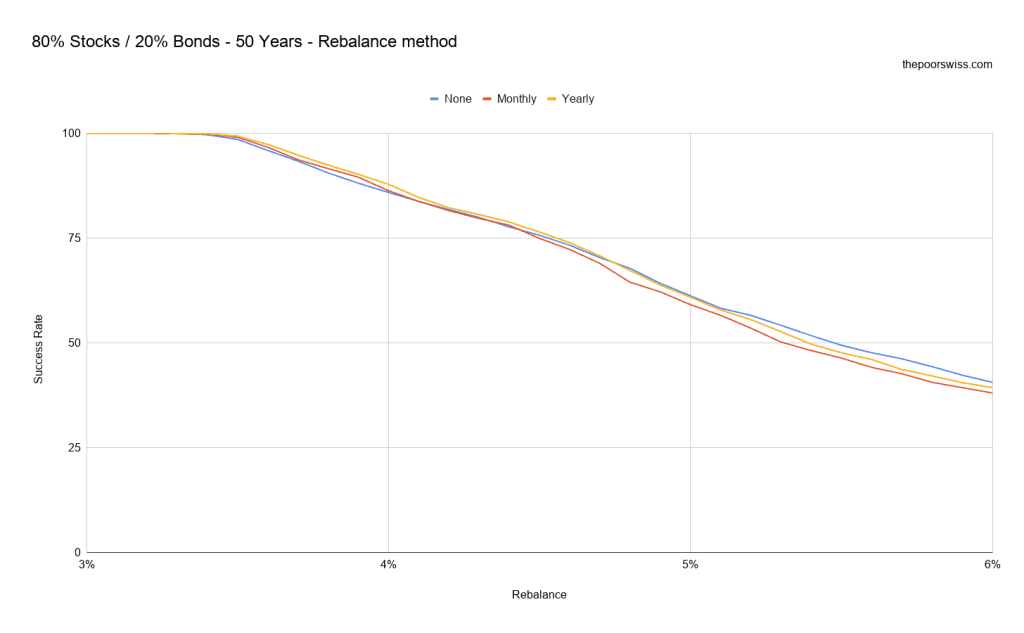

Let’s jump to 50 years now:

This time, No rebalancing starts to outperform yearly rebalancing from about 4.7% withdrawal rate.

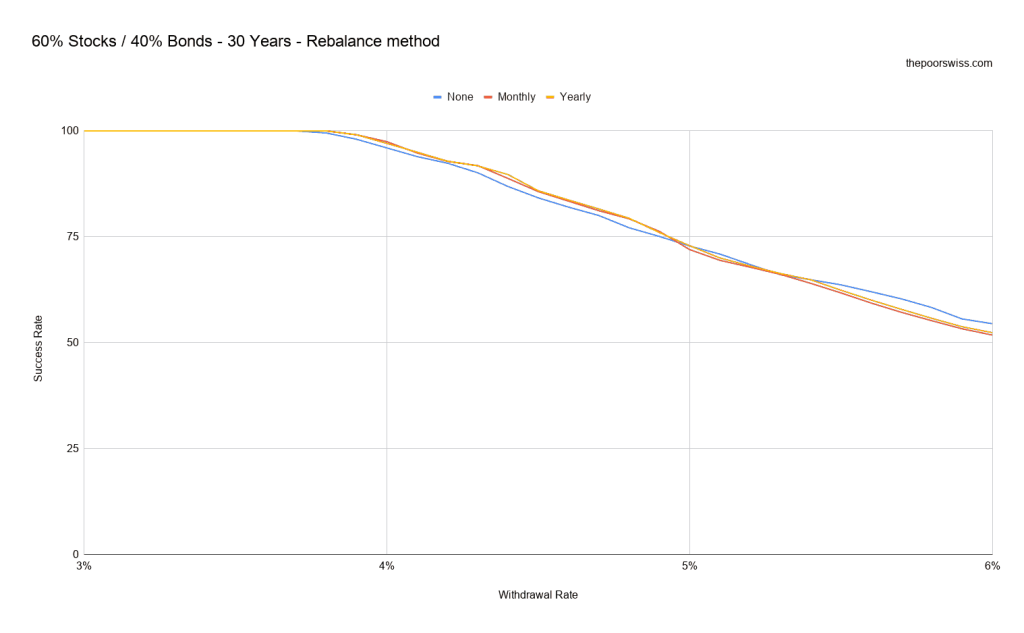

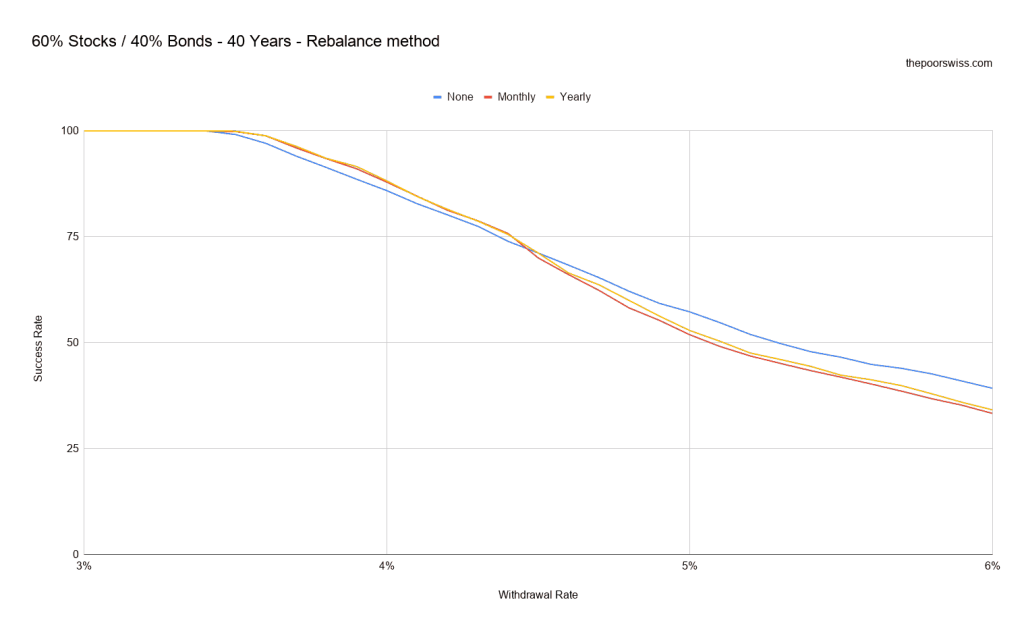

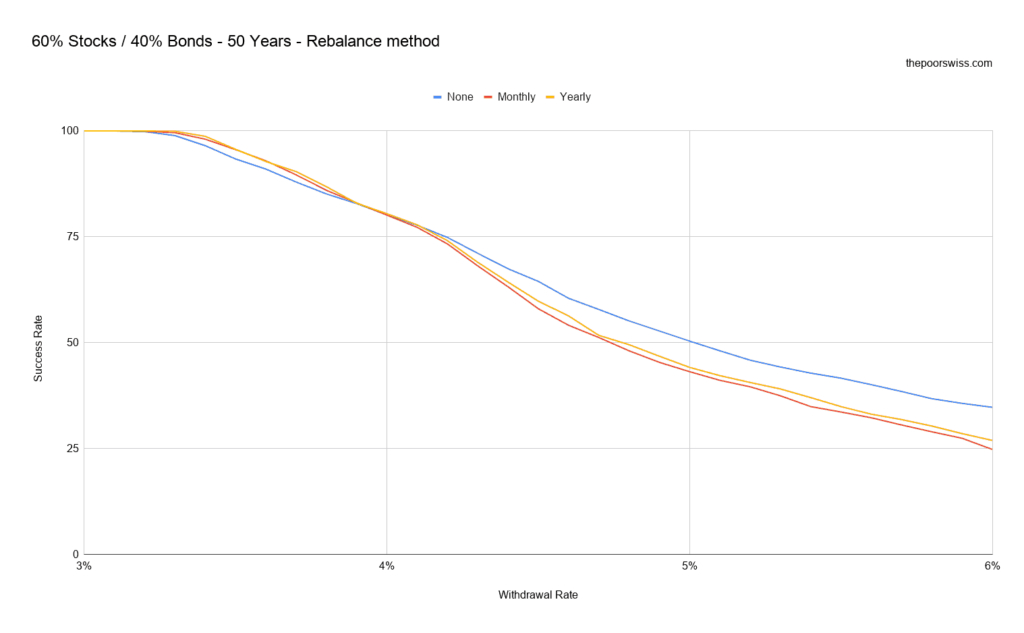

60% Stocks / 40% Bonds

Let’s try with the very popular portfolio with 60 percent in stocks and 40 percent in bonds. It is a portfolio that many people use.

Once again, we start with 30 years retirement:

There is more margin for imbalance in this portfolio. So the effects of rebalancing are higher than in the first case. We can see that below 5% withdrawal rate, it is better to rebalance yearly. However, after this limit, you should probably not do any rebalancing.

With 40 years, the effects of rebalancing are more important. After a 4.4% withdrawal rate, you should avoid rebalancing. And below that, the effects are also more important.

Finally, with a 50 years retirement horizon, the effects of no rebalancing are significant. Below a 4% withdrawal rate, not rebalancing could cost you a few percent chances of success.

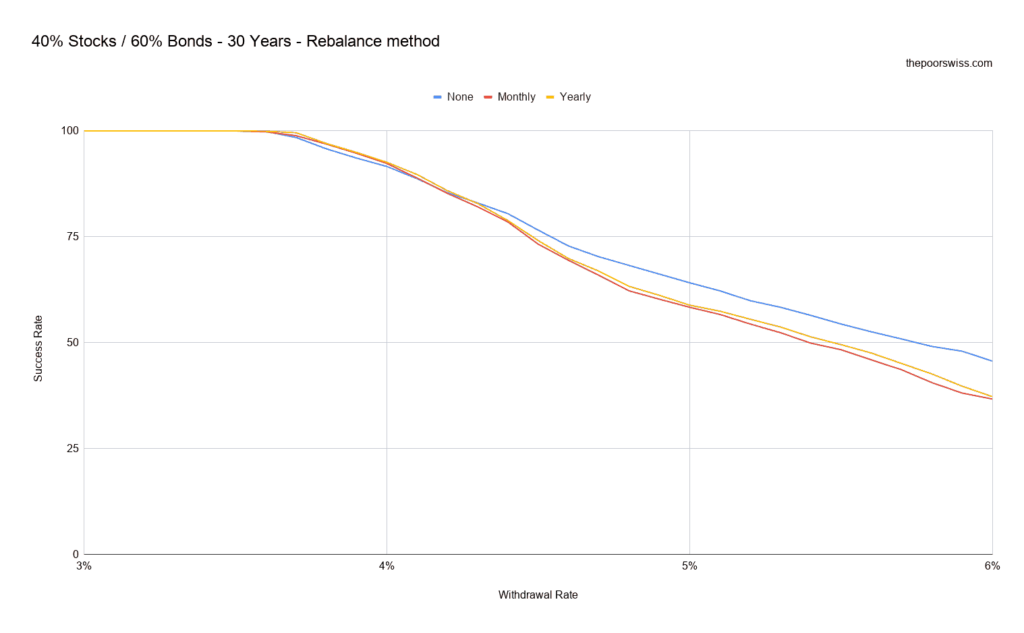

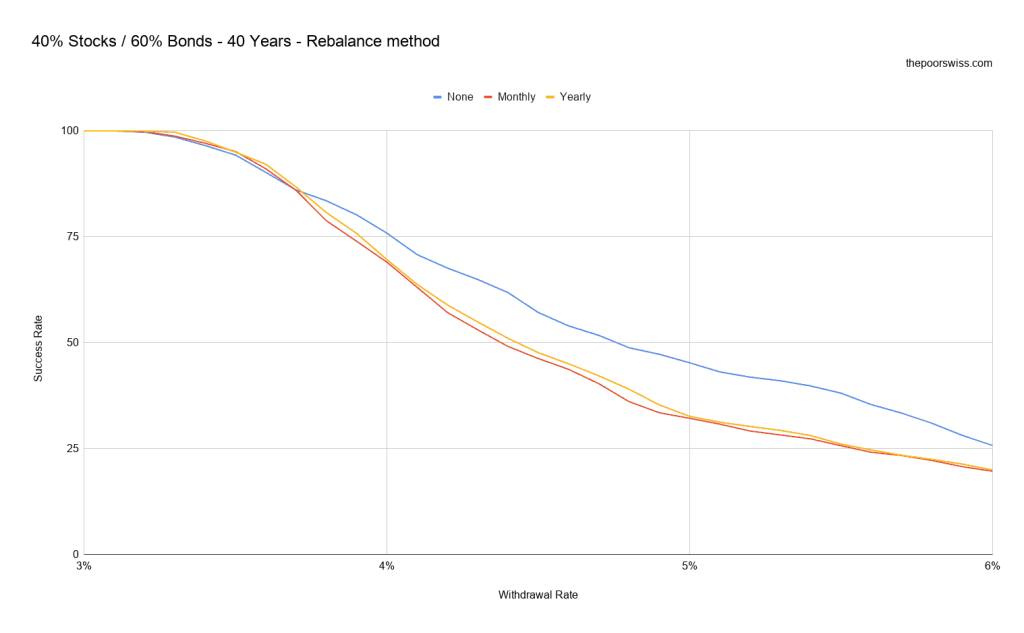

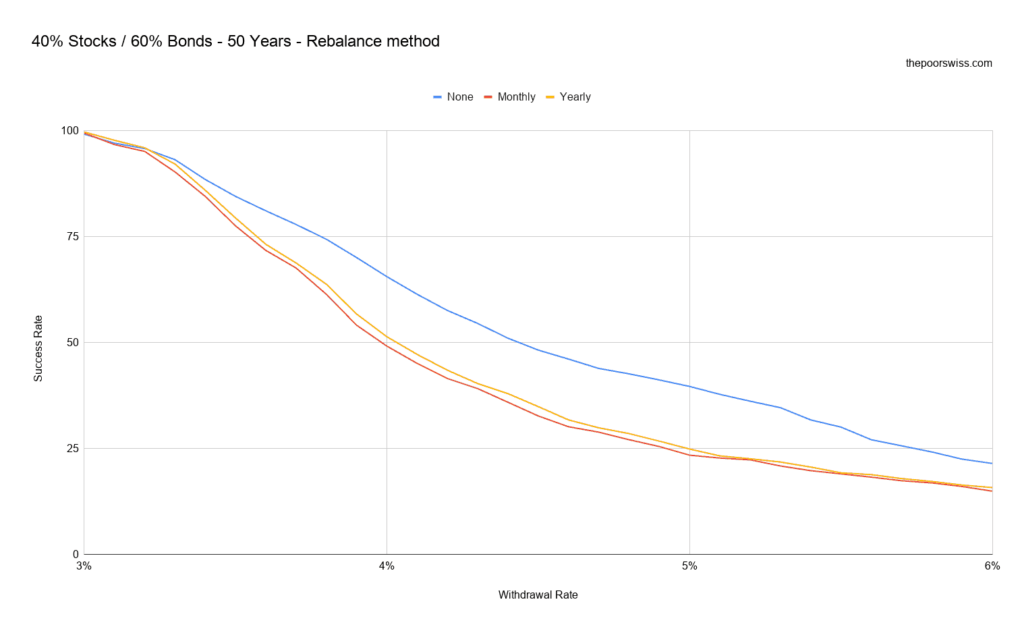

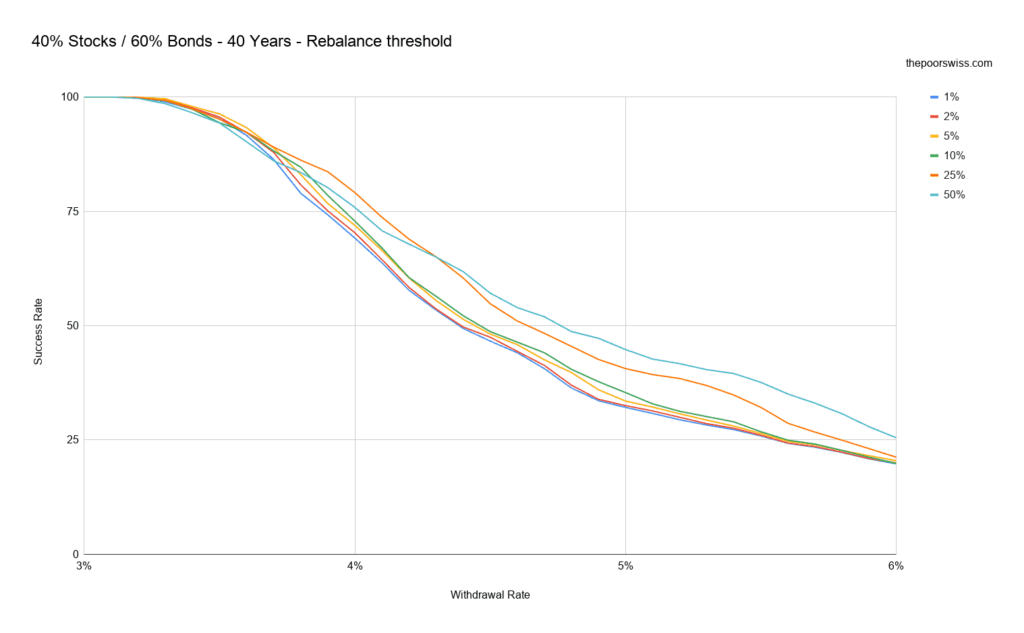

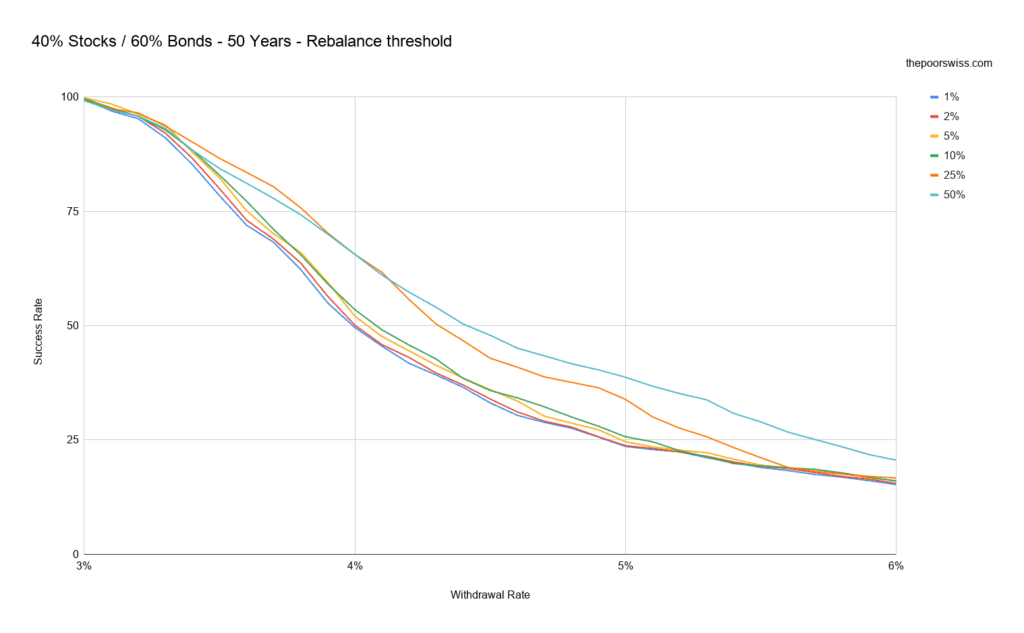

40% Stocks / 60% Bonds

The last portfolio we will test is a portfolio with 40 percent of stocks and 60 percent of bonds. It is also a typical conservative retirement portfolio for many people.

We can observe the same thing as before, with the interest of rebalancing going lower and lower as you increase the withdrawal rate.

Once we go to 40 years of retirement, it becomes better not to rebalance very quickly.

Finally, after 50 years, you should not rebalance. However, this is not a great portfolio to plan for 50 years of retirement. Your chances are going lower very quickly.

Periodic rebalancing – Conclusion

Let’s make a small intermediary conclusion already for periodic rebalancing.

One thing is fascinating: yearly rebalancing was always at least as good as monthly rebalancing! So, historically, it was better to rebalance only once a year instead of once a month. It will not make a huge difference. But it can give one or two more percent chances of success. And this is always good to take. Moreover, it is also simpler!

Also, the smaller allocation to stocks you have, the more difference rebalancing can make. And the longer the retirement, the higher the difference as well.

The last conclusion we can do is that if you plan on a high withdrawal rate, you are probably better off not rebalancing at all. It makes sense. Since the returns on stocks are historically higher, it is better to let them run their course.

Threshold Rebalancing

Now, we can also compare these results with threshold rebalancing. Generally, people using this technique will rebalance each month if the imbalance is higher than a certain threshold.

Ideally, you should rebalance as soon as the imbalance appears. But, this means you need to monitor your portfolio regularly. Monitoring your portfolio is highly inconvenient. And I hope nobody does that manually. It is what some computers do with automated trading. But monthly is more than enough for threshold rebalancing.

For instance, if your standard allocation to stocks is 60%, but your current allocation is 63%, you have a 3% imbalance. If your threshold is 2%, you will rebalance. If your threshold is 5%, you will wait.

I am going to test several different thresholds:

- 1% (this is almost the same as monthly rebalancing)

- 2%

- 5%

- 10%

- 25%

- 50% (this is almost the same as never rebalancing)

Once again, we will measure the chance of success for different portfolios with these different thresholds.

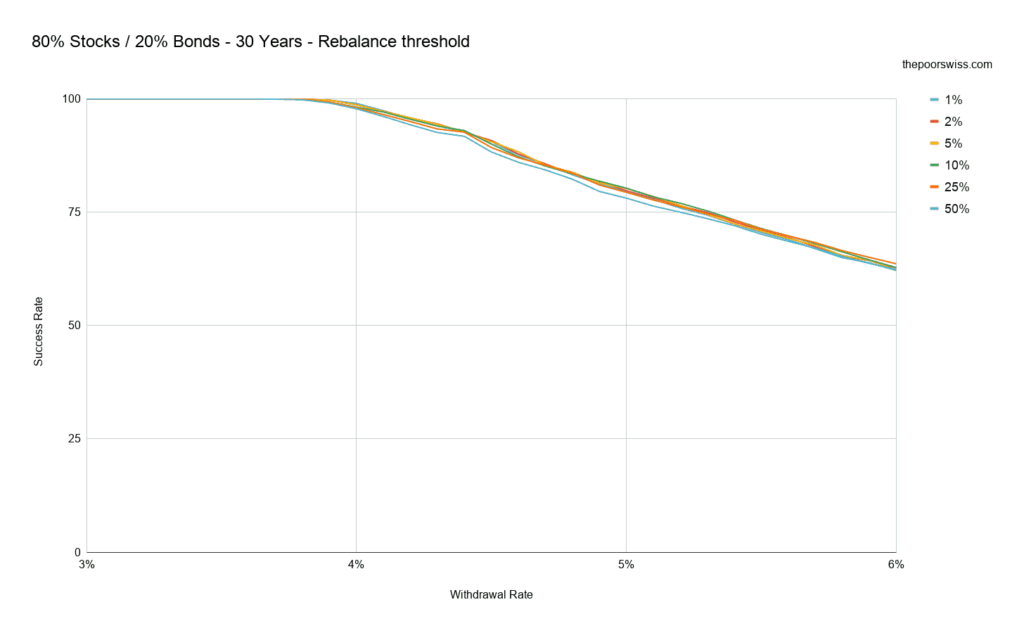

80% Stocks / 20% Bonds

Let’s start with our portfolio with 80% allocated to stocks. Here is what it looks like with 30 years of retirement:

As expected, there is not much difference in this case. There is not much opportunity for rebalancing. We can still see interesting behavior. The higher the withdrawal rate gets, the higher the threshold you can use.

Overall, in this case, the best threshold is about 10% if you use more than a 4% withdrawal rate.

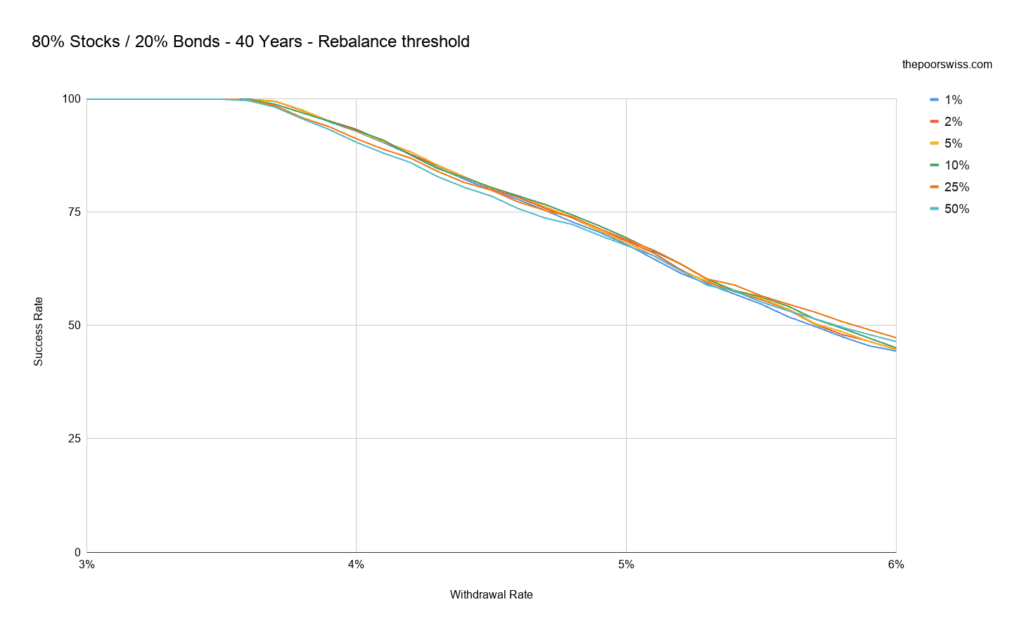

Let’s see if that changes for 40 years:

There is slightly more impact on rebalancing on your chances of success. It is interesting to note that neither 1% nor 50% is the best choice here. It means that monthly rebalancing (same as 1%) is easily outperformed by other thresholding. Below a 5% withdrawal rate, 10% is the best threshold. After 5%, 25% becomes the best threshold.

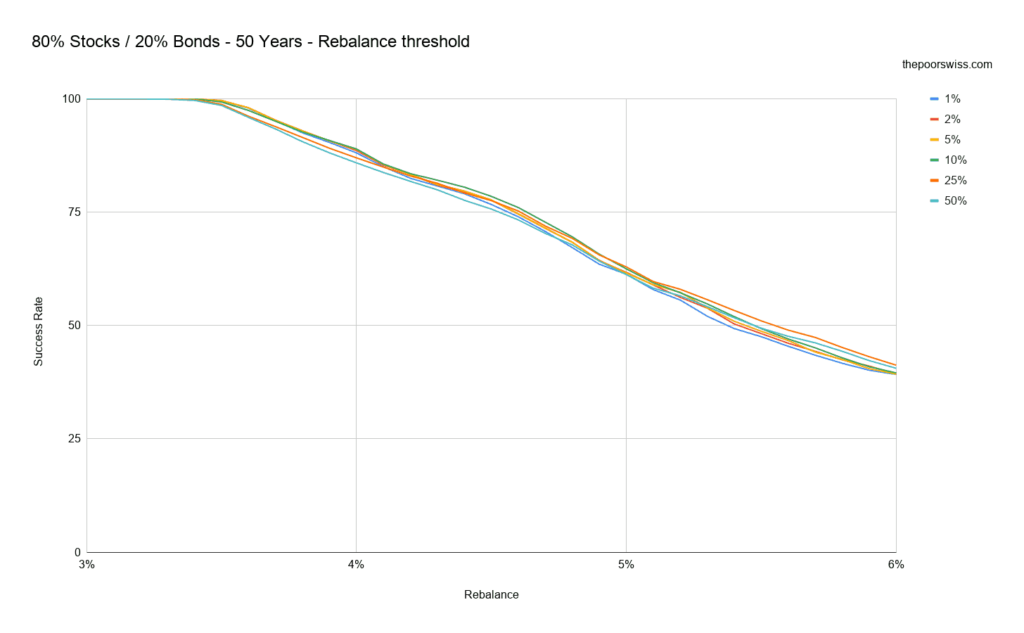

Let’s check if this holds for 50 years:

Once again, as we increase the retirement time, there are more differences between the strategies. We have the same result as before: below 5% withdrawal rate, a threshold of 10% is best, and a 25% threshold becomes better after that.

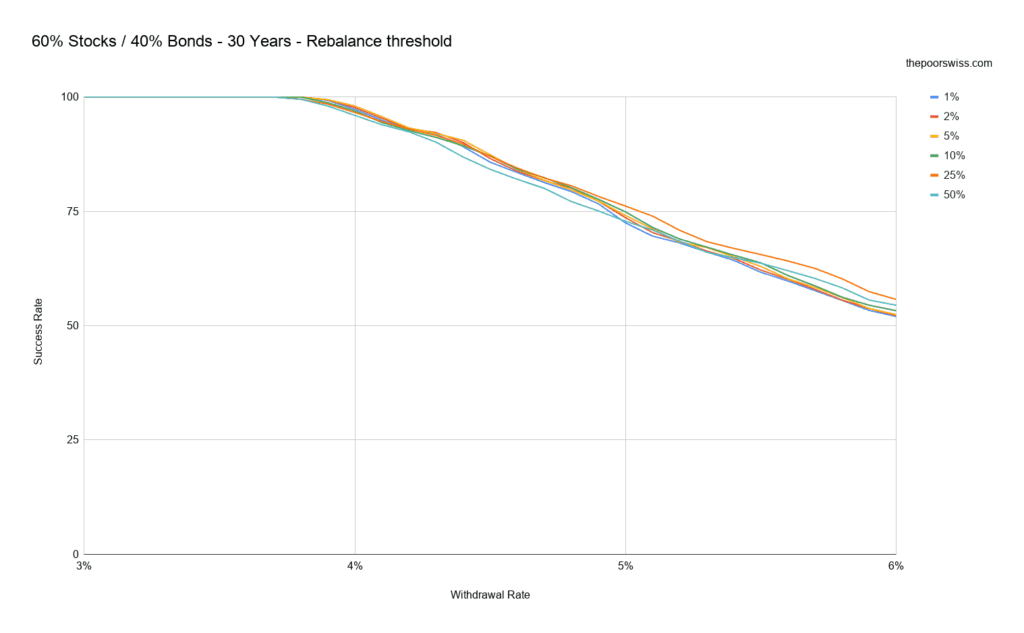

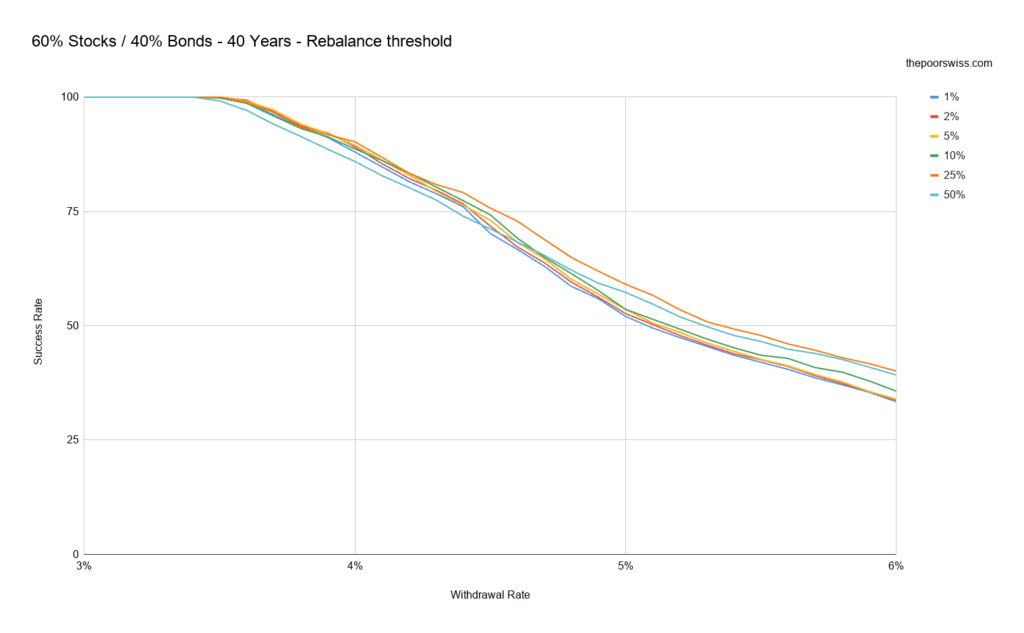

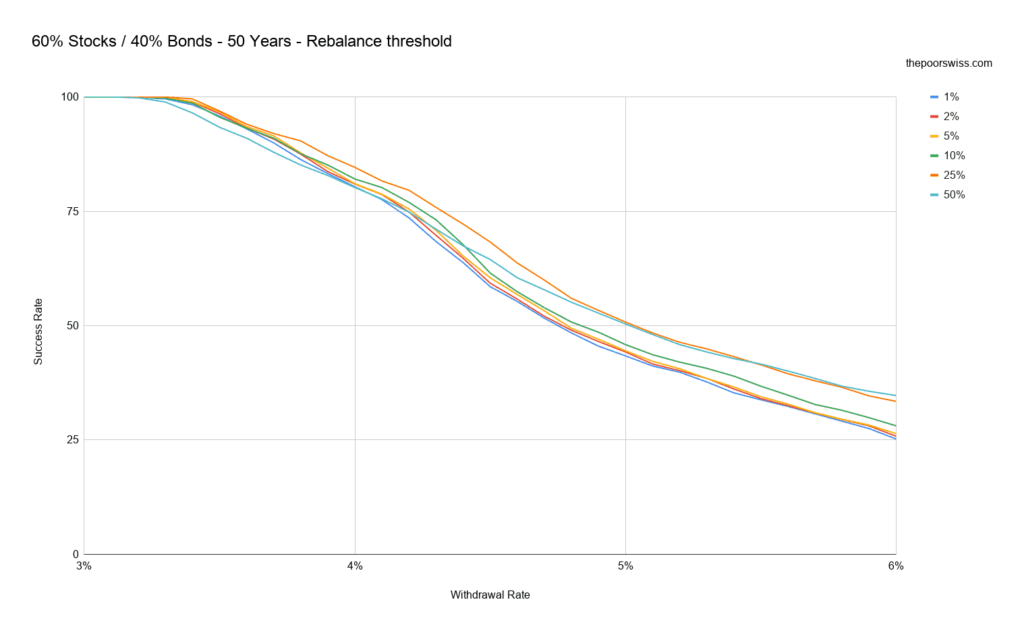

60% Stocks / 40% Bonds

Let’s continue with the popular portfolio, with 60% allocated to stocks. We saw before that this portfolio had more opportunities for rebalancing. So, let’s see what threshold rebalancing does for it.

First, with 30 years of retirement:

We can observe that there is more difference between the different thresholds of rebalancing. Once again, the worst rebalancing thresholds are 1% and 50%. 10% and 25% are once again excellent.

These results are interesting. 25% is almost always the best threshold here. Only below 3.5% is it better to have a smaller threshold. And we can also see that the differences between the thresholds are getting more significant.

Finally, with 50 years in front of you:

In this scenario, you should always opt for a 25% rebalance threshold. Even for low withdrawal rates, this will be the best option.

It is very interesting because I never saw this discussed before for this particular portfolio. And many people use this portfolio. It can make a difference of several percent chances of success compared to yearly or monthly rebalancing.

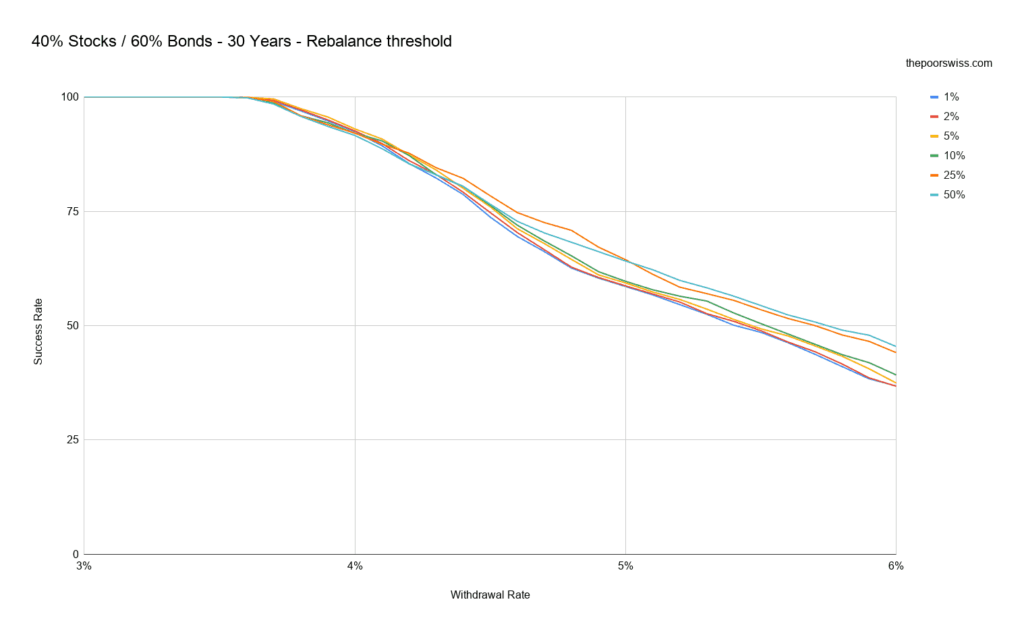

40% Stocks / 60% Bonds

Finally, let’s try again with our more conservative portfolio.

This case is quite interesting. Below a 4% withdrawal rate, you are best off with a 5% threshold. From 4% to 5%, you should use 25%, and after 5%, you should not rebalance at all (50%).

Let’s see if the same stands true for 40 years:

The difference between the thresholds is even more impressive. But the chances of success are also getting quite slim. Until a 4.3% withdrawal rate, 25% is a good option, but you should use 50% or not rebalance at all after this.

And finally, let’s see what happens with 50 years of simulation:

We can observe almost the same thing. Until 4.1% WR, you can use a 25% rebalancing threshold. After this, you should forego rebalancing. But in this scenario, even with a 4% withdrawal rate, you are likely to run out of money before 50 years.

Threshold Rebalancing – Conclusion

There are several interesting conclusions we can get from these simulations. I was not expecting so much difference between the different thresholds.

First, rebalancing monthly with only a 1% threshold is generally the worst rebalancing strategy. You should use a higher threshold. It seems like 5% and 10% work quite well on average for low withdrawal rates. Once you start thinking of longer retirement, 25% is becoming very interesting.

Generally, the higher your withdrawal rate, the higher the threshold you should use to rebalance your portfolio. This correlation makes sense since you want high returns to compensate for large withdrawals. So, you want your stocks to grow more.

Finally, another thing that makes sense: a portfolio with a smaller allocation to stocks will have more impact from rebalancing. This increased impact is because the stocks will have more opportunities to get off balance.

Conclusion

There are several important conclusions we can draw from these results. And it is even more exciting because there are not many simulations like that out there.

On average, yearly rebalancing is better than monthly rebalancing. It is significant since a lot of people are planning to rebalance monthly. Historically, you have a slightly better chance of success by rebalancing once a year.

Also, the longer your retirement, the more critical it becomes to choose the correct rebalancing method. For example, if you plan a 50 years retirement with the 60/40 portfolio, you should probably only rebalance when your portfolio is 25% off balance.

With a larger withdrawal rate, the best course of action is to rebalance once your portfolio is imbalanced by 25%. Even not rebalancing is better than monthly and yearly rebalancing.

If you have a very long retirement plan and use a conservative portfolio, you will be better off not rebalancing or rebalancing only when a large imbalance is present. It is logical since having a very conservative portfolio will reduce your returns. So letting the stocks got out of balance will increase your profits. As such, this will increase your chances of success.

Overall, it was very interesting to compare these rebalance strategies. I would not have expected such differences between them. I hope you will find these results are interesting as I did!

In the future, I also want to try if these conclusions hold between assets that are less different. For instance, in my portfolio, I have about 20% of Swiss stocks. Should I rebalance my stocks in retirement? I will do the simulation once I have more data.

Another thing I want to try if we can use the withdrawals to rebalance the portfolio. This would be the same thing we do during the accumulation phase but with negative numbers. Instead of investing more in the underperforming asset, we sell more of the overperforming asset.

If you have not read it already, I encourage you to learn about the Updated Results of the Trinity Study for 2019. And you can compare them with the original Trinity Study results.

If you are interested in the simulation code, you can read my article about the FIRE Calculator.

What do you think of these results? What is your strategy for rebalancing in retirement?