(Disclosure: Some of the links below may be affiliate links) In Switzerland, you can make a voluntary contribution to your second pillar. These contributions come with some tax advantages since you can deduct that from your income. Therefore, you have a return equal to your marginal tax rate. And this return is almost instant. However, the money is then blocked into the second pillar. And the returns on that blocked money have been very low in recent years. Finally, you can only withdraw the money from your second pillar if you retire, buy a house, or start a company. Many people ask whether they should contribute money to their second pillar or continue investing in stocks. In this article, I am going to answer this question. Second pillar contribution So how does a voluntary

Topics:

Mr. The Poor Swiss considers the following as important: Financial Independence, Investing, retirement, Switzerland

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

(Disclosure: Some of the links below may be affiliate links)

In Switzerland, you can make a voluntary contribution to your second pillar. These contributions come with some tax advantages since you can deduct that from your income. Therefore, you have a return equal to your marginal tax rate. And this return is almost instant.

However, the money is then blocked into the second pillar. And the returns on that blocked money have been very low in recent years. Finally, you can only withdraw the money from your second pillar if you retire, buy a house, or start a company.

Many people ask whether they should contribute money to their second pillar or continue investing in stocks.

In this article, I am going to answer this question.

Second pillar contribution

So how does a voluntary contribution to the second pillar works?

Usually, you pay each month some amount of your salary to the second pillar. And this is matched by your company. You do not have a say in this. So there is no way to optimize that.

However, you can contribute some amount yourself to cover the holes in your second pillar. If you had a low salary when you started, you are sure to have holes in your contributions. When you contribute, you can deduct it from your taxes, just like the third pillar.

How much of a reduction in taxes this will realize is challenging to calculate correctly. It depends on your marginal tax rate. The amount will depend on your income, your wealth, and where you pay your taxes. In most cases, this will be between 30% and 40%. That means that the immediate rate of return of this contribution will be 30% to 40%. We can view voluntary contributions as a form of investment.

Now, the invested money will be blocked until you can take it. In the second pillar article, we have seen only four cases when you can take this money out: building a house, starting a company, retiring, or leaving Switzerland. In those cases, you will lose out a part of the second pillar as taxes. But this is not as much as your marginal tax rate. And voluntary contributions are always locked for three years.

As long as it is inside the second pillar, your money will get some interest. Unfortunately, the interest is currently extremely low now. You can expect about 1% interest in most pension funds in Switzerland. Nevertheless, it is a safe interest for now. It cannot go down. So, you can consider the second pillar as a place to have your bond allocation.

There is a second tax advantage to the second pillar. You do not have to pay taxes on the second pillar assets. So, if you have a large net worth, you will not have to pay wealth tax on your second pillar assets.

But this is a smaller advantage than the first one. It will still reduce your taxes a little further, but where the first tax advantage can be up to 40%, the second advantage is about 1% in the best case. Nevertheless, it is still important to know that you do not pay any wealth tax on your second pillar.

Scenarios

The obvious alternative is to invest in stocks. We can check how the same sum behaves if invested in stocks or contributed to the second pillar. First of all, let’s run some scenarios to see how that works.

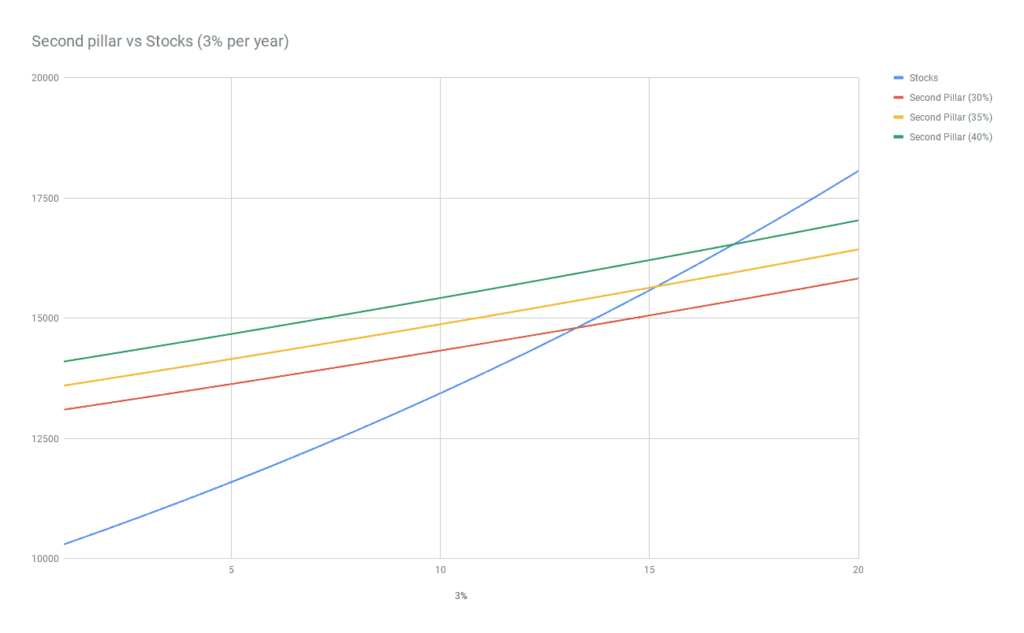

Let’s start with a return per year of 3% for the stocks. This is a very conservative estimate. For the second pillar, we will consider 30%, 35%, and 40% marginal rates. The current interest rate on most second pillars is 1%. So we will take that as the reference. Here are the results for twenty years.

As you can see, it takes 13 years for the stocks to catch with even the lowest marginal rate. And it takes about 17 years to catch with the largest marginal rate. In that case, a 3% return per year on the stock market is slow to catch up with a substantial interest as a tax deduction.

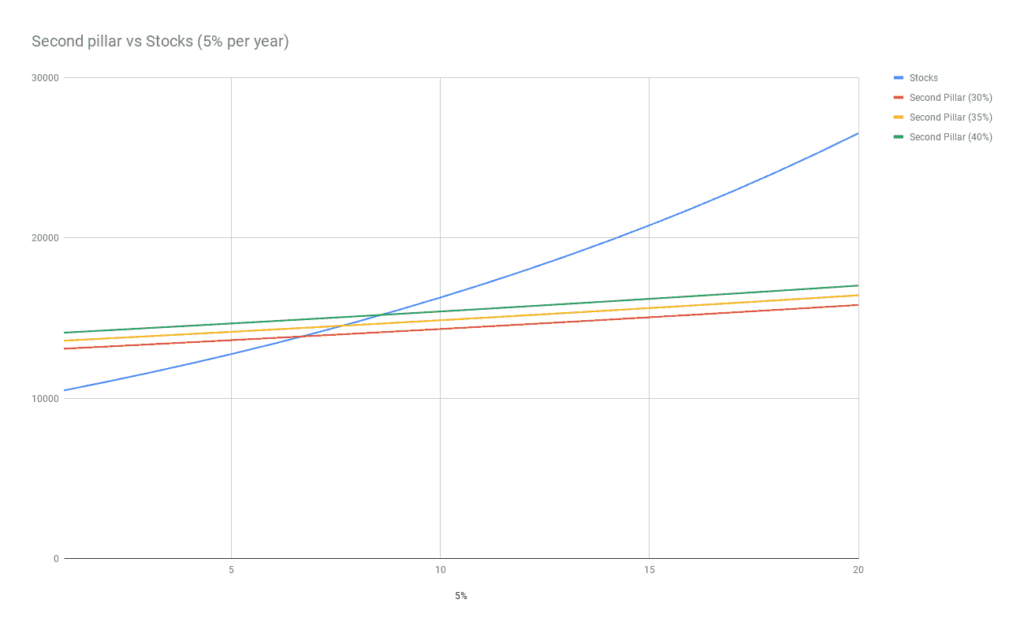

But generally, stocks are returning more than 3% per year. So let’s see what happens with a 5% return per year.

This time, it takes less than ten years for the stocks to go up as much as the second pillar. And they are ending up much higher. This exponential growth is the power of compounding. Even 5% per year can return a lot in the long term. 5% per year is what I expect from the stock market.

Obviously, in practice, you will not get 5% per year. You may get 10% one year and -20% the next year. But this is how the stock market works, and I am prepared for this. You can only expect average returns over the long term.

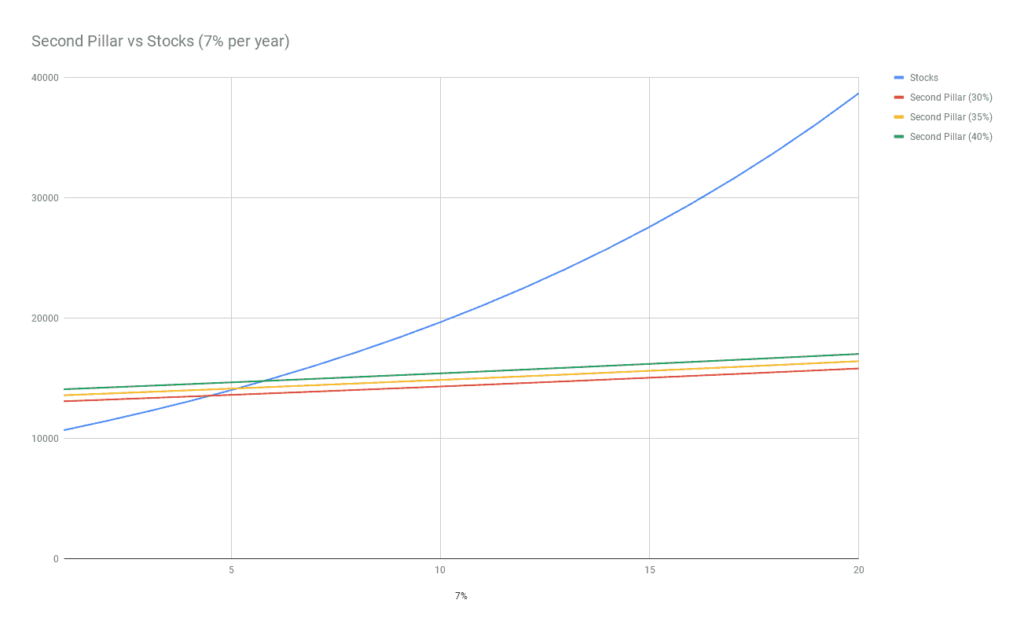

Now, some people are counting on about 7% of return per year. So, let’s see how that will go:

With 7% of stock returns per year, the return on the second pillar contributions is dwarfed. Compounding gets stronger and stronger as the returns increase. After twenty years, your stocks will be worth more than twice your second pillar contribution.

Based on this uniquely, one should probably not invest in the second pillar.

However, there are other considerations. First of all, it will depend on the term of your investing. If you are investing in the long term, it is probably better to stick with stocks. But if you are to get access to your second pillar soon, it may be a solid investment. It could be a good investment if you are going to retire soon or if you are going to build a house or start a company in the medium-term.

But, do not forget that voluntary contributions are locked for three years. So if you intend to buy a house in the next three years, you should not invest in it.

Another thing you need to take into account is whether you have a great second pillar account or not. If you have a good second pillar account invested in stocks, it will become more interesting to invest in it! But the great majority of people in Switzerland will not have access to a good second pillar.

The other consideration is whether you need bonds in your net worth or not.

Your bond allocation

Due to its safe nature and the guaranteed interest rate, I consider my second pillar as bonds. I integrate my second pillar into my net worth as bonds.

So another reason to buy into the second pillar is depending on your allocation. If your bond allocation is too low for your current allocation, you can make a voluntary contribution to increasing it. Given that it also has a nice tax advantage when you purchase, it is probably better than bonds. Especially, it is better than Swiss bonds that have a negative interest rate. If I need to buy bonds, I will contribute to my second pillar.

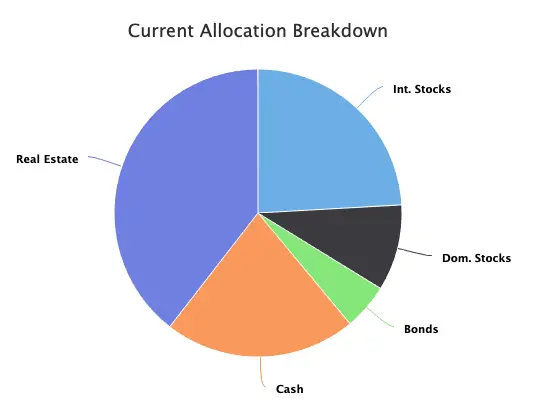

For instance, here is the allocation of my net worth at the start of 2021:

We currently have too few bonds in our portfolio. We aim for our bonds to be 10%, and it is currently 5.2%. So, it shows that we should contribute a little to our second pillar. Unfortunately, it is not a good time for us, as we will see in the next section.

Proper Timing

There are some cases where it becomes very interesting to make such contributions.

- When you know, you will retire or buy a house in the medium-term (but further than three years). Since they are a short-term investment, it is good to use them as such.

- When you know you are going to leave your company and switch to a vested benefits account. This could be the case when you are retiring early or leaving Switzerland. These accounts are often much better than second pillar funds. So it could be interesting to max out your contributions to have them invested properly.

On the other hand, there is one case where you should not contribute to your second pillar: when you do not get any tax advantage. When you withdraw money early from the second pillar (for a house or business), you will not get any tax advantage until you have paid back the withdrawn money. So, it may take you several years of normal contribution to get tax advantages again.

This is the case for us. We just withdrew money from our second pillar and cannot get any tax advantage until it is back to where it was. Even though we could profit from some bonds in our net worth, it does not make sense without the tax advantages.

These examples show that timing is important for second pillar contributions.

Conclusion

It is clear from the different scenarios from an investment point of view that contributions to the second pillar are not as good as it seems. Even though they have a substantial initial return on investment, they have very little returns per year after that.

Nevertheless, money in a second pillar is an excellent alternative to bonds. They have a guaranteed (at least for now) interest and offer an excellent tax reduction. These tax reductions are something that would be quite interesting to do as one is nearing retirement. But keep in mind that you can only contribute to your second pillar if you have a salary or have your own company.

But it is not necessarily the best investment at all times. Like every other investment, it will depend on your context and your situation. You should consider every element before you decide on any investment. And never make any rash decisions!

I may make some contributions in the future. Our income increased significantly in these past few years. This means that our marginal tax rate is getting higher and higher. It means that we could save a lot in taxes by contributing to our second pillar. Also, our current allocation to our second pillar is really low. But currently, we cannot get any tax advantages for several years. So, we will have to see the situation after this.

What do you think about this? Are you contributing to your second pillar?