(Disclosure: Some of the links below may be affiliate links) If you have decided to invest in a precise stock market index, you must first choose the stock market index. And once you have selected an index to invest in, you will have to decide through which index fund you will invest in this index. For this, you can choose either a mutual fund or an Exchange Traded Fund (ETF). For popular indexes, there will be a wide choice of index funds replicating the performance of this index. Even if you only choose popular funds for a precise index, it will still be challenging to decide. As you will see in this article, there are many things you can take into account when you compare two index funds. The most important remains the price, as most people know. But there are other points you can

Topics:

Mr. The Poor Swiss considers the following as important: Investing

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

(Disclosure: Some of the links below may be affiliate links)

If you have decided to invest in a precise stock market index, you must first choose the stock market index. And once you have selected an index to invest in, you will have to decide through which index fund you will invest in this index. For this, you can choose either a mutual fund or an Exchange Traded Fund (ETF). For popular indexes, there will be a wide choice of index funds replicating the performance of this index.

Even if you only choose popular funds for a precise index, it will still be challenging to decide. As you will see in this article, there are many things you can take into account when you compare two index funds. The most important remains the price, as most people know. But there are other points you can use to compare two index funds. And some of these points are not obvious.

In this guide, we will see all the things you can look at when you need to choose an index fund, whether it is a mutual fund or an Exchange Traded Fund (ETF).

Total Expense Ratio (TER)

The Total Expense Ratio (TER) of an index fund is probably the most important metric you need to look at! In some cases, it is simply called the Expense Ratio (ER). Since you are comparing two funds that follow the same index, the difference in returns will depend on how much fee they are charging you.

The TER is the total amount of fees removed from the fund each year to pay for the fund’s management. These fees include paying for the employees and advertisement, for instance. The TER is expressed as a percentage. This percentage is removed from the fund around the year.

When you invest passively, the only control you have over future returns is the total amount of fees you will pay. Therefore, you need to choose an index fund with a very low TER.

For instance, we can look at two index funds following the S&P 500 index:

- Vanguard S&P500 ETF (VOO): The TER is 0.04%

- SPDR S&P 500 ETF (SPY): The TER is 0.09%

If you have 100’000 USD invested and choose VOO over SPY, you will “save” 50 USD per year. 50 USD per year may not sound like much. But after 20 years at 8% yearly returns, this is more than 4000 USD that you will have saved. Therefore, based only on the TER, you should choose VOO over SPY.

In my opinion, the TER is the most important metric for comparing two different index funds. However, this is not the only metric! You need to consider many other things as well.

Assets under Management (AUM)

Many index funds are tracking the same index. Some of them are managing a lot of money, and some of them are much smaller. The amount of money one fund manages is called the Assets Under Management (AUM). This metrics gives you how much money people invested in the fund. It is an important metric to see if a fund is popular. However, it is a bit more difficult to evaluate than the TER.

Generally, a very large fund is a better choice than a tiny one. If the fund is very small, there is a risk it may end up being closed. It may also indicate that it is not popular for some other reasons. A very large fund is also probably more liquid than a smaller one.

Now, there is an exception here. If you want to track the performance of an index with small-cap companies, you may want to choose a smaller fund. The reason is that if a fund is too big, the large investments in small companies may have a significant effect on its stock price. Moreover, some small-cap funds have been known to start investing in medium-cap companies when they grew. It means you are not investing in the same thing anymore.

In any case, you should not consider absolute values. For instance, a fund managing 400 million dollars is not necessarily better than one managing 350 million dollars. However, there is something to be said when you compare a fund managing two billion dollars and one managing ten million dollars.

Now, there is a slight twist here. For many funds, you will find two numbers. For instance, if you look at VOO on Vanguard, you will find these two numbers:

- Fund total net assets: 400.7 billion USD

- Share class total net assets: 90.6 billion USD

The reason is that this fund, like many others, is available in several different share classes (ETF, Admiral shares, and Investor Shares). Therefore, the first number is the amount of all the shares of the stock. And the second number is the amount of all assets under management only for shares of the ETF itself. The total net assets is the number you are interested in.

Let’s take an example again with the Russel 3000 Index:

- iShares Russell 3000 ETF (IWV): 9.6 billion USD AUM

- Vanguard Russell 3000 ETF (VTHR): 420 million USD AUM

IWV is more than twenty times larger than VTHR. Based on only the AUM, you are better off with the IWV.

Number of stocks

Even though you may think that two index funds following the same index should have the same number of stocks, it is not always true. Therefore, an important thing to consider when comparing two index funds is the number of stocks (or holdings) of both funds.

At the time of this writing, Vanguard S&P500 ETF (VOO) has 509 stocks. It is quite counter-intuitive since it follows an index of 500 companies! It gets even worse because the S&P500 index has, in fact, 505 stocks. The reason is that some companies, such as Alphabet (Google), have several classes of shares, and the index comprises them all.

Several reasons may make an index have more or fewer stocks than its index. For instance, if the fund is too small and there are many stocks in the index, it may not yet have the opportunity to buy the smallest companies.

Since most funds are market-capitalization-weighted, there are more shares of the big companies than of the small ones. The fund will acquire the shares of the smallest companies as it grows. Another reason is that for saving money on transactions, some funds do not buy and sell all the time. Therefore, there may be some differences between the index and the fund. Finally, the managers of the fund are free to add or remove companies from the index.

Generally, you should prefer funds with a number of holdings as close as possible to the number of stocks in the index. For most indexes, there will not be much difference between funds. But if you are looking at very large indexes, you may want to pay attention to that.

Trading Volume

Another interesting thing to consider is the trading volume of each index fund you are comparing. The trading volume is the number of transactions that are done for the fund. Each time one share is sold or bought, the volume is increased by one. It is a pretty straightforward notion. Generally, a bigger fund has a bigger trading volume. However, some similar funds have a much higher volume than others.

It is important because it tells you how liquid a fund is. A large trading volume indicates that shares are easy to buy and sell for this fund. But, it also tells you that the difference between the ask price and the bid price is small. This difference is often called the bid-ask spread. The smaller the spread is, the better prices you will get when you buy and sell.

If you hold for the long-term, it is not that important. But it could be good to know that you can liquidate your shares at the best price.

For instance, we can look at the average trading for three S&P 500 funds:

- SPDR S&P 500 ETF (SPY): This fund has a trading volume of 122 million shares per day.

- iShares Core S&P 500 ETF (IVV): This fund only has 6.3 million trades average daily trading volume.

- Vanguard S&P 500 ETF (VOO): This last fund only has 4.4 million trades per day on average.

Interestingly, even though SPY is less than three times larger than VOO, it has thirty times more trading volume. Thus, it is very consistently one of the highest trading volume instruments on the stock market.

Fund Domicile

If you are in the United States, you will likely only invest in the United States. That is not to say you should not invest in indexes outside of the U.S., but you can find U.S. funds with international exposure.

In Europe, it is a bit more challenging to choose between index funds coming from different countries. If all other things are equal, the fund domicile should be taken into account. Of course, there are some cases where you will not find funds from different countries. But for popular indexes such as The S&P 500 index, there are many funds from many different countries.

For European investors, U.S. funds are generally the best. The reason is related to taxes on dividends. Investing in U.S. funds is more tax-efficient than investing in Swiss funds in Switzerland. It is only true for funds containing U.S. equities. But since half of the world stock market is in the U.S., it is more than likely that you have many U.S equities in your portfolio.

If you invest in an S&P500 fund from the U.S., 30% of the dividends will be withheld. However, you can reclaim the entirety of these dividends. It makes an effective 0% withholding tax. The next best thing is to invest in an Ireland fund where only 15% will be effectively withheld. For other countries, it will vary from 15% to 35% for Swiss investors. So if you can, you should invest in U.S. funds, and if you cannot, you should invest in Ireland funds.

There is just one caveat with U.S. funds: the U.S. estate tax. If you still hold these funds and pass away, you will have to declare your funds to the Internal Revenue Service (IRS) from the U.S. This will likely be a burden to your heirs. However, unless you have more than 11 million dollars, they should not have to pay a tax on it.

If you are opting for any non-Swiss ETFs (including U.S. ETFs), read my article on how to file your taxes with foreign ETFs.

Dividend Distribution

When you hold an index fund, you own shares from a lot of companies. Some of these companies will pay a dividend. First, the fund managers are receiving these dividends. However, in the end, the dividends are for you. Therefore, at some point, the shareholders of the fund, you, will receive these accumulated dividends.

There are two ways to do that. First, the fund can distribute the money as a dividend from the fund. Generally, funds do that quarterly. The other way is to accumulate dividends directly into the funds. That way, the fund share price will grow of the same amount of dividends you would have gotten per share. Interestingly, European fund providers use this a lo. But U.S. fund providers only use it very rarely.

In some countries, there are some tax advantages to having accumulating funds. It is not the case in Switzerland. Here, they have the same tax efficiency. Another advantage of accumulating funds is that you can save a bit on transactions because you do not have to buy shares with dividends. If you plan always to reinvest the dividends, accumulating funds may make sense.

On the other hand, distributing funds may give you some more flexibility. You will have some extra cash that you can invest in whichever fund you want. You could use that to rebalance your portfolio. This extra useful cash is the main reason why I prefer distributing funds. To learn more, this article compares accumulating funds and distributing funds.

Replication Technique

I have already talked at length about index replication in the past. First, there are two main families of replication: physical replication and synthetic replication.

Physical replication is simple. It means that the fund will hold shares of the companies in the index. Synthetic replication means they will use some derivatives to replicate the performance of the market. I do not want to go into detail about synthetic replication. I recommend you do not invest in synthetic ETFs! You should keep it simple with physical ETFs.

There are two main ways of physically replicating the index: Full Replication or sampling.

Full Replication means that the fund will hold shares from all the companies from the index. Full Replication is a simple strategy to replicate the performance of the index correctly. However, this is not always possible. For example, if the index has too many companies, it may not be efficient to hold shares of all the companies.

When it is not possible, or not efficient, to do Full Replication, index funds use sampling. In that case, they own only a part of the shares of the companies of the index. For instance, they could hold shares of 90% of the companies of the index. Sampling is not bad and is very close to what we discussed in the “Number of Stocks” section.

However, there is something different in that funds can also hold other things. Sampling funds can also contain some derivatives such as futures, contracts, and options to replicate the performance of the market. Thus, the fund managers have more freedom to do what they want.

I much prefer a Full Replication fund rather than a Sampling fund. However, if the index is really large, you may not have the choice. In that case, it is better to prefer Sampling funds with the highest number of equities from the index. That way, you will know better what the fund holds!

Tracking Difference and Tracking Error

If you want to go deep into your analysis of an Exchange Traded Fund or an index fund, you can consider the Tracking Difference and the Tracking Error as metrics to compare two different funds.

The Tracking Difference is the difference between the performance of the ETF and the performance of the index. For instance, if the index returned 10% in one year and the fund returned 8.9%, the tracking difference is 1.1%.

Many things influence the Tracking Difference. The most obvious factor is the TER. Indeed, all the fees of the fund are removing some returns. But this is not the only thing. To reduce fees, funds will only buy and sell shares a few times each year. That means that they do not always perfectly replicate the market. This can make a big difference. And the number of shares held by the fund can also make a difference.

The Tracking Error is directly related to the Tracking Difference. The Tracking Error measures the variability of the differences in returns. It is measured as the standard deviation of the daily Tracking Differences over one year.

Generally, you want the lowest Tracking Difference and Tracking Error for an ETF. Unfortunately, it is difficult to find these metrics. I have not found a website that gives me the tracking errors and tracking differences for all ETFs. If you know one, please let me know! If you want this data, you will have to look at the documents provided by the fund provider. They are generally updated every quarter with this information.

However, this is an advanced comparison. You probably will not have to go that deep in your analysis of an ETF!

Historical Fund Returns

Something that some people want to compare is the historical returns of the funds. In itself, it is not useful because this is the past, and we have no way of predicting the future.

Past Performance Is No Guarantee of Future Results

However, it is interesting to see if there is a significant difference between different funds. The past performance is highly related to the Tracking Difference of the funds. If there is a significant difference in Tracking Difference between two funds, there will also be a significant difference in returns. Most of the time, you will see a large correlation with the TER of the funds.

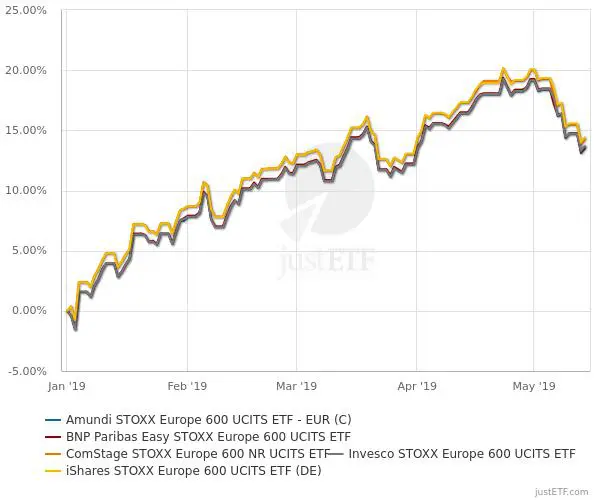

For instance, here is the graph of the performance of five ETFs for the Euro STOXX 600 index:

Two of the funds are performing significantly better than the other three. The five funds have very comparable TERs, so it is different in how they follow the index. In general, you will not have such a difference! I had to look for a while to find a good example. In the long term, these five funds do not have so much difference.

It could be useful to compare the historical returns if you are hesitant between several funds. They should be as close as possible to the index performance.

Currency Hedging

The last thing I want to mention is currency hedging. But first, you need to consider that not all funds are in the same currency. Generally, each fund is in the currency of the country the fund is from. Most S&P 500 funds are in USD, for instance. However, if you take an S&P 500 fund provided by a European fund provider, it could be in EUR. In any case, the underlying currency would always be in dollars. It is just traded in a different currency.

Let’s get back to currency hedging now. Owning a fund in foreign currency implies a currency risk. If your base currency becomes stronger, your investments in foreign currencies will lose value. And if they become weaker, you will get more. This risk is called currency risk.

In the short term, there can be a lot of variations. Some people do not want to take that risk. Therefore, they buy a fund hedged against their currency. If you buy a USD-denominated fund hedged to CHF, it will not matter if the USD or the CHF becomes stronger. Currency-hedged funds always have more fees than the equivalent unhedged fund. The hedge fee is a premium you pay to eliminate the currency risk.

There is something fundamental to know. It is not because you have an S&P 500 fund denominated in CHF that you do not have any currency risk. If the dollars go up or down, the value in CHF will vary a lot! But, as said before, the underlying currency of the S&P 500 is always the dollar. And all the companies in this index trade in dollars!

I do not invest in currency-hedged funds. I am investing in the long-term. As such, I do not believe the fees are worth it. If you invest consistently, the variations in the foreign currencies will also be averaged over time.

If you want more information, read my in-depth article about currency hedging.

Conclusion

As you can see, even after you selected an index, it remains a difficult task to pick a mutual fund or an Exchange Traded Funds (ETFs) for this index. You can take many parameters into account when you compare two funds.

You do not have to use all these parameters. Depending on the situation, you may only need to look at a few of them. Although it is a critical parameter, the TER is not the only thing you should look for in a fund. Sometimes, the cheapest fund is not the best. It may be too small or holding too many derivatives. And even if you do not need these parameters to make your choice, it is essential to know them for the funds you are investing in. It is essential to understand your investments!

Now that you know how to choose an index fund, you may want to know how to design an entire ETF Portfolio!

If you do not have a broker account yet, I recommend you try Interactive Brokers. IB is a very cheap broker with a lot of great features.

What about you? How do you choose between two funds?