(Disclosure: Some of the links below may be affiliate links) Yova is a Swiss Robo-Advisor that focuses on impact investing. The main idea is to invest to make the world better. Not only will you get good returns for your investment, but your money will work at improving the world. But how does Yova compare with other Robo-Advisor, and how much does it cost? That is what we are going to find out in this complete review of Yova. By the end of this article, you will know all the advantages and disadvantages of investing with Yova. You will also know if this service fits your personal investing needs. Keep in mind that I am not investing with Robo-Advisors. For people willing to put in the time and effort, DIY Investing is better and will save you money. But DIY Investing takes time and

Topics:

Mr. The Poor Swiss considers the following as important: Investing

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

(Disclosure: Some of the links below may be affiliate links)

Yova is a Swiss Robo-Advisor that focuses on impact investing. The main idea is to invest to make the world better. Not only will you get good returns for your investment, but your money will work at improving the world.

But how does Yova compare with other Robo-Advisor, and how much does it cost? That is what we are going to find out in this complete review of Yova.

By the end of this article, you will know all the advantages and disadvantages of investing with Yova. You will also know if this service fits your personal investing needs.

Keep in mind that I am not investing with Robo-Advisors. For people willing to put in the time and effort, DIY Investing is better and will save you money. But DIY Investing takes time and knowledge. For people not willing to invest their time and effort, investing with Robo-Advisors is the next best thing.

Yova

Yova is a Robo-Advisor that focuses uniquely on impact investing. They are targeting people that want to make the world a better place with their money. Of course, since it is an investment platform, they try to invest in profitable companies.

Yova was launched in 2017. Even though they are a young platform, they have been growing quickly and are already managing several million CHF.

It is important to note that you need at least 2000 CHF to invest with them. The reason for this is that below that level, it would not be possible to get a good diversification.

So, let’s now delve into the details of this review.

Yova Investing Strategy

They have a very different investment strategy than other Robo-Advisors. Indeed, while most Robo-Advisors invest in Exchange Traded Funds (ETFs), Yova will invest in stocks and bonds directly.

Another area in which they are different is that they are only investing in sustainable companies. Other Robo-advisors have an option for sustainable investing, but it is not their primary focus. With Yova, you will not be able to invest in other companies. So, they are only for investors that want to invest in this fashion.

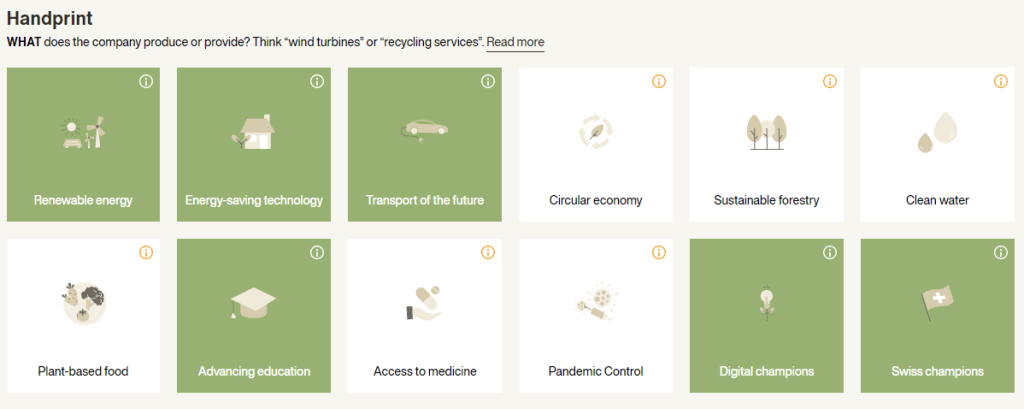

Your portfolio will be chosen based on some custom criteria based on two main factors:

- The handprint of the company: the products and services

- Renewable Energy and Clean Water, for instance.

- The footprint of the company: how they are doing business

- Gender equality and equal pay, for instance.

Each investor will have access to a personal portfolio. You will be able to choose the topics that matter to you and the things that you disagree with.

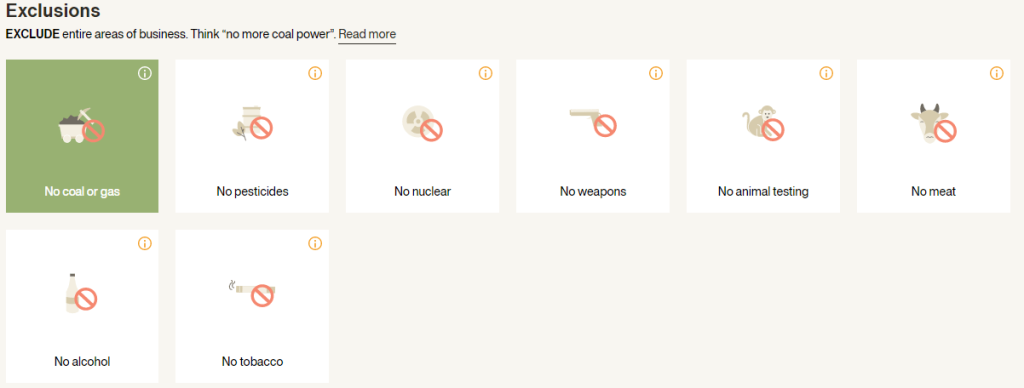

On top of that, each investor will also be able to exclude or include companies directly. All these features make Yova a highly-customizable Robo-Advisor, probably the most customizable Robo-Advisor in Switzerland.

Your asset allocation will be based on your risk profile: how long you want to invest the money and how old you are. For instance, a young investor like me could have 100% invested in stocks. On the other hand, an investor close to retirement may have only 60% of stocks (or even less). The minimum is 20% invested in stocks, and the maximum is 100%, which is great.

In the end, you will have about 40 stocks in your portfolio. These stocks will be diversified across various sectors and countries.

Overall, Yova offers an investing strategy that is very good if your focus is on sustainable investing. They are the best Robo-Advisor for this single purpose. I prefer to have more stocks for more diversification, and I prefer to invest in wider ETFs to avoid stock picking. Nevertheless, I understand the appeal of sustainable investing.

Yova Fees

Yova is different from other services in that they do not have fixed fees. The amount of fees you pay depends on how much money you invest with them.

If you have strong financial goals, investing fees are extremely important.

The investing fees at Yova are all-inclusive annual fees. So, you will pay a portion of your assets as management fees. Here are the fees based on the amount of money invested:

- Below 50’000 CHF: 1.2% annual fee

- Between 50’000 and 150’000 CHF: 1.0% annual fee

- Between 150’000 and 500’000 CHF: 0.8% annual fee

- Above 500’000 CHF: 0.6% annual fee

With a very large amount of money invested, you can get outstanding fees compared to other Robo-Advisors. However, if you do not invest much (like most people), the fees at Yova are high. For me, a 1.2% annual fee is not acceptable. Of course, you will have to decide for yourself if you are comfortable with this level of fee.

Now, there is something else crucial about these fees: the level of fees you pay only depends on how much you invested, not on your current account balance. For instance, if you invest 40’000 CHF and your account balance reaches 51’000 CHF because of good market conditions, you will continue to pay the 1.2% fee! But you will pay the fees on the total account balance (51’000 CHF). It is not fair, and it is not clear on their pricing information.

Now, there is something else I dislike about Yova pricing, and it is their comparison with other pricing. Here is how they compare themselves with other alternatives:

The first thing that irks me a little is that they compare themselves against an ETF Robo-Advisor with a 0.94% fee, which is already high for Switzerland. The cheapest I know would have a fee of 0.64%, which would be almost half as expensive as Yova. This is a common marketing strategy, i.e., to not compare against the best.

On the other hand and this irks me a lot is the comparison with an extremely expensive DIY Platform (SwissQuote). There are two major problems with this comparison.

First, they are using a very expensive platform (SwissQuote) instead of a cheaper and better one like Interactive Brokers. Using a better broker would make this go down dramatically.

The second problem is that they are comparing against ETF Robo-Advisors but not comparing against ETF DIY Investing. If we take my case, I pay about a 0.3% fee per year, all-inclusive. My fees would come down to being four times cheaper than Yova. Since I have more than 100’000 CHF invested, the fee would be down to 1.0% for me (still three times more expensive than my fees!).

I am not saying that to show off that my strategy is cheaper than Yova. I am saying that because it does not help customers! People should know that investing by themselves is less expensive than what Yova tries to show. If you want more details about such a comparison, read my article about the different levels of investing.

Overall, I think that Yova fees are not great. For low invested amounts, the fees are too high compared to a cheaper Robo-Advisor. If you have a considerable amount of money invested in Yova, the fees will be good. I also dislike the fact that only money invested can make your fees go down while they compute the fee on the full account balance. Finally, their comparison with other alternatives could have better transparency.

How to open an account with Yova?

Opening an account is a very easy process with Yova. You can start an account for free so that you can get familiar with their systems.

When you are opening an account, the first step will be to create your strategy. To define your strategies, you will have to make several decisions.

The first decision is to pick your handprint topics. At this stage, you can choose to focus your investing on particular products or services companies are using. For instance, you can choose to invest in companies working for renewable energies.

The second decision is to pick your footprint topics. You can narrow your focus on companies based on how they are operating. For instance, you can focus on companies with a low CO2 footprint.

Finally, the third decision is whether you want to exclude some categories from your portfolio. For instance, you could ban all companies focusing on nuclear energy from your portfolio.

After this crucial step, you will have to let Yova know about your risk profile. You will only have to answer four questions about that. Then, they will give your risk profile and your allocation to stocks. You can override this stock allocation if you want more or less than they are recommending.

After these steps, you will have access to your portfolio. You will get a list of 30-40 stocks that they will invest in for you. And you still have the choice to exclude some companies from the list or add companies to your portfolio.

Once you are happy with your strategy, you can continue with the registration process. At this point, you will create your account with SAXO bank (where your assets will be held), and you will fill in the regular information about yourself.

Overall, the registration process is smooth. It goes very fast, and it is great that we can start with the strategy before all the other steps. It makes it possible for people to get an idea of their portfolio before they add money to their account. And the level of customization is excellent as well.

Is investing with Yova safe?

Let’s see if investing with Yova is safe.

First, since they are not a bank, they cannot hold your assets. All your shares will be held, in your name, by SAXO Bank. Yova is only considered the asset manager. So, they can execute trades in your name, but they cannot access your funds. The cash is still protected by the general Swiss deposit protection, up to 100’000 CHF. So the portion of your assets that is not yet invested is also safe.

If Yova goes bankrupt, all your funds will be accessible, in your name, at SAXO Bank. It is a good level of safety for your assets. It is the same strategy used by almost all Robo-Advisors in Switzerland.

From a technical point of view, all communication is encrypted, which is the standard minimum these days. However, Yova does not have Two-Factor Authentication (2FA). I would not invest any significant amount of money in any service that does not offer 2FA. And if you care about online security, you should always use 2FA.

So, overall investing with Yova will be safe since they are using asset segregation. But technical security would be much better if they had second-factor authentication support.

Yova Pros

Let’s summarize the main advantages of investing with Yova:

- Highly customizable sustainable portfolio.

- Excellent focus on sustainability.

- You can invest up to 100% in stocks.

- Easy account creation.

- Low fees if you invest more than 500’000 CHF.

Yova Cons

Let’s summarize the main disadvantages of investing with Yova:

- Very high fees if you invest less than 150’000 CHF.

- The fees only go down if you invest more, not if your account balance increases.

- Lack of transparency with their pricing and marketing.

- No second-factor authentication support.

User Reviews

I wanted to see what people were saying online about Yova. Unfortunately, there are very few online reviews about this service. My favorite source of reviews, TrustPilot, has zero reviews for it. However, there are a few reviews on Google. Based on 28 reviews, they got an average grade of 4.7 stars out of 5.

Of course, this is not enough reviews to draw proper conclusions, but it is still interesting. I also looked at forums to find people’s opinions on Yova.

Overall, the positive points in the reviews are mostly about the team itself. Indeed, it seems like the team is easily approachable and very helpful. And people also greatly appreciate the level of customization that is possible in their portfolios.

On the other hand, the negative reviews were about two things:

- The very high fees of the service.

- Their heavy advertising campaign.

So, overall, users of Yova have very good reviews of the service. People not using Yova are mostly complaining about the high fees and the fact that we can invest elsewhere for much cheaper.

Yova vs Selma

Selma is a great Swiss Robo-Advisor that will let you invest simply. It is a great way to invest in the stock market without the hassle of DIY Investing.

Selma is another good Robo-Advisor in Switzerland. And Selma also has an option for Sustainable investing.

There are some major differences between these two Robo-Advisors. Indeed, Selma will invest in Exchange Traded Funds (ETFs) instead of single stocks.

When you select sustainable investing, Selma will invest in sustainable versions of its ETFs.

Now, these two versions of sustainable investing are different. Yova’s sustainable strategy goes much further than Selma‘s. With Selma, you only have the bare minimum of sustainability.

On the other hand, Selma’s fees are better than Yova’s. With Selma, you will only pay about 0.98% in fees for your portfolio. Unless you have more than 150’000 CHF, Selma is cheaper than Yova.

From an ease of use point of view, both solutions are good.

For more details, I have an in-depth comparison of Yova vs Selma.

Yova vs True Wealth

Another serious alternative is True Wealth, which also has an option for sustainable investing.

True Wealth uses the same strategy as Selma in that it invests in the ETF. So, it has the same sustainability quality as Selma. It means that regarding sustainability only, Yova is better than TrueWealth.

On the other hand, True Wealth is even cheaper than Selma and much cheaper than Yova. With sustainable investing, True Wealth only costs 0.8% per year. So, you need 150’000 CHF invested with Yova for its fees to be cheaper.

Finally, True Wealth is slightly less user-friendly, but not by a huge margin.

For more details, I have a review of True Wealth.

FAQ

What is the minimum you can invest with Yova?

You need to invest at least 2000 CHF.

How much will you pay in fees for Yova?

You will pay 1.2% of your portfolio to get it managed.

Who can invest with Selma?

Every Swiss resident that is at least 18 years old.

What happens if Yova goes bankrupt?

Your shares are stored in your name, in Saxo Bank. If the service goes bankrupt, you can get back your assets.

Conclusion

Overall, Yova is a good Robo-Advisor for investing sustainably in the future. It will let you invest very simply in the stocks and bonds of companies that have a positive impact on the future. And you will be able to customize your portfolio to your exact principles.

However, this highly sustainable investment comes at a price. The fees of Yova start at a very steep price. Below 50’000 CHF, you will pay a 1.2% fee on your assets. For me, this fee is simply too high.

Other alternatives allow you to invest sustainably in the Robo-Advisor world, and you will save on fees. Both Selma and True Wealth are significantly cheaper. And I much prefer investing in ETFs than in single stocks. Even though having about 20 to 30 stocks is enough for diversification. Using ETFs means you do not have to pick the stocks. Therefore, I prefer passive investing while Yova is more active investing.

You can save even more fees by investing yourself. Most people overestimate the complexity of investing yourself. Investing fees are very important, and there are significant differences between different investing levels.

What about you? What do you think of Yova?

Yova Review For 2020: Pros And Cons - The Poor Swiss

Yova is a good Swiss Robo-Advisor with a strong focus on impact investing. Should you use Yova for sustainable investing?

Price Currency: CHF

Operating System: Web application

Application Category: Robo-Advisor