(Disclosure: Some of the links below may be affiliate links) VIAC is an excellent company that provides the best third pillar in Switzerland. And they just entered the Vested Benefits market. It means that they can also serve the second pillar for some people. It is excellent news!VIAC Vested Benefits account offers a large allocation to stocks at a low price. On paper, it looks great. Let’s review this account in detail now.This article is in my in-depth review of VIAC Vested Benefits accounts. It is an excellent account, but it has some shortcomings. I am going to review the investment models, the fees, and the customization you can do with your portfolio.VIAC Vested BenefitsIn May 2020, VIAC announced that they were starting to offer Vested Benefits accounts. Before that, VIAC was only

Topics:

Mr. The Poor Swiss considers the following as important: retirement, Switzerland

This could be interesting, too:

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Dirk Niepelt writes “Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

(Disclosure: Some of the links below may be affiliate links)

VIAC is an excellent company that provides the best third pillar in Switzerland. And they just entered the Vested Benefits market. It means that they can also serve the second pillar for some people. It is excellent news!

VIAC Vested Benefits account offers a large allocation to stocks at a low price. On paper, it looks great. Let’s review this account in detail now.

This article is in my in-depth review of VIAC Vested Benefits accounts. It is an excellent account, but it has some shortcomings. I am going to review the investment models, the fees, and the customization you can do with your portfolio.

VIAC Vested Benefits

In May 2020, VIAC announced that they were starting to offer Vested Benefits accounts. Before that, VIAC was only offering third pillar accounts. There are offering the best third pillar account in Switzerland. Their second pillar is important to mention.

VIAC is relatively recent. It was founded in 2017. Since then, they have been growing very well. Only one and a half years after their creation, they were already managing more than 160’000 million CHF in assets.

VIAC vested benefits account follows the same philosophy as their third pillar offer. The idea is to provide high returns (with high equity allocation) with low-cost funds.

They are basing their accounts on passive funds. Since research has shown that active investing does not perform better in the long-term, it is better to invest in the broad market instead of investing in stocks directly.

Another way they use to cut the costs down is to be a digital company. They do not have banking offices (but support is available by email and phone). You will access your vested benefits account from the web interface. They will likely offer access to your account from your phone as well.

Interestingly, if you already have an account at VIAC for your third pillar, you do not have a new account! You can use the same account to manage both retirement accounts.

If you have access to vested benefits accounts, you can start investing with VIAC Vested Benefits accounts directly. It is the case for people that are not employed anymore or people that left Switzerland.

If you want more information about VIAC, I have an entire review of their third pillar offering. And I have also interviewed VIAC’s CEO.

If you need a refresh, I have an article about the second pillar.

Investment strategy

VIAC’s strategy is based on low-cost index funds! This strategy means they have great diversification and low fees. This investment model is the same that they apply to their third pillar. And it is the same philosophy I use for my investing.

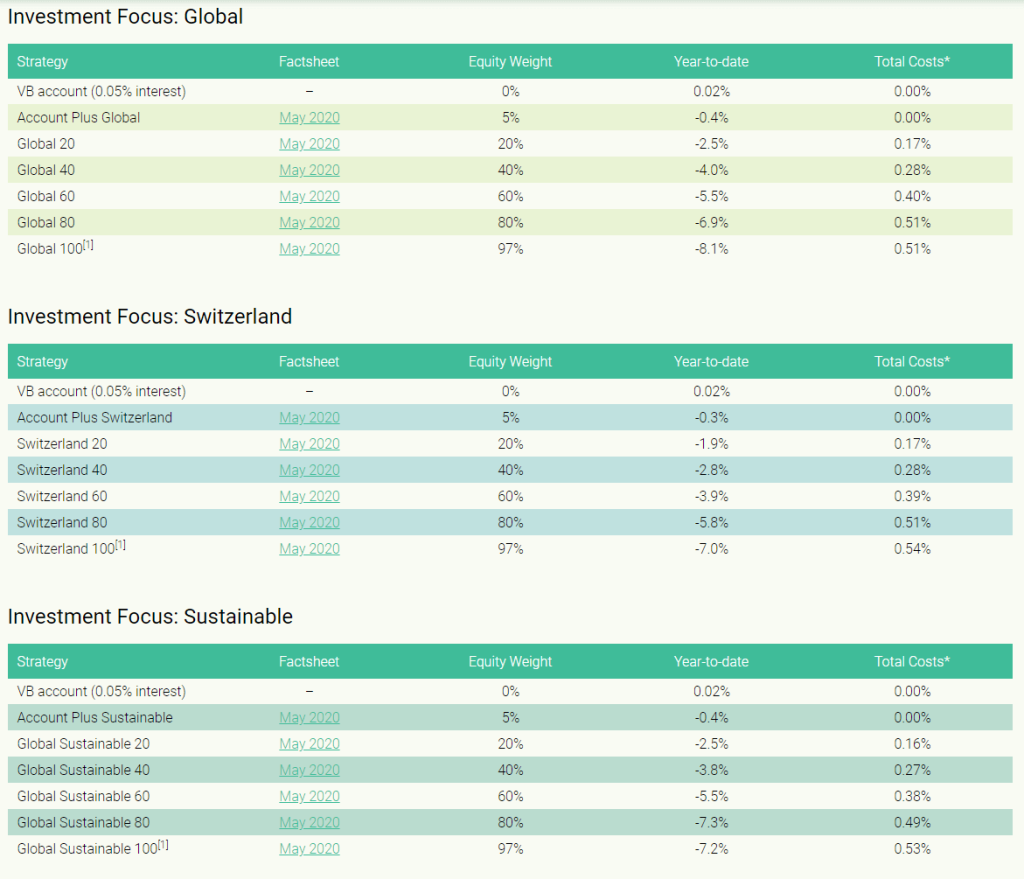

At VIAC, your vested benefits will be invested in a set of index funds. There are several available strategies. They are grouped into three categories:

- Global: Stocks from the entire world with good diversification.

- Switzerland: Stocks from Switzerland.

- Global Sustainable: Stocks from the entire world with a focus on sustainable factors.

And for each of these categories, you can choose several levels of allocation to stocks, from 0 to 97% (called 100). Here are all the strategies available:

These strategies should be enough for most people. I prefer the Global 100 strategy. It is the strategy that works best with my goals.

However, there is one significant limitation! The strategies with 97% invested in stocks are only available for the extra-mandatory part of your second pillar! The mandatory part can only be invested with up to 80% in stocks, not more. For some people, it makes sense. But for people with a long investment horizon and a good risk capacity, this is a bit disappointing.

If you want more freedom, you can choose your individual strategy. It means you can choose directly through the list of index funds. You can make the portfolio that makes the most sense to you. However, there are also some limitations:

- You need a minimum of 40% invested in CHF.

- You cannot invest more than 80% in stocks for the mandatory part of your portfolio.

- Most funds have a maximum. For instance, you can only 20% in the SMI and 17% in Real Estate. I am not sure exactly where these limits come from.

Here is an example of such a limitation:

I think customization is a bit too limited. I know that most of these limits are there by law, but I wish we could go a bit more in-depth in the customization. But, it is already great that we can customize it ourselves.

So, if you invest with VIAC Vested Benefits account, you will get a high allocation to stocks and a nice allocation to foreign shares.

Fees

Now that we have taken a look at their strategy, let’s take a look at the fees in detail.

The fees are varying based on how much stocks you have in your portfolio. The more stocks you have, the higher fee you will pay. If you do not invest in stocks, you will pay zero fees with VIAC!

However, we are more interested in strategies with very high allocations to stocks. The highest allocation to stocks of VIAC is 97%. Here are the fees for the three strategies with their maximum stock allocation:

- Global 100: 0.51% TER

- Switzerland 100: 0.54% TER

- Global Sustainable 100: 0.53% TER

So, the fees are really low! With a significant allocation to stocks, you will pay between 0.51% to 0.54%.

The fees can go down all the way to zero if you do not want to invest them.l But this is probably not what you are looking for.

On top of that, there is an extra foreign currency exchange fee. VIAC will pay 0.75% for currency exchange. Now, this does not mean you have an additional charge of this magnitude. In practice, this is reduced by their algorithm by reusing sale and buy operations. VIAC estimates this fee to be about 0.05% extra fee on average. So let’s take this estimation.

If you use your vested benefits account to buy a house, you will need to pay a 300 CHF fee. But this is the only extra fee that you will see with VIAC.

So, we need to account for a price between 0.56% and 0.59% in total per year for managing the second pillar assets. A great thing is that there is no extra fee, for instance, for transferring your portfolio to another provider or leaving Switzerland.

So, overall, the fees for the VIAC vested benefits account are excellent!

Opening a VIAC vested benefits account

Let’s take a look at how one can open a vested benefits accounts with VIAC.

A great thing is that you can do almost everything online directly from the VIAC Vested Benefits Website. From there, you can register an account. And then, they will walk through the registration. It is straightforward. If you have ever opened an online account before, you will be able to do that effortlessly. You just need to have a copy of your ID ready to go. They will also confirm your identity with your phone.

If you already have an account with VIAC for your third pillar, you can log in to your account. And from there, you can directly register for the vested benefits solution. There will be less information necessary.

In both cases, once you are done with all the information, you will get a template of a letter that you can send to your current vested benefits account (if any). That way, you can transfer your existing vested benefits funds if you desire to do so. Otherwise, you can give the displayed information to your current pension fund to transfer your assets if you are leaving the company.

Overall, it is incredibly easy to open a VIAC vested benefits account. Anybody can do it, and it will take you less than 10 minutes.

Security

The security of your money is paramount. So, we need to take a look at the security of VIAC vested benefits accounts.

VIAC is an official vested benefits provider. Therefore, they are very well regulated. Swiss Law regulates all Swiss vested benefits accounts. Also, your money is segregated from VIAC themselves. WIR Bank holds all your assets. So even if VIAC goes bankrupt, your assets are still safe in a reputable big bank.

In this case, online security needs are a bit special. From the web interface, you cannot order a transfer of money. The only thing you can do is to change your portfolio. So the worst thing that hackers can do from your account is to reduce your equities allocation and learn some personal information. It is still essential that they have good technical security. But it is not as critical as for a bank account.

The connection to the web application is encrypted. You will need a password to access your VIAC vested benefits account. When you are doing som special operation, you will need to confirm your identity with an SMS code. While this is enough security, I wish that the second-factor authentication would always be used to connect. Doing so would protect your personal information better.

For me, the security of VIAC is sufficient for a vested benefits account. I just wish a second-factor was mandatory to connect to the web application.

VIAC vs valuepension

Recently, I have done a review of the valuepension vested benefits account. valuepension is a solid contender to VIAC vested benefits account. So, it is interesting to make a small comparison between the two products. I will make a full comparison of the two products later on.

There are a few things that are different between the two vested benefits accounts.

- VIAC has a total fee between 0.56% and 0.59%, while valuepension has a fee of 0.53% to 0.55% (could be higher with some funds). So valuepension is slightly cheaper than VIAC.

- valuepension lets you invest up to 99% in stocks, while VIAC only enables you to go up to 97%.

- valuepension lets you have more exposure to foreign currencies. This extra exposure means more capacity for diversification.

- valuepension has fixed fees regardless of the amount of stock you are investing in. VIAC has lower prices if you do not invest everything into stocks.

- VIAC gives you interests on your cash allocation. On the other hand, valuepension has zero interest on the cash you have.

- valuepension is domiciled in Schwyz. It means that the withholding taxes for people leaving Switzerland and withdrawing their vested benefits account will be lower with valuepension than with VIAC. Schwyz is the state with the lowest withholding taxes.

Overall, they are both great vested benefits accounts. However, I think that valuepension offers a better account than VIAC. There is one exception. If you do not plan to invest heavily in stocks, VIAC will be better. But the main advantage of these accounts is to invest heavily in stocks. So I do not see why people would invest with VIAC with large cash allocation.

I will make a full comparison of both accounts in the future. In any case, these two accounts are significantly better than all the other vested benefits accounts I have seen.

And valuepension should release their third pillar by the end of 2020. If the third pillar from valuepension is at least as good as their second pillar offer, it should be an exciting alternative to VIAC.

Conclusion

It is excellent that VIAC started its VIAC Vested Benefits account. We need more good retirement accounts in Switzerland.

The VIAC Vested Benefits account is a great offer. You can invest heavily in stocks, for a very low fee. These two things are what matters most with retirement accounts for long-term investors.

While it is great, VIAC Vested Benefits account is not perfect. You can only invest up to 80% in stocks for the mandatory part of your second pillar. Also, the maximum exposure to foreign currencies is 60%. These limits reduce the diversification that we can reach with this account.

For these reasons, I currently think that the valuepension vested benefits account is superior to the VIAC Vested Benefits account. I will make a full comparison of these two offers later on. But it seems that you can allocate more to stocks with valuepension and have a higher global diversification.

If you want to learn about another great vested benefits account, you can read my review of the valuepension vested benefits account.