(Disclosure: Some of the links below may be affiliate links) I already compared Interactive Brokers and DEGIRO for different cases. However, I have only considered portfolio weighted towards U.S. ETF. However, for many investors in Europe, it is currently not possible to invest in such ETFs because of PRIIPs. This set of investment regulations went into action in 2018.Currently, Swiss investors can still invest in the U.S. ETF with IB. But this may not last. Once this changes, we will face the same issue as European investors. The alternative is to invest in European ETFs.The two cheapest brokers in Europe are DEGIRO and Interactive Brokers. So, if you cannot invest in U.S. ETFs, should you use DEGIRO vs Interactive Brokers?Let’s find out by comparing both using a portfolio of European

Topics:

Mr. The Poor Swiss considers the following as important: Investing

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

(Disclosure: Some of the links below may be affiliate links)

I already compared Interactive Brokers and DEGIRO for different cases. However, I have only considered portfolio weighted towards U.S. ETF. However, for many investors in Europe, it is currently not possible to invest in such ETFs because of PRIIPs. This set of investment regulations went into action in 2018.

Currently, Swiss investors can still invest in the U.S. ETF with IB. But this may not last. Once this changes, we will face the same issue as European investors. The alternative is to invest in European ETFs.

The two cheapest brokers in Europe are DEGIRO and Interactive Brokers. So, if you cannot invest in U.S. ETFs, should you use DEGIRO vs Interactive Brokers?

Let’s find out by comparing both using a portfolio of European ETFs. We are only going to compare the costs of both brokers, not the features and usability, for instance.

Investing involves risks of losses. Make sure you are aware of that before you start investing.

Our investment portfolios

For this comparison of brokers, we are going to consider two different portfolios.

Since the fees will not change, we are not interested in the exact ETFs that are being used. We are only interested in which exchange the ETFs are purchased from. For a choice of ETFs, I wrote about possible portfolios with European ETFs. To know why we have to invest in European ETFs, you can read about why we may be losing access to the superior U.S. ETFs.

The first portfolio is for a Swiss investor. This investor has 25% of his portfolio in a Swiss ETF (from the SIX stock exchange). And the rest of the portfolio is from a European ETF (from the Euronext Paris stock exchange).

Our second portfolio, for a European investor, is even more straightforward. This investor has 100% of his portfolio in European ETFs (from the Euronext Paris Stock Exchange).

In both cases, each investor is only investing once a month in one ETF. It is a perfect way to invest and with low fees. Some people are investing in every quarter. But it barely reduces fees, and it makes you keep more cash. Investing monthly is also an excellent way to build an investment habit. So monthly investments make more sense.

For these two investors, we are going to compare the prices of two brokers: DEGIRO vs Interactive Brokers. These two brokers are the cheapest available in Europe. But who is the cheapest for each scenario? Let’s find out!

DEGIRO Fees

First, we need to study the fees for each service. Let’s start with DEGIRO. DEGIRO has two different accounts: Basic and Custody. There are a few others, but they do not matter for simple investors. So, we are going to focus on these two.

The difference between the accounts is that DEGIRO can lend your shares if you have a Basic account. With a custody account, they cannot lend your shares. But you will pay some extra fees.

Regardless of which account you use, you will have to pay a connectivity fee of 2.5 EUR (2.68 CHF) per year, and per stock exchange on which you own shares. If you have an ETF on SIX and one on Euronext Paris, you will pay 5 EUR per year.

If you convert currency on your account, you will pay a fee of 0.10%. It can quickly become expensive once you invest a large amount of money. This will happen if your base currency is CHF and you have to buy an ETF in EUR.

The fee system of DEGIRO is pretty simple. Unfortunately, it is slightly different for each country. I wish DEGIRO had the same prices regardless of which country you come from.

Basic Account

With DEGIRO Basic, a Swiss investor will pay 2 EUR (2.15 CHF) and 0.03% of the transaction value for each purchase of a Swiss ETF. And the price is also the same (2 EUR (2.15 CHF) and 0.03%) for a European ETF.

Now, for the European investor case, I am going to take the example of DEGIRO France. The fees are a bit dit different from country to country. So, if you are not in France, you can check out the fees on your DEGIRO website.

This investor will pay 2 EUR and 0.02% for each purchase of a European ETF. It would be the same price for a Swiss ETF. But European investors are unlikely to invest in Swiss ETFs. Interestingly, this is slightly cheaper than investing for a Swiss investor.

Custody Account

With DEGIRO custody, the transaction fees are the same as for Basic. But you will have to pay a fee when you receive a dividend. For each dividend, you will pay 1 EUR and 3% of the dividends. In our simulation, we are going to simulate a 1.8% dividend yield and quarterly dividends.

Interactive Brokers Fees

Now, we also have to study the fees for Interactive Brokers. They do not have two account types, but they do have two fee systems: Fixed and Tiered. So we are going to compare these two. Other than the prices, there are no other differences between the two pricing systems.

Regardless of where you live, you will pay the same fees. This makes the fees bit simpler.

For both account types, you will have to pay custody fees if you have less than 100’000 USD in your account. In that case, you will have to pay 10 USD (10 CHF) each month. If you pay some transaction fees this month, you will pay fewer custody fees. For instance, if you pay 1 USD in fee, you will only pay 9 USD in custody fees. If you pay 9 USD in fee, you will only pay 1 USD in custody fees.

For both account types, you will pay 2 USD (2 CHF) for currency exchange. The Swiss investor will have to exchange some CHF into EUR to buy European ETFs.

Fixed Pricing

The Interactive Brokers Fixed pricing is extremely simple.

For buying an ETF on the Swiss Stock Exchange, you will pay 0.10% of the total transaction. The minimum fee is 10 CHF. There is no maximum fee.

For purchasing an ETF on the European Stock Exchange, you will pay 0.10% as well. But the minimum fee is only 4 EUR (4.28 CHF), and the maximum is 29 EUR (31.05 CHF).

Tiered Pricing

The Interactive Brokers Tiered system is incredibly more complicated.

First, for each region, you will have to pay some transaction fees to IB. Then, based on the stock exchange, you will have to pay some fees. And they are entirely different based on which exchange.

For buying an ETF on the Swiss Stock Exchange (I took EBS), you will pay 0.05% in transaction fees to IB (with a minimum of 1.5 CHF and a maximum of 49 CHF). You will then pay a flat fee of 1.5 CHF for the exchange and an exchange fee of 0.02%. On top of that, you will pay a 0.55 CHF clearing fee and 1 CHF trade reporting fee.

For buying an ETF on the European Stock Exchange (Euronext Paris), you will pay 0.05% in IB transaction fees with a minimum of 1.25 EUR (1.34 CHF) and a maximum of 29 EUR (31.06 CHF). You will pay 0.01% exchange fee (with a minimum of 0.8 EUR). And the clearing fee will be 0.1 EUR.

We can observe that it is much cheaper to trade on Euronext than on SIX. Switzerland does have a reputation for being expensive!

As you can see, this is much more complicated than the Fixed system. But you do not have to worry about all of this. I will do the math for you!

Swiss Investor – Portfolio Swiss / Europe

Let’s start with our Swiss portfolio, with 25% of a Swiss ETF and 75% of a European ETF. In this case, our example investor will invest once every four months in the Swiss ETF and the other months in the European ETF. The Swiss Investor will have CHF as its base currency. It means that buying the European ETF will incur a currency conversion.

It is the kind of portfolio that most Swiss invest in. If you do not want a Swiss ETF, skip over to the next section for a full Europe ETF Portfolio. However, the next section will be based on the EUR as a base currency.

For this Swiss investor, we are going to compare DEGIRO vs Interactive Brokers for several scenarios.

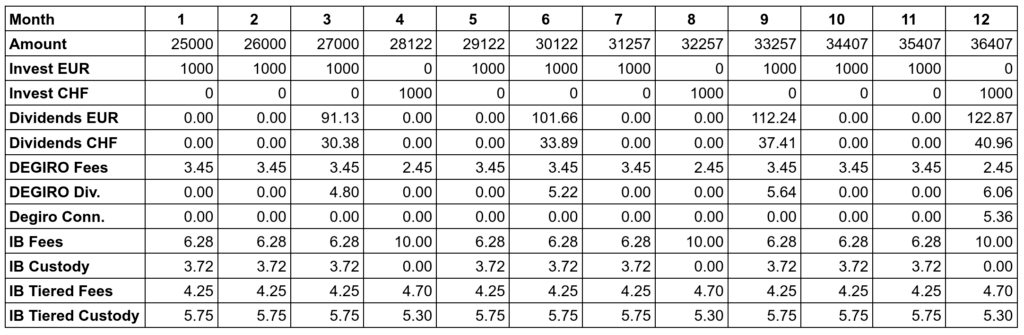

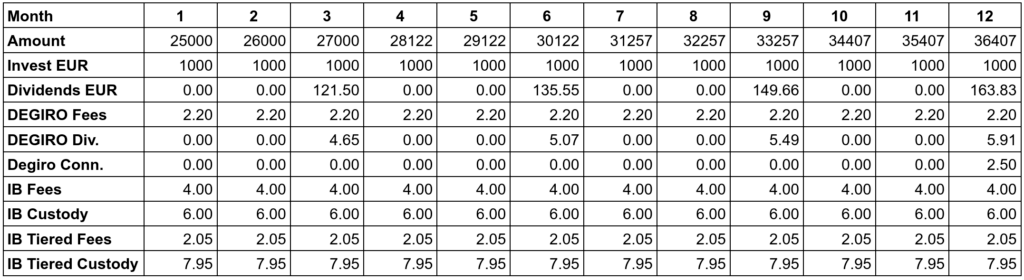

Starting investor

Our first scenario is with a person starting investing. The investor begins with 25’000 CHF and invests 1000 CHF every month. It is a typical scenario for a person just starting investing in the stock market. But this is only an example, there is no problem starting with zero CHF.

Here are the detailed results of this scenario:

And here are the total fees for each broker account:

- DEGIRO Basic: 43.76 CHF

- DEGIRO Custody: 65.48 CHF

- Interactive Brokers Fixed: 120 CHF

- Interactive Brokers Tiered: 120 CHF

In this case, because of the custody fees, Interactive Brokers is significantly more expensive than DEGIRO. And we can see that even for a small portfolio, the Basic account of DEGIRO is already considerably cheaper than the Custody account.

So, in this particular case, DEGIRO Basic is the best choice.

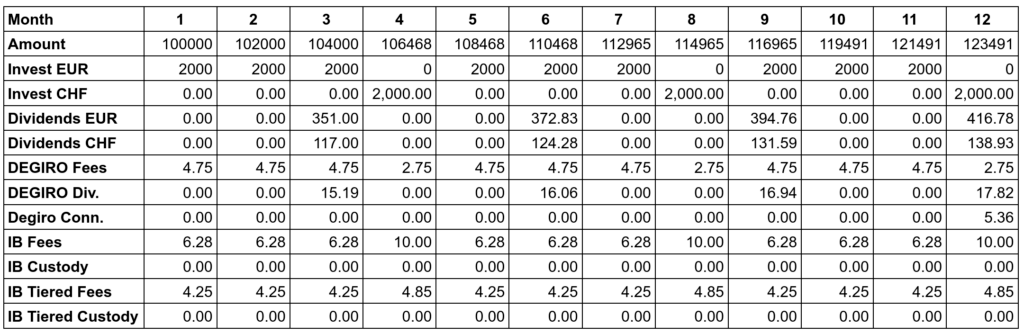

Standard Investor I

For the second scenario, we can take an investor with 100’000 CHF and investing in 2000 CHF every month. After a few years of investing (or less), this is the state that many investors will reach.

This scenario yields the following results for the different brokers:

And here are again the total fees for each broker account:

- DEGIRO Basic: 56 CHF

- DEGIRO Custody: 122 CHF

- Interactive Brokers Fixed: 87 CHF

- Interactive Brokers Tiered: 53 CHF

In this scenario, the Tiered account of Interactive Brokers become the cheapest option. Once you pass the minimum of 100’000 CHF, Interactive Brokers become very competitive. We can also observe that the Custody account of DEGIRO starts to become expensive because we get more dividends.

So, in this particular case, Interactive Brokers Tiered is the best choice. However, it is only marginally cheaper than DEGIRO Basic. Both are excellent choices for this scenario.

Standard Investor II

Let’s see what happens if we invest in 5000 CHF every month instead of 2000 CHF. It is still a typical investing case.

This scenario would give us the following totals:

- DEGIRO Basic: 94 CHF

- DEGIRO Custody: 171 CHF

- Interactive Brokers Fixed: 93 CHF

- Interactive Brokers Tiered: 68 CHF

We can see that Interactive Brokers is still the best option here. But we can also see that the gap between Tiered and Fixed pricing is not that big anymore. DEGIRO Basic starts to get more expensive because of the currency exchange fees. And the Custody account is starting to get expensive because of the fees on dividends.

Once again, in this particular case, Interactive Brokers Tiered would be the best choice.

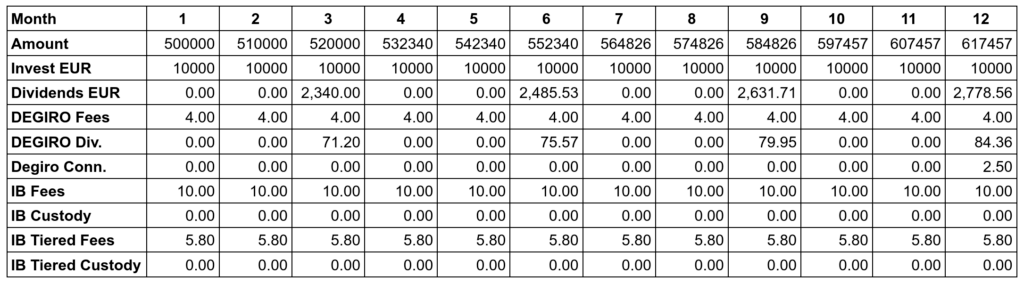

Advanced Investor

Let’s check the last scenario for our Swiss investor. This time, our investor has 500’000 CHF and is investing 10’000 CHF every month. This is not a typical scenario since this is a lot of money. But this is still possible.

We get the following totals from this case:

- DEGIRO Basic: 157 CHF

- DEGIRO Custody: 469 CHF

- Interactive Brokers Fixed: 138 CHF

- Interactive Brokers Tiered: 100 CHF

Not a lot of things have changed in this scenario. We can note that the gaps between the different options are increasing. The Tiered account is still the best option. DEGIRO Basic is now more expensive than Interactive Brokers Fixed. Custody is too costly now, about three times more expensive than DEGIRO Basic.

In this case, Interactive Brokers Tiered is the cheapest option. But when you invest 10’000 CHF per month, the difference with DEGIRO Basic is very small!

Conclusion Swiss Investor

We can draw several conclusions for Swiss investors:

- When you have more than 100’000 CHF, Interactive Brokers Tiered is the cheapest account if you invest more than 2000 CHF per month.

- The difference between Interactive Brokers Tiered and DEGIRO Basic is quite small.

- For a smaller portfolio or smaller monthly investment, DEGIRO Basic is the cheapest option.

- DEGIRO Custody account starts to be expensive once your portfolio increases and generates more dividends. You may want to consider using Interactive Brokers if you do not want your broker to lend your shares.

- Most of the fees of DEGIRO are coming from the currency exchanges.

European Investor – Europe Only ETF Portfolio

If you live in Europe, you will likely have a portfolio with only European ETFs.

In this case, the example investor will invest every month in a European ETF. It is a simple scenario. Since a European investor will have euros, it will not need any currency conversion in this scenario. It will make a significant difference!

This should be the case for most European Investors except for Swiss investors. It could also be different for people from the United Kingdom since they do not have euros.

Some of the prices from DEGIRO vary from country to country. For this example, I took the prices from France. It changes the fees for ETF to 2 EUR and 0.02% instead of 2 EUR and 0.03%. With Interactive Brokers, there are no differences based on where you come from.

For this European investor, we are going to compare DEGIRO vs Interactive Brokers for the same scenarios as before.

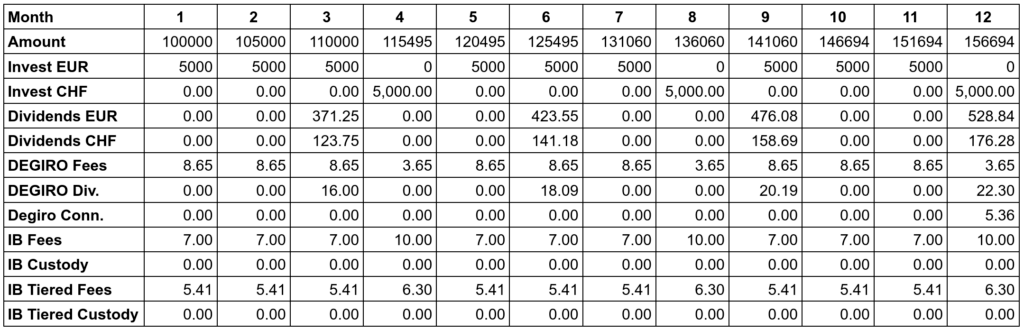

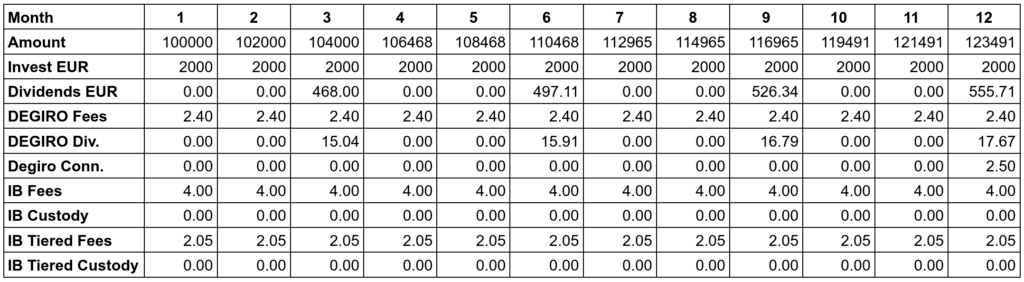

Starting investor

Our first scenario is for a person starting investing. The investor begins with 25’000 EUR and invests 1000 EUR every month. This is a typical scenario for a European just starting investing in the stock market.

Here are the detailed results of this scenario:

And here are the total fees for each broker account:

- DEGIRO Basic: 29 EUR

- DEGIRO Custody: 50 EUR

- Interactive Brokers Fixed: 120 USD (109 EUR)

- Interactive Brokers Tiered: 120 USD (109 EUR)

Once again, for a starting investor, the custody fees of Interactive Brokers make it a bad option. For starting, the best option is the DEGIRO Basic option. For a small portfolio, the Custody fees of DEGIRO are not very expensive yet. But of course, the goal should be to grow the portfolio. Hence, you will eventually reach 100’000 USD.

So, in this particular case, DEGIRO Basic is the best option.

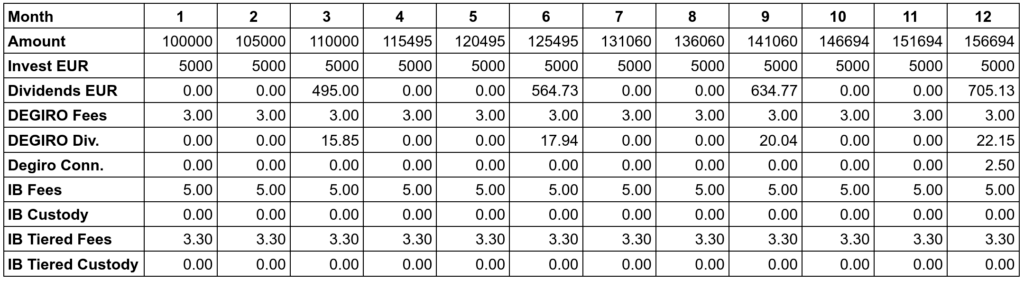

Standard investor I

Our second scenario is with a person in the second stage of investing. The investor already has a portfolio of 100’000 EUR. This standard investor invests 2000 EUR each month.

Here are the detailed results for this scenario:

And here are the total fees for each broker account:

- DEGIRO Basic: 31 EUR

- DEGIRO Custody: 97 EUR

- Interactive Brokers Fixed: 48 EUR

- Interactive Brokers Tiered: 25 EUR

Now that we reached the limit for Interactive Brokers, it becomes a very interesting option. The Interactive Brokers Tiered account is now the cheapest. But there is only a minimal difference with DEGIRO Basic. On the other hand, the DEGIRO Custody account is starting to become more expensive.

For this particular case, Interactive Brokers Tiered is the best option, which DEGIRO Basic a very close second.

Standard Investor II

Let’s see what would happen if this standard investor would invest 5000 EUR per month instead of 1000 EUR.

This would give us the following fees per broker account:

- DEGIRO Basic: 39 EUR

- DEGIRO Custody: 114 EUR

- Interactive Brokers Fixed: 60 EUR

- Interactive Brokers Tiered: 40 EUR

With only 1 EUR difference, both DEGIRO Basic and Interactive Brokers Tiered are excellent options. Even Interactive Brokers Fixed remains a very fair price. However, DEGIRO Custody is now almost three times more expensive.

For this particular case, DEGIRO Basic is the best option, very closely followed by Interactive Brokers Tiered account.

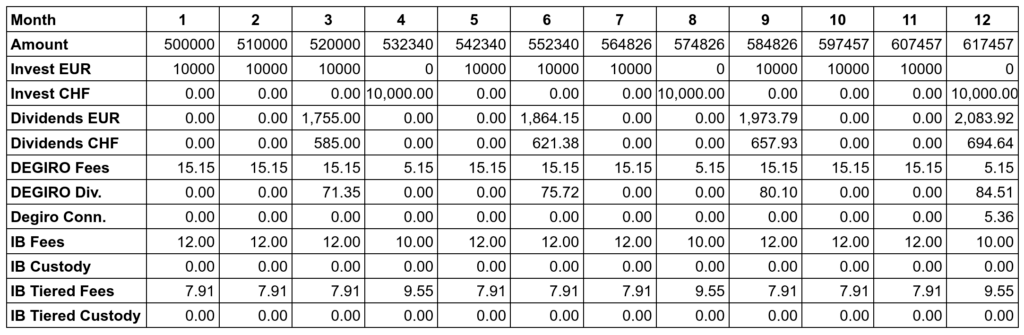

Advanced Investor

Let’s check the final scenario for our European investor. This time, our investor has 500’000 EUR and is investing 10’000 EUR every month. It is not a typical scenario since this is a lot of money. But this is still possible for dedicated investors or high-income earners.

This scenario would give us these detailed results:

Here are the prices for each broker account:

- DEGIRO Basic: 51 EUR

- DEGIRO Custody: 362 EUR

- Interactive Brokers Fixed: 120 EUR

- Interactive Brokers Tiered: 70 EUR

This time, DEGIRO Basic is the winner. It increased very little compared to the previous scenario. On the other hand, DEGIRO Custody is becoming too expensive.

In this last case, DEGIRO Basic is the best option.

Conclusion European Investor

We can draw several conclusions for European investors:

- DEGIRO Basic is the cheapest account unless you invest less than 2000 EUR per month.

- Interactive Brokers Tiered is a very cheap option as well if you have more than 100’000 EUR.

- DEGIRO Custody account starts to be expensive once your portfolio increases and generates more dividends. You may want to consider using Interactive Brokers if you do not want your broker to lend your shares.

- Investing without currency exchanges can save a lot of money.

Conclusion

There you have it! We now know the cheapest option between DEGIRO vs Interactive Brokers for several scenarios. Interestingly, both broker accounts are competitive.

We can draw a few conclusions from this comparison:

- For a Swiss Investor, Interactive Brokers Tiered should be the cheapest broker.

- For a European Investor, DEGIRO Basic should be the cheapest broker option.

- There is very little difference in prices between DEGIRO Basic and Interactive Brokers Tiered.

- DEGIRO Custody is quickly becoming expensive as your portfolio grows in size.

- People should not worry too much about the custody fees at Interactive Brokers. For a serious investor, 100K USD should not be too difficult to reach.

So which should you choose? If your base currency is euros and you plan to invest in ETFs from European stock exchanges, you should go with DEGIRO Basic. If your base currency is Swiss francs and you plan to invest in a mix of European and Swiss ETFs, you should go with Interactive Brokers Tiered account.

If you do not know where to start, you can learn about how to start investing in the stock market.

If you are still investing in U.S. ETF, you may want to check my comparison of brokers for a portfolio with U.S. ETFs.

What about you? Which broker do you use?