Investec Switzerland. The Swiss Market Index is set to finish the week slightly higher as investors digest second quarter earnings reports and central bank policy announcements. © Taina Sohlman | Dreamstime.com Global financial markets showed resilience this week following the failed coup attempt in Turkey over the weekend. Second quarter earnings proved to be the main drive of sentiment with shares from Europe to the US fluctuating as investors watched earnings releases closely for evidence of stronger economic growth. Government bond yields rose this week after the European Central Bank kept policy changes on hold despite signaling that fresh stimulus was likely in the coming months if the economic environment continues to deteriorate. The Bank of Japan and US Federal Reserve are due to release policy statements next week. In Switzerland the Credit Suisse ZEW indicator, which gauges financial analysts’ expectations for the domestic economy for the next six months, fell 13.5 points in July suggesting that financial experts no longer expect a speedy improvement for the Swiss economy. Analyst’s blamed the pro-Brexit vote in the UK for the negative outlook for the entire European region. In company news, several Swiss companies published their second quarter earnings this week.

Topics:

Investec considers the following as important: ABB, Business & Economy, Editor's Choice, Swatch, Switzerland Brexit

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

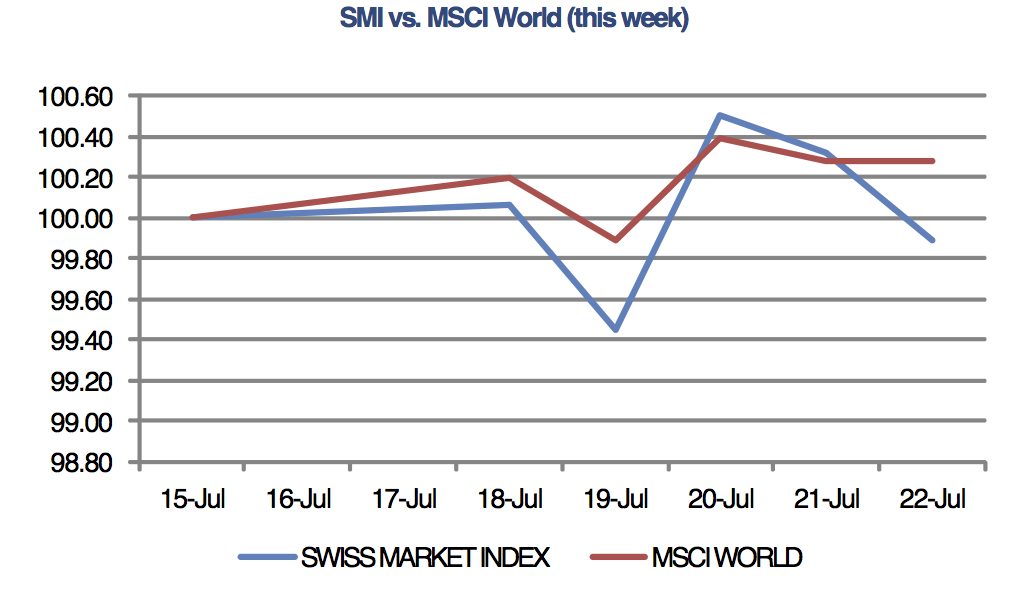

The Swiss Market Index is set to finish the week slightly higher as investors digest second quarter earnings reports and central bank policy announcements.

© Taina Sohlman | Dreamstime.com

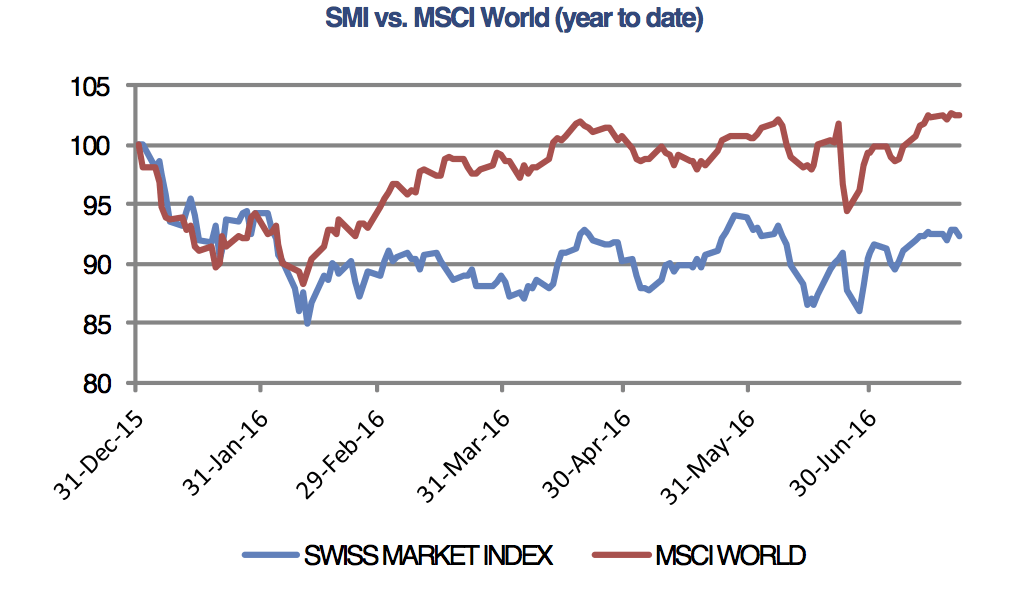

Global financial markets showed resilience this week following the failed coup attempt in Turkey over the weekend. Second quarter earnings proved to be the main drive of sentiment with shares from Europe to the US fluctuating as investors watched earnings releases closely for evidence of stronger economic growth.

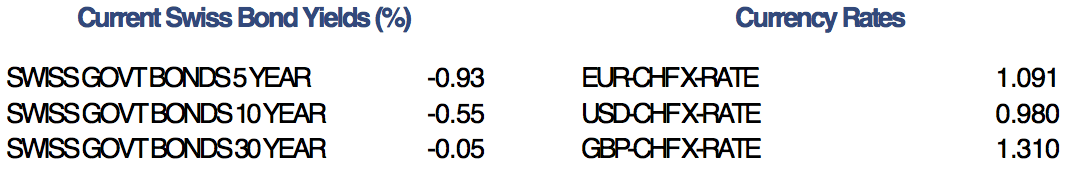

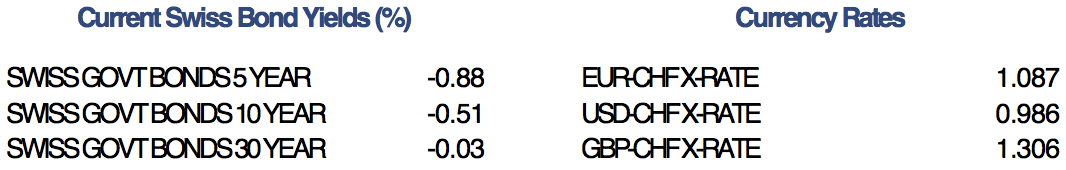

Government bond yields rose this week after the European Central Bank kept policy changes on hold despite signaling that fresh stimulus was likely in the coming months if the economic environment continues to deteriorate. The Bank of Japan and US Federal Reserve are due to release policy statements next week.

In Switzerland the Credit Suisse ZEW indicator, which gauges financial analysts’ expectations for the domestic economy for the next six months, fell 13.5 points in July suggesting that financial experts no longer expect a speedy improvement for the Swiss economy. Analyst’s blamed the pro-Brexit vote in the UK for the negative outlook for the entire European region.

In company news, several Swiss companies published their second quarter earnings this week. Roche and ABB surprised on the positive side, Novartis reported a mixed bag and Swatch, struggling with falling global sales, announced that operating profit declined 54% to 353 million francs.