Investec Switzerland. The SMI is set to finish lower this week (-1.83%), underperforming the MSCI World (+1.03% ) as US stocks gained after the Federal Reserve scaled back expectations for the path of interest-rate increases on Wednesday. © Katsiaryna Pakhomava | Dreamstime.com Stocks around the world gained mid-week after Yellen and the Federal Open Market Committee (FOMC) left rates on hold and indicated that fewer rate rises will occur this year due to sluggish global growth. On Thursday, the Swiss National Bank, the Bank of England and Norges Bank, the central bank of Norway, followed suit and held rates at current levels. The week’s biggest gains from the more dovish interest rate mood were achieved in Emerging Market stocks, with the MSCI Emerging Markets Index heading for its highest close since December as stocks of energy exporters from Saudi Arabia to South Africa rallied. Switzerland’s central bank held interest rates at a record low as expected and repeated its intention to intervene in currency markets if needed to prevent the Swiss franc from further strength. The Swiss National Bank cut both its growth and inflation forecast for 2016 and now sees prices dropping 0.8% this year.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, SMI. Investec Switzerland

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

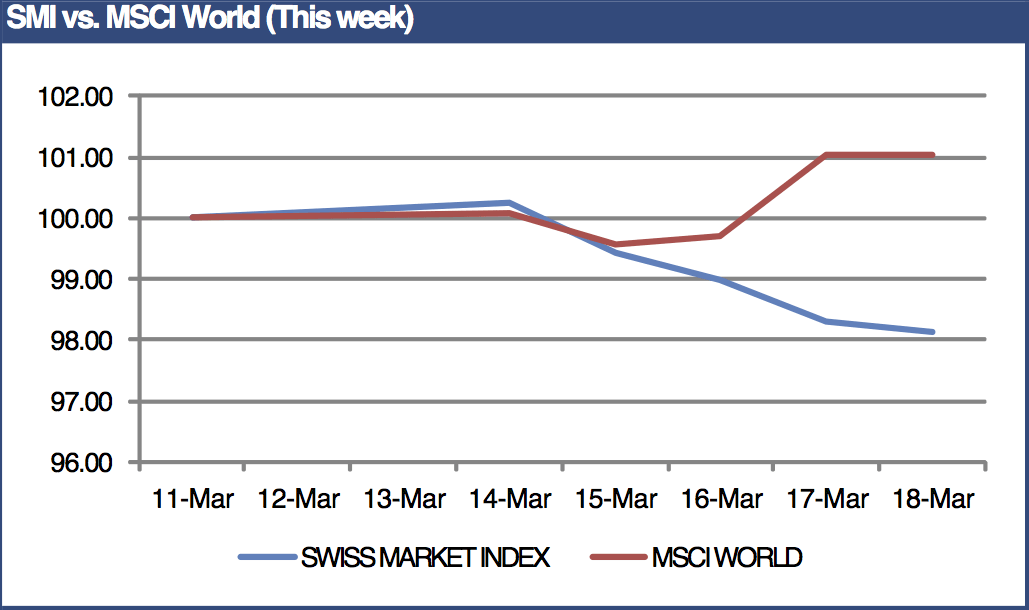

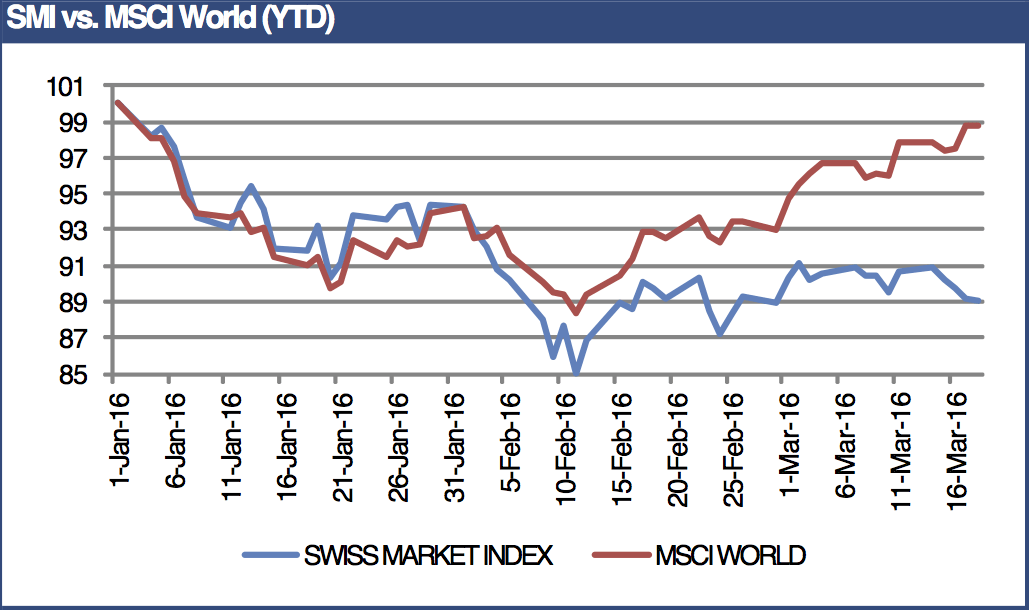

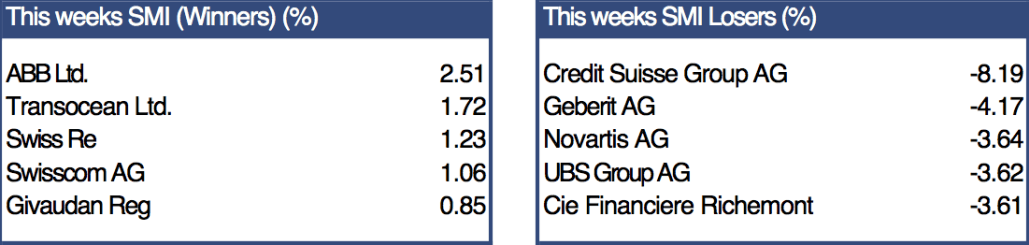

The SMI is set to finish lower this week (-1.83%), underperforming the MSCI World (+1.03% ) as US stocks gained after the Federal Reserve scaled back expectations for the path of interest-rate increases on Wednesday.

© Katsiaryna Pakhomava | Dreamstime.com

Stocks around the world gained mid-week after Yellen and the Federal Open Market Committee (FOMC) left rates on hold and indicated that fewer rate rises will occur this year due to sluggish global growth. On Thursday, the Swiss National Bank, the Bank of England and Norges Bank, the central bank of Norway, followed suit and held rates at current levels. The week’s biggest gains from the more dovish interest rate mood were achieved in Emerging Market stocks, with the MSCI Emerging Markets Index heading for its highest close since December as stocks of energy exporters from Saudi Arabia to South Africa rallied.

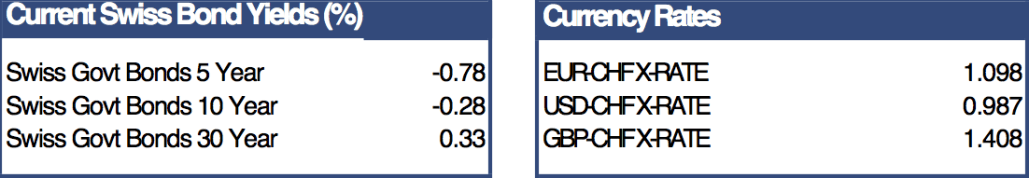

Switzerland’s central bank held interest rates at a record low as expected and repeated its intention to intervene in currency markets if needed to prevent the Swiss franc from further strength. The Swiss National Bank cut both its growth and inflation forecast for 2016 and now sees prices dropping 0.8% this year. In keeping rates on hold, SNB Head Thomas Jordan breaks with colleagues at the European Central Bank and the Bank of Japan, who have made policy changes already this year to stimulate inflation. After the additional stimulus announced by the ECB last week failed to have much impact on the franc versus the euro, the SNB could afford to hold off on any further policy decision.

In company news, LafargeHolcim reported their first full 2015 annual results since the merger of Holcim and Lafarge in July 2015. The firm’s full-year profit was in line with analyst’s estimates. The world’s largest cement maker said that it expects demand to grow overall in 2016 even as a slowdown in some emerging market economies like India and Brazil hurt earnings last year.