Investec Switzerland. The SMI is set to finish the week (-1.43%) lower, underperforming global equity markets (+1.50%), which were buoyed after US Fed Chair Janet Yellen said on Tuesday that slackening global growth called for a gradual approach to raising rates. With a negative performance of -13.2% year to date, the Swiss index is among the world’s worst performers tumbling almost twice as much as the STOXX Europe 600 Index in the year 2016. The curse lies in the safe haven characteristics of the SMI’s constituents. SMI index heavyweights, such as food Company Nestlé, drug-makers Roche and Novartis, make up more than 50% of the index and are seen as defensive stocks by investors. However, the recent market rebound has favoured economically sensitive stocks such as miners and energy firms, over the more defensive Swiss shares. © Wavebreakmedia Ltd | Dreamstime.com Even with the lowest valuations in more than a year relative to global shares, investors have not been tempted back to buying Swiss equities. One of the reasons may be the outlook for the health care sector. Pharmaceuticals was among the worst performing sectors in 2016 on a global basis, as the US presidential primaries brought uncertainties for drug makers. In particular, Democrat front-runner Hillary Clinton has begun a campaign against high drug prices.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

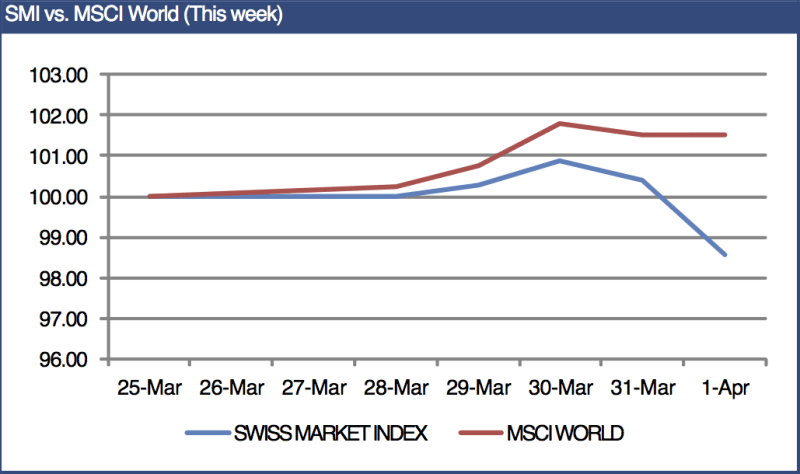

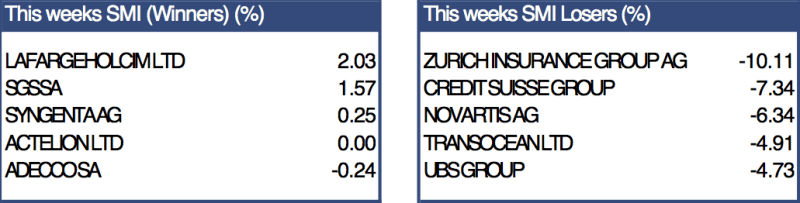

The SMI is set to finish the week (-1.43%) lower, underperforming global equity markets (+1.50%), which were buoyed after US Fed Chair Janet Yellen said on Tuesday that slackening global growth called for a gradual approach to raising rates.

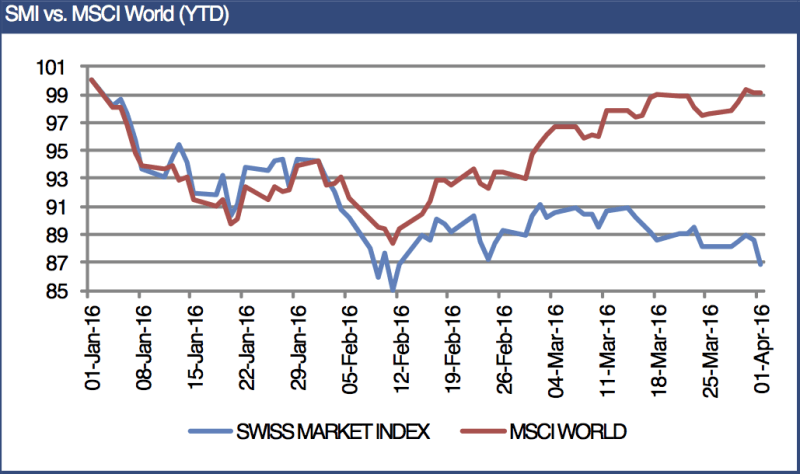

With a negative performance of -13.2% year to date, the Swiss index is among the world’s worst performers tumbling almost twice as much as the STOXX Europe 600 Index in the year 2016. The curse lies in the safe haven characteristics of the SMI’s constituents. SMI index heavyweights, such as food Company Nestlé, drug-makers Roche and Novartis, make up more than 50% of the index and are seen as defensive stocks by investors. However, the recent market rebound has favoured economically sensitive stocks such as miners and energy firms, over the more defensive Swiss shares.

© Wavebreakmedia Ltd | Dreamstime.com

Even with the lowest valuations in more than a year relative to global shares, investors have not been tempted back to buying Swiss equities. One of the reasons may be the outlook for the health care sector. Pharmaceuticals was among the worst performing sectors in 2016 on a global basis, as the US presidential primaries brought uncertainties for drug makers. In particular, Democrat front-runner Hillary Clinton has begun a campaign against high drug prices.

In economic data, the KOF Economic Barometer looks like it could stay above the long-term average of 102.5 points, compared to 102.6 points in February. Positive signals came mainly from private consumption, while the indicators for the manufacturing sector and export related indicators were negative. Indicators for the construction and financial sectors showed only minimal changes and the hospitality industry was almost unchanged. Positive signals from private consumption were confirmed by the UBS consumption indicator. The index rose on the back of continued strong demand for automobiles, which increased 1.2% year on year in February.

In company news, Credit Suisse was one of the leading decliners after the company said that managers became aware of trading positions that forced the bank to take almost $1 billion of write-downs. Chairman Urs Rohner said that there were no blind spots, when asked about the matter at a conference in Zurich on Thursday.