Investec Switzerland. The Swiss Market Index along with global stocks are trading flat this week ahead of Federal Reserve’s Janet Yellen’s Friday speech at the central bank’s annual Jackson Hole Summit. All eyes on Jackson Hole – © Dan Bannister | Dreamstime.com The Federal Chairwoman’s speech at the meeting of central bank governors in Wyoming is expected to provide clues about when to expect the next rise in US interest rates. While it is unlikely that Janet Yellen will signal the exact timing of US rate hikes, her comments could have an impact on financial markets depending on whether a September, December or 2017 hike is implied. Earlier this week, Federal Reserve’s Vice Chair Stanley Fischer said that the US economy is nearing the Fed’s goals and the job market is near full strength, adding to speculation that a rate increase is due. In Switzerland, pharma giants Roche and Novartis were amongst the week’s biggest losers after Hillary Clinton criticized drug pricing on Wednesday. The Democratic presidential nominee’s has repeatedly attacked aggressive pricing within the pharmaceutical sector and has proposed reforms to force pharmaceutical companies to spend more on research, ban direct-to-consumer advertising for prescription drugs and cap costs for medications.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland, Swiss Shares

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

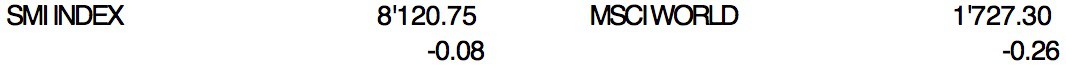

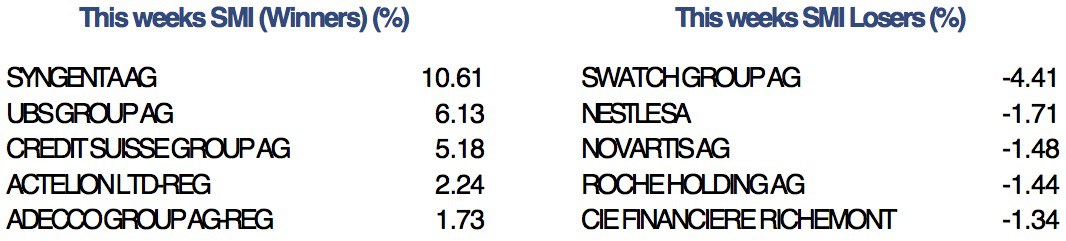

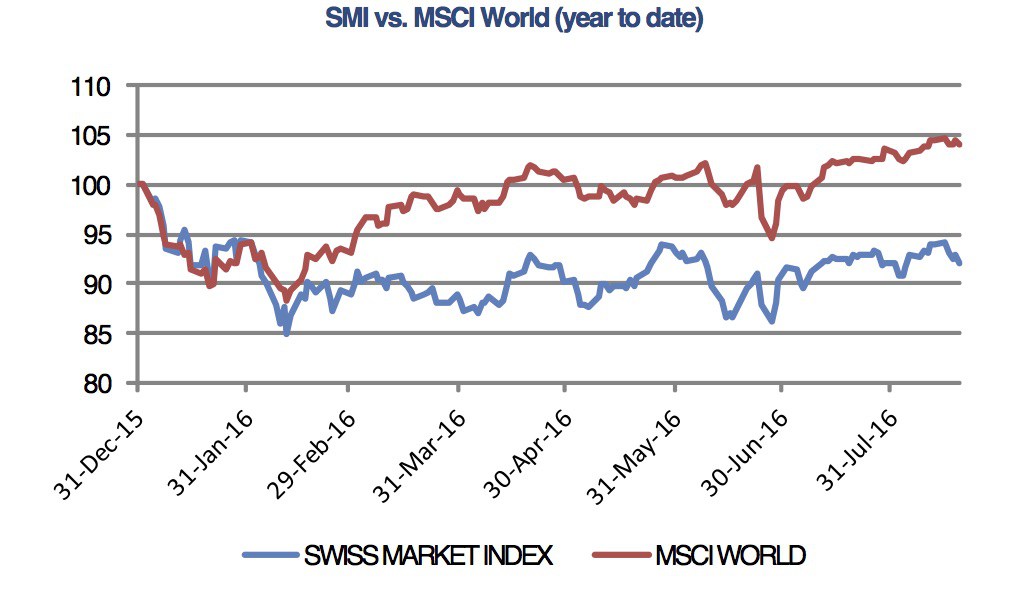

The Swiss Market Index along with global stocks are trading flat this week ahead of Federal Reserve’s Janet Yellen’s Friday speech at the central bank’s annual Jackson Hole Summit.

All eyes on Jackson Hole – © Dan Bannister | Dreamstime.com

The Federal Chairwoman’s speech at the meeting of central bank governors in Wyoming is expected to provide clues about when to expect the next rise in US interest rates. While it is unlikely that Janet Yellen will signal the exact timing of US rate hikes, her comments could have an impact on financial markets depending on whether a September, December or 2017 hike is implied.

Earlier this week, Federal Reserve’s Vice Chair Stanley Fischer said that the US economy is nearing the Fed’s goals and the job market is near full strength, adding to speculation that a rate increase is due.

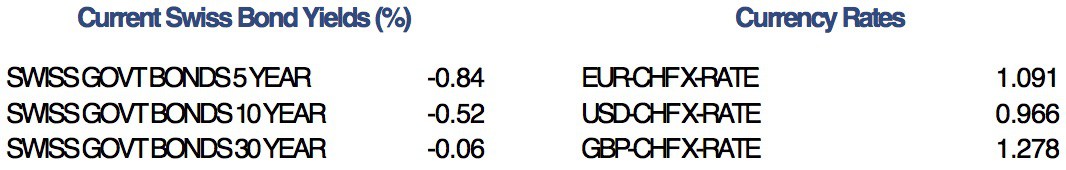

In Switzerland, pharma giants Roche and Novartis were amongst the week’s biggest losers after Hillary Clinton criticized drug pricing on Wednesday. The Democratic presidential nominee’s has repeatedly attacked aggressive pricing within the pharmaceutical sector and has proposed reforms to force pharmaceutical companies to spend more on research, ban direct-to-consumer advertising for prescription drugs and cap costs for medications.

In other company news, Syngenta rallied more than 10% this week after a US security regulator approved state-owned China National Chemical Corp’s planned $43 billion takeover of the Swiss company. The deal had previously been delayed while the US reviewed its impact.