Investec Switzerland. The SMI is set to close higher this week but lagging behind gains of global equity markets after heavyweight Roche fell almost 5% on Thursday after paying its dividend. © Blopatic | Dreamstime.com Stock markets around the world extended their rally this week, continuing to benefit from substantial gains in the price of crude oil after data showed declines in American oil production. Risk appetite also increased this week as investors begin to anticipate further stimulus announcements at the European Central Bank (ECB) meeting scheduled for next week. In Switzerland, economic data was broadly positive and even surprised on the upside. GDP figures showed that the Swiss economy returned to growth at the end of last year as it fought off the impact of a stronger currency that had threatened to push the country into a recession. GDP rose 0.4% in the fourth quarter; the most in a year. The reading for the third quarter was however revised down; instead of remaining stagnant, the economy actually contracted by 0.1% in the three months ending August 2015. Other positive news came from PMI and from the expectations of economic growth (KOF). The KOF Economic Barometer climbed in February and is now above its long-term average. The rise of the barometer was credited to a more positive outlook for the manufacturing sector.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Roche dividend

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

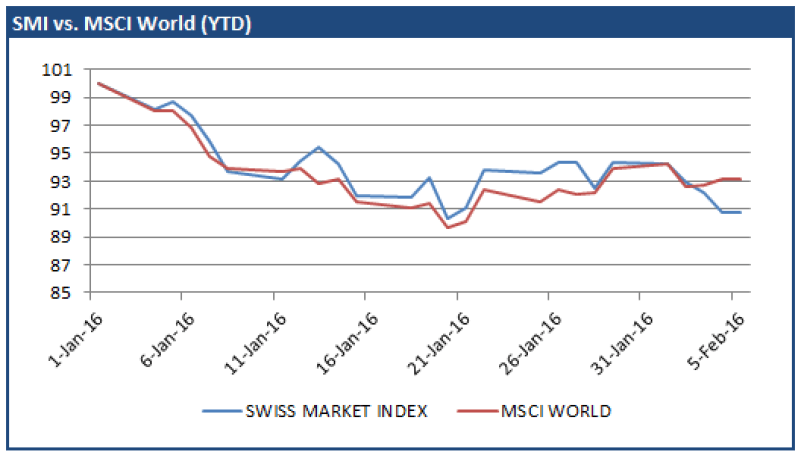

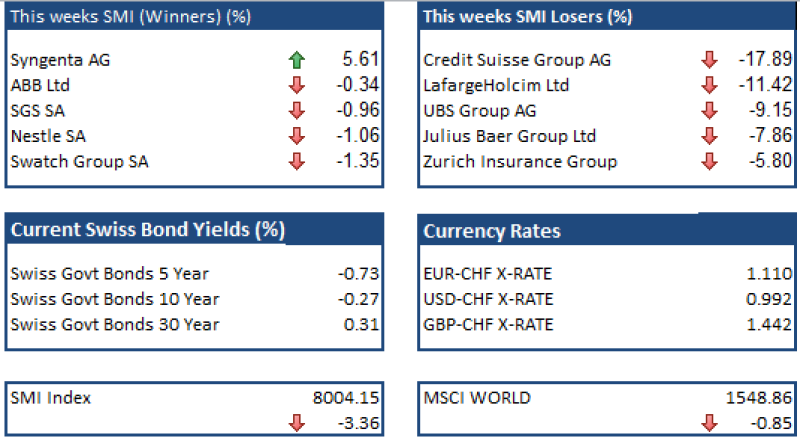

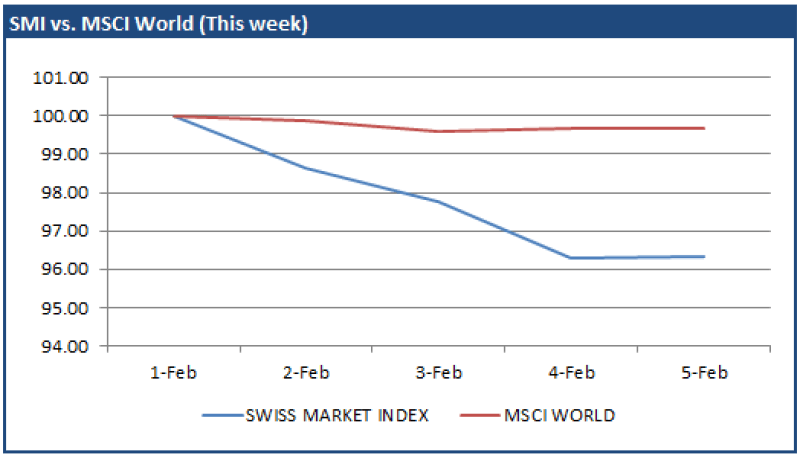

The SMI is set to close higher this week but lagging behind gains of global equity markets after heavyweight Roche fell almost 5% on Thursday after paying its dividend.

© Blopatic | Dreamstime.com

Stock markets around the world extended their rally this week, continuing to benefit from substantial gains in the price of crude oil after data showed declines in American oil production. Risk appetite also increased this week as investors begin to anticipate further stimulus announcements at the European Central Bank (ECB) meeting scheduled for next week.

In Switzerland, economic data was broadly positive and even surprised on the upside. GDP figures showed that the Swiss economy returned to growth at the end of last year as it fought off the impact of a stronger currency that had threatened to push the country into a recession. GDP rose 0.4% in the fourth quarter; the most in a year. The reading for the third quarter was however revised down; instead of remaining stagnant, the economy actually contracted by 0.1% in the three months ending August 2015.

Other positive news came from PMI and from the expectations of economic growth (KOF). The KOF Economic Barometer climbed in February and is now above its long-term average. The rise of the barometer was credited to a more positive outlook for the manufacturing sector.

The upward trend in manufacturing was also confirmed this week by the Swiss Purchasing Manager Index (PMI) which climbed for the first time since the SNB abandoned its EUR/CHF back in January of last year. The report showed that not only did production increase but factory orders also rose at the fastest pace since late 2014. However, the report noted the industry’s improved outlook has been achieved by laying off staff, moving production abroad and remains dependent on a EUR/CHF level above 1.10. Investor focus now turns to the ECB meeting next week and the consequences for the Swiss franc if further stimulus measures are announced.

Company news was light this week as the reporting season comes to a gradual end. Cyclical companies such as UBS, Credit-Suisse, LafargeHolcim and Transocean were among the best performing stocks as risk sentiment improved. UBS Group rose despite news that its French unit is being investigated for possible witness tampering. The probe comes just a few weeks after allegations emerged that the Bank helped clients in Belgium evade taxes. Roche was the week’s biggest loser, trading ex-dividend on Thursday and losing almost 5% in one day.