A divided nation goes to the polls today. As we wait to find out if Kamala Harris or Donald Trump will be the next US President, here’s a snippet from an interview we did over the summer. We asked Americans living in Switzerland what they think about the polarised political climate back home. Check out SWI swissinfo.ch to read more about this and what a Trump or Harris administration could mean for Switzerland. --- swissinfo.ch is the international branch of the Swiss Broadcasting...

Read More »Nervous Calm Hangs over the Markets

Overview: A nervous calm hangs over the markets as the US goes to the polls. The proximity of the presidential contest warns that the results may not been known as soon as people hope. Indeed, many fear the voting simply begins the next phase of the contest, with premature declarations of victory and disputes over votes. The dollar is in mostly narrow ranges today, but the Antipodeans and Scandis are the strongest, and the Reserve Bank of Australia kept rates on...

Read More »The Menace of the State

The election is upon us. We wonder whether we have to have war, tariffs, and deficit spending, regardless of whom we support. What are we to do? Faced with the intractable problems of misgovernment, we need to look deeper. Following the great Murray Rothbard, we should ask, do we need a State at all? Rothbard’s answer was a clear “No.” And not only do we not need a State; the State is a menace.Following Franz Oppenheimer and Albert Jay Nock, Rothbard identified the...

Read More »Swiss model accuses Trump of sexual assault, US sanctions Swiss lawyers, new Swiss banknotes

Visit SWI swissinfo.ch to read more about these stories. ?️

Read More »USD/CHF slides to test 0.8645 support with US inflation data on tap

The US Dollar depreciates for the second consecutive day and approaches support at 0.8645. The focus today is on the US PCE Prices Index but the highlight of the week is Friday's NFP report. A break of 0.8645 would confirm a double top at 0.8700. The US Dollar is on the back foot on Thursday, with investors bracing for the release of October’s PCE Prices Index data. The USD/CHF is testing the support area at 0.8645 after being rejected at the...

Read More »Swiss central bank posts CHF62.5bn profit

SNB generates profit of CHF 62.5 billion in the first three quarters Keystone-SDA Listen to the article Listening the article Toggle language selector...

Read More »Trump-Faktor und Marktbedingungen könnten für neuen Bitcoin-Rekord sorgen

In den letzten Wochen ist Bitcoin in Richtung seines Allzeithochs geklettert, beflügelt durch Spekulationen über die bevorstehende US-Präsidentschaftswahl. Doch wird das Krypto-Urgestein sein Rekordhoch noch in diesem Jahr knacken können? • Bitcoin knackt 70’000-Dollar-Marke • US-Wahl und Marktumfeld sorgen für Auftrieb • Neuer Rekord nach der US-Wahl möglich Bitcoin nähert sich Rekordhoch Die vergangenen Wochen waren für Kryptoanleger durchaus interessant. Im...

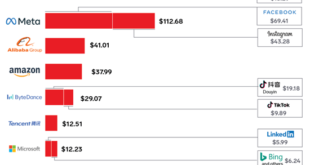

Read More »Is Social Media Actually “Media,” Or Is It Something Else?

By placing search/social media in the bucket of newspapers, radio and TV networks, perhaps we've obscured their true nature as "Digital Marketing Mechanisms." Language is a funny thing. If we don't have a word for something, in some way it doesn't exist. When we find a word in another language that describes this something, we borrow the word, for example schadenfreude from German and tsunami from Japanese. If we use an existing word to describe something...

Read More »US Treasury sanctions two Swiss lawyers for aiding Russian clients

The US Treasury Department announced sanctions against 275 individuals and entities in countries including India, Switzerland, China, and Turkey, Keystone-SDA/ Copyright 2024 The Associated Press. All Rights Reserved Listen to the article...

Read More »Government vs. Crypto: Who Controls the Future?

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More » SNB & CHF

SNB & CHF