Pick one, America: national security of the essential material foundation of everything, the industrial base, or “global markets,” maximizing greed / corporate profits. Sorry about the clickbait title. We all know there isn’t “one solution” to anything as complex as a socio-economic-cultural-political system. But this is based on looking at all the problems from one very shaky perspective: that the foundations of any solutions are rock-solid and all we need to do is...

Read More »Swiss debt enforcement offices aiding money laundering

In Switzerland, it is possible to pay delinquent debts with large sums of cash. Some criminals are using the loophole to launder money, reports Le Matin. Photo by MART PRODUCTION on Pexels.com Swiss broadcaster SRF investigated several official debt enforcement offices across Switzerland and found that large sums of cash were passing through some of them. In Geneva, CHF 24 million of cash passed through its cantonal offices des poursuites in 2021, some of it dirty,...

Read More »They Wouldn’t Listen! Jeff Snider with Steve van Metre [Eurodollar University, Ep. 258]

Steven Van Metre and Jeff Snider have partnered together to bring financial information, investment advice and monetary education to the public. Watch the this YouTube LIVE! stream to learn more. CONTACTS: Jeff Snider: https://www.eurodollar.university/ Steve Van Metre: http://www.portfolioshield.net/ DISCLOSURES: Jeffrey Snider (The Promoter) is acting as a promoter for an investment advisory firm, Atlas Financial Advisors, Inc. (AFA). Jeffrey Snider is affiliated with AFA as a promoter...

Read More »The Dollar Jumps and the Euro Slips under $1.03

Overview: The dollar is soaring today, and the euro is trading at new 22-year lows having traded below $1.03. Even a 50 bp hike by the Reserve Bank of Australia has failed to prevent a sharp drop in the Australian dollar. The session seemed to have begun off well enough. Japan, South Korean, Taiwan, Australian, and Indian shares advanced in the Asia Pacific region. Europe’s Stoxx 600 began off firmly, but quickly unwound yesterday’s 0.55% gain. US futures are...

Read More »Bitcoin Miner verdienen wieder mehr als Ethereum Miner

Die Kurse habe sich zwar stabilisiert, sind jedoch im gesamten Markt weit von ihren Höchstständen entfernt. Alle größeren Cryptocoins verloren deutlich an Wert, darunter auch Bitcoin und Ethereum. Interessant wird es jedoch, wenn wir den relativen Wert der beiden Cryptocoins miteinander vergleichen. Bitcoin News: Bitcoin Miner verdienen wieder mehr als Ethereum MinerBis Mitte Juni ging es für den Bitcoin-Preis im Vergleich zu Ethereum runter, doch in den letzten drei...

Read More »Swiss conference on Ukraine’s recovery

An international conference on reconstructing post-war Ukraine is being held in the Swiss city of Lugano. Ukrainian President Volodymyr Zelensky addressed the conference by video link. He said, “Russia’s war is not just an attempt to take our country, but a challenge to the European system. The reconstruction of Ukraine is therefore not just a local matter, but the task of the entire democratic world.” The two-day event had already been scheduled before the Russian...

Read More »The Swiss army: your questions answered Part 3

In Switzerland, all able-bodied men complete compulsory military service, while others opt for a civilian service. But how useful is a conscript army in light of what Russia did to Ukraine? This is one of many questions SWI readers sent to us. Daniel Reist, head of media relations for the Swiss armed forces, takes a shot at answering them. Our third question is: why does Switzerland need an army? More questions and answers are to follow in the coming weeks. --- swissinfo.ch is the...

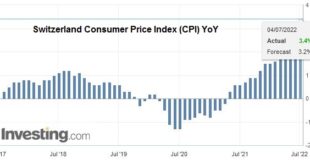

Read More »Swiss Consumer Price Index in June 2022: +3.4 percent YoY, +0.5 percent MoM

04.07.2022 – The consumer price index (CPI) increased by 0.5% in June 2022 compared with the previous month, reaching 104.5 points (December 2020 = 100). Inflation was +3.4% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.5% increase compared with the previous month is due to several factors including rising prices for fuel. Heating oil also recorded a price increase, as did fruiting vegetables....

Read More »Inflation ‘back with a vengeance’ in Switzerland

The price of household goods for Swiss consumers rose 3.4% in June compared to the same month last year, led by the surging cost of fuel and heating oil. “Inflation, which has de facto been absent for more than a decade, is back with a vengeance,” said economic forecast group BAK Economics. “However, this is no reason for inflation or stagflation [rising prices combined with slower economic output] panic.” BAK Economics is confident that a number of factors will...

Read More »Weekly Market Pulse: Things That Need To Happen

Perspective: per·spec·tive | pər-ˈspek-tiv b: the capacity to view things in their true relations or relative importance Merriam-Webster Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view. Things that seemed so important at the time, years ago, turned out to be nothing more than bumps along the road of life. That is as...

Read More » SNB & CHF

SNB & CHF