On August 9, 2007 the second largest bank in Europe - BNP Paribas - kicked off the Global Financial Crisis (2007-09) and the Silent Depression (2007-2?). It started with three illiquid money market funds. ****EP. 272 REFERENCES**** What's Lacking Right Now Is the Fed's Will To Act: https://bit.ly/3QaHR0e RealClear Markets Essays: https://bit.ly/38tL5a7 Epoch Times Columns: https://bit.ly/39ESkRf ****THE EPISODES**** YouTube: https://bit.ly/310yisL Vurbl: https://bit.ly/3rq4dPn Apple:...

Read More »Vitalik Buterin glaubt an Crypto-Zahlungen für den Mainstream

Immer mehr Anbieter ermöglichen Crypto-Zahlungen – vor allem online. Doch von einer Akzeptanz dieser Zahlungen des Mainstreams sind wir dennoch weit entfernt. Vielmehr sind Cryptocoins primär zu einem Investitions- und Spekulationsobjekt geworden. Ethereum News: Vitalik Buterin glaubt an Crypto-Zahlungen für den MainstreamVitalik Buterin jedoch glaubt an diese Akzeptanz und die damit verbundene Mass Adoption für die nahe Zukunft. Auf der Korean Blockchain Week 2022...

Read More »US Dollar Offered but Stretched Intraday

Overview: The US dollar is trading heavily against all the major currencies, led by the Norwegian krone and euro. Emerging market currencies are also firmer. However, risk-appetites seem subdued. Even though most large bourses in Asia Pacific advanced but Japan and Hong Kong, European markets are nursing small losses and US futures are little changed. Benchmark 10-year yields are firmer with European yields 3 bp firmer and Italy’s premium over Germany slightly...

Read More »Risk RISING In Banking System; It’s Time To Opt Out | Keith Weiner

With a yield curve inversion and increased leverage, risk in the banking system is clearly rising, says Keith Weiner, CEO of Monetary Metals. "Where does this all end?" he asks. "Nobody knows, but it seems like it's a pretty good deal to have some gold coins and stash them away somewhere." He adds, "to own gold is how people opt out of this mad, mad world." Monetary Metals: https://monetary-metals.com 0:00 Intro 0:45 Inflation & gold 13:21 Creditor to...

Read More »Risk RISING In Banking System; It’s Time To Opt Out | Keith Weiner

With a yield curve inversion and increased leverage, risk in the banking system is clearly rising, says Keith Weiner, CEO of Monetary Metals. "Where does this all end?" he asks. "Nobody knows, but it seems like it's a pretty good deal to have some gold coins and stash them away somewhere." He adds, "to own gold is how people opt out of this mad, mad world." Monetary Metals: https://monetary-metals.com 0:00 Intro 0:45 Inflation & gold 13:21 Creditor to...

Read More »Gold vs. Bitcoin: A Soho Forum Debate

Monetary Metals CEO Keith Weiner defends the future of gold against bitcoin podcaster Pierre Rochard. https://reason.com/video/2022/08/08/gold-vs-bitcoin-a-soho-forum-debate/?post_type=video ------------------ Will gold remain an important form of money, or are cryptocurrencies like bitcoin set to overtake it? That was the subject of a Soho Forum debate held on July 26 at the Mises Institute in Auburn, Alabama, as part of Mises University, an annual instructional program in the...

Read More »Dog Days

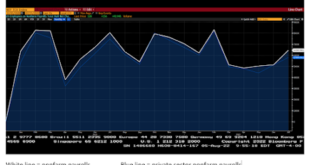

Overview: The dog days of August for the Northern Hemisphere are here and the capital markets are relatively subdued. Equities are firmer. The notable exceptions in Asia was China, Hong Kong, and Taiwan. The MSCI Asia Pacific Index has advanced for the last three weeks. Europe’s Stoxx 600 slipped almost 0.6% last week and has recouped most of it today. US futures are steady to firmer. The US 10-year yield is struggling to stay above 2.8%, while European benchmarks...

Read More »CME Group to Launch Euro-Denominated Bitcoin and Ether Futures on August 29

CME Group, the world’s leading derivatives marketplace, announced it plans to further expand its cryptocurrency derivatives offering with the introduction of Bitcoin Euro and Ether Euro futures on August 29, pending regulatory review. Designed to match their U.S. dollar-denominated counterparts, Bitcoin Euro and Ether Euro futures contracts will be sized at five bitcoin and 50 ether per contract. These new contracts will be cash-settled, based on the CME CF...

Read More »CME Group to Launch Euro-Denominated Bitcoin and Ether Futures

CME Group, the world’s leading derivatives marketplace, announced it plans to further expand its cryptocurrency derivatives offering with the introduction of Bitcoin Euro and Ether Euro futures on August 29, pending regulatory review. Designed to match their U.S. dollar-denominated counterparts, Bitcoin Euro and Ether Euro futures contracts will be sized at five bitcoin and 50 ether per contract. These new contracts will be cash-settled, based on the CME CF...

Read More »Meta: Digital Collectibles to Showcase NFTs on Instagram

Starting this week on Instagram, Meta is testing digital collectibles with select US creators and collectors to share NFTs that they have created or bought. Meta/Instagram started with the international expansion to 100 countries in Africa, Asia-Pacific, the Middle East, and the Americas. Additionally, they now support wallet connections with the Coinbase Wallet and Dapper, as well as the ability to post digital collectibles minted on the Flow blockchain. In order...

Read More » SNB & CHF

SNB & CHF