Here are three news stories from Switzerland this week: 1. CHF17 million ($19.3 million) in fraud including manipulating parking cards of disabled people. 2. New regulations for domestic violence victims with temporary residency in Switzerland. 3. An iconic Alpine hut by Lake Oeschinen is in a permanent danger zone due to the constant threat of rock falls.

Read More »The Folly of Federal Reserve Stabilization Policy: Part I 1948-1985

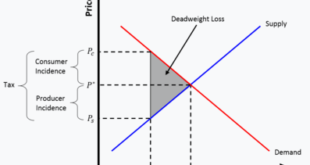

The Federal Reserve Board is responsible for formulating macro stabilization policy. More specifically, the Federal Reserve Board seeks tradeoffs between inflation and unemployment rates. Fed officials need meaningful data to formulate useful policies. Data on the unemployment rate that coincides with zero inflation provides a starting point for policy formulation. Fed officials also need data on the rate at which inflation reduces unemployment rates. Finally, data...

Read More »The Myth of National Defense Spending

Among the most persistent of myths in the sphere of economics is of the supposed benefits of government spending in the economy. Apologists will include government spending in gross domestic product measures, as if government production is truly “productive.” A common argument in favor of government spending is national defense spending.US senator Tommy Tuberville (R-AL) declared on Twitter that he would be voting against a defense package that would send further...

Read More »Australian Government Blames Grocery Retailers for Inflation

In 2024 the Australian senate is establishing an inquiry into Coles and Woolworths, the two biggest grocery retailers in the country. These two retailers hold a market share of two-thirds of the retail grocery market in Australia.This follows sharp rises in government spending, inflation, consumer prices, and lending rates following the Covid crisis. Instead of addressing inflation-fueled spending, governments have chosen grocery retailers as the bad guy to blame for...

Read More »The Fed Cannot Cut Rates as Fast as Markets Want

Market participants started the year with aggressive expectations of rapid and large rate cuts. However, after the latest inflation, growth, and job figures, the probability of a rate cut in March has fallen from 39 to 24%. Unfortunately for many, headline figures will support a hawkish Federal Reserve, and the latest comments from Jerome Powell suggest rate cuts may not come as fast as bond investors would like.For the Federal Reserve, the headline macro figures...

Read More »Playing for Kekes

Moderate Conservatism: Reclaiming the Centerby John KekesOxford University Press, 2022; 256 pp.John Kekes, who taught for many years at the State University of New York at Albany, does not agree with the protagonist of Henrik Ibsen’s Brand that “the devil is compromise,” at least where politics is concerned. The thesis of Moderate Conservatism can be seen as an extended commentary on that disagreement. Kekes is a value pluralist who values many different things,...

Read More »Private property rights under siege

Share this article Part I of II by Claudio Grass, Switzerland People invest in gold for many different reasons. Many do so out of concern over economic, monetary or political uncertainty. Others seek a hedge against inflation, a way to protect and preserve the real purchasing power of their savings. There are also those who simply seek some peace of mind, a dependable insurance, so that no matter what the future holds and no matter how bad the “worst case...

Read More »Ueda’s Comments Knock the Yen Back, while the Euro Flirts with $1.08

Overview: The US dollar is mixed today. The dollar-bloc currencies and the Scandis are enjoying a slightly firmer tone, while the euro and sterling are edging higher in European turnover. The Swiss franc is softer, and the yen has given back most of yesterday's gains after BOJ Governor Ueda acknowledged that central bank seeks further confirmation that sustainable price goal is within reach. We see it as a further signal of an April move on rates rather than this...

Read More »A Black Man’s Inconvenient Truth: Canceling Racist Historical Omissions

Can a Black man communicate inconvenient truths? One did and a reporter for The Root, a Black on-line magazine, labeled them foolishness. What has he said? Among others, reportedly this: It was Africans who fought wars against Africans and then enslaved the losers. It was victorious African warriors who sold defeated African warriors to European slave traders in exchange for cloth, guns, and money. . . It was Africans who watched as Africans were sailed away in the...

Read More »US Spot Bitcoin ETFs Daily Trading Volume Soars to 6 Billion USD

Ten newly launched US spot bitcoin exchange-traded funds (ETFs) broke their daily volume records on February 28, 2024, totaling nearly US$7.7 billion worth of assets being traded on that day alone, data shared on X by James Seyffart, an ETF analyst at Bloomberg Intelligence, reveal. The figure represents a staggering 63.8% increase from their previous peak of US$4.7 billion from their first day of trading on January 11, 2024, and demonstrates booming interest from...

Read More » SNB & CHF

SNB & CHF