Dr. Paul is right! People need to look at the money issue. Wars, spending, debt accumulation, subsidies, and foreign aid are intimately linked to the money machine known as the Federal Reserve.Central banks have two main purposes: inflate the money supply and bail out the big financial firms. By inflating the money supply, governments can finance their operations cheaply and surreptitiously at our expense. If we wish to expose the state and all its...

Read More »Hair of the Dog — Progressives in Congress Need Another Hit of Low Interest Rates

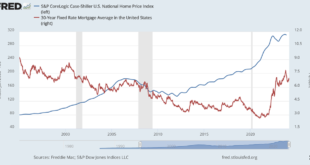

Bernie Sanders, Elizabeth Warren, and the Congressional Progressive Caucus recently sent an open letter to the chairman of the Federal Reserve, Jerome Powell, demanding lower interest rates.The letter is full of the economic illiteracy one would expect from progressives, especially those in Congress. For example, it misreads price inflation data and argues that the failure to lower interest rates endangers home affordability and increases income inequality. These...

Read More »Two Cheers for Vivek Ramaswamy for His Commentary on the Fed

Tu ne cede malis, sed contra audentior ito Website powered by Mises Institute donors Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436 [embedded content] Tags: Featured,newsletter

Read More »CNN Is Wrong. Deflation Is a Good Thing

Tu ne cede malis, sed contra audentior ito Website powered by Mises Institute donors Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436 [embedded content] Tags: Featured,newsletter

Read More »Personal Medical Bankruptcy: Made in DC

[unable to retrieve full-text content]When the government wants to make something more affordable, that usually means new subsidies, laws, and regulations that drive up the real price. Higher medical prices will mean more medical bankruptcies. [embedded content] Tags: Featured,newsletter

Read More »Failing to Make the Case for Race-Based Reparations

Tu ne cede malis, sed contra audentior ito Website powered by Mises Institute donors Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436 [embedded content] Tags: Featured,newsletter

Read More »Police Dogs Have Abolished Constitutional Due Process

Tu ne cede malis, sed contra audentior ito Website powered by Mises Institute donors Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436 [embedded content] Tags: Featured,newsletter

Read More »California’s Latest Hustle: Utility Bills Based on Ratepayers’ Income

Tu ne cede malis, sed contra audentior ito Website powered by Mises Institute donors Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436 [embedded content] Tags: Featured,newsletter

Read More »Who Really Works Against the Public?

“The public be damned” is a statement by railroad magnate William Henry Vanderbilt that has been twisted out of context. While the American ruling classes insist that private enterprise is the enemy of the people, it really is our government that bears that distinction. [embedded content] Tags: Featured,newsletter

Read More »How State Intervention Fueled Haiti’s Descent into Chaos

[unable to retrieve full-text content]As the official government in Haiti loses control, many are calling it a failed state. Crises like this are often evoked to discredit libertarians. But blame for Haiti’s current plight lies with the actions of states, not the absence of them. [embedded content] Tags: Featured,newsletter

Read More » SNB & CHF

SNB & CHF